Home Depot 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Home Depot, Inc. | 27

Notes to Consolidated Financial Statements

The Home Depot, Inc. and Subsidiaries

Investments

The Company’s investments, consisting primarily of high-grade

debt securities, are recorded at fair value based on current

market rates and are classified as available-for-sale. Changes in

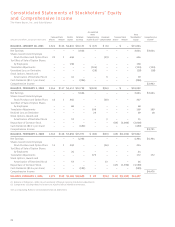

the fair value of investments are included in Accumulated Other

Comprehensive Income (Loss), net of applicable taxes in the

accompanying Consolidated Financial Statements. The Company

classifies its investments with an original maturity of less than

one year and those investments it intends to sell within one year

as current assets.

Income Taxes

The Company provides for federal, state and foreign income taxes

currently payable, as well as for those deferred due to timing

differences between reporting income and expenses for financial

statement purposes versus tax purposes. Federal, state and for-

eign tax benefits are recorded as a reduction of income taxes.

Deferred tax assets and liabilities are recognized for the future

tax consequences attributable to differences between the financial

statement carrying amounts of existing assets and liabilities and

their respective tax bases. Deferred tax assets and liabilities are

measured using enacted income tax rates expected to apply to

taxable income in the years in which those temporary differences

are expected to be recovered or settled. The effect of a change in

tax rates is recognized as income or expense in the period that

includes the enactment date.

The Company and its eligible subsidiaries file a consolidated U.S.

federal income tax return. Non-U.S. subsidiaries, which are

consolidated for financial reporting purposes, are not eligible to

be included in the Company’s consolidated U.S. federal income

tax return. Separate provisions for income taxes have been deter-

mined for these entities. The Company intends to reinvest the

unremitted earnings of its non-U.S. subsidiaries and postpone

their remittance indefinitely. Accordingly, no provision for U.S.

income taxes for non-U.S. subsidiaries was recorded in the

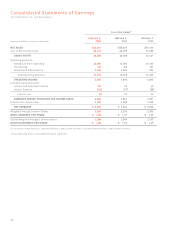

accompanying Consolidated Statements of Earnings.

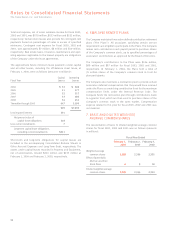

Depreciation and Amortization

The Company’s Buildings, Furniture, Fixtures and Equipment are

depreciated using the straight-line method over the estimated

useful lives of the assets. Leasehold improvements are amortized

using the straight-line method over the life of the lease or the use-

ful life of the improvement, whichever is shorter. The Company’s

Property and Equipment is depreciated using the following

estimated useful lives:

Life

Buildings 10-45 years

Furniture, Fixtures and Equipment 5-20 years

Leasehold Improvements 5-30 years

Computer Equipment and Software 3-5 years

Capitalized Software Costs

The Company capitalizes certain costs related to the acquisition

and development of software and amortizes these costs using the

straight-line method over the estimated useful life of the software,

which is three years. Certain development costs not meeting the

criteria for capitalization are expensed as incurred.

Revenues

The Company recognizes revenue, net of estimated returns, at the

time the customer takes possession of merchandise or receives

services. When the Company receives payment from customers

before the customer has taken possession of the merchandise or

the service has been performed, the amount received is recorded

as Deferred Revenue in the accompanying Consolidated Balance

Sheets until the sale or service is completed.

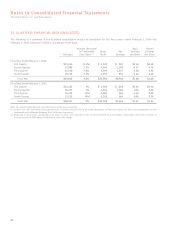

Service Revenues

Net Sales include service revenues generated through a variety of

installation and home maintenance programs. In these programs, the

customer selects and purchases materials for a project and

the Company provides or arranges professional installation.

Under certain programs, when the Company provides the installa-

tion of a project and the material as part of the installation, both

the material and labor are included in service revenues.

In August 2003, the Company adopted Emerging Issues Task

Force (“EITF”) 00-21, “Revenue Arrangements with Multiple

Deliverables” (“EITF 00-21”) which establishes standards for the

recognition of revenue from arrangements with multiple deliver-

ables. Under EITF 00-21, if the product is contingent upon the

service, revenue for both the service and product is recognized at

the time the service is complete. The adoption of EITF 00-21 did

not have any impact on the Company’s Consolidated Financial

Statements as the Company was previously recognizing revenue

in accordance with the criteria set forth under this pronouncement.

All payments received prior to the completion of services are

recorded in Deferred Revenue in the accompanying Consolidated

Balance Sheets. Net service revenues, including the impact of

deferred revenue, were $2.8 billion, $2.0 billion and $1.6 billion

for fiscal 2003, 2002 and 2001, respectively.

Self Insurance

The Company is self-insured for certain losses related to general

liability, product liability, workers’ compensation and medical

claims. The expected ultimate cost for claims incurred as of the

balance sheet date is not discounted and is recognized as a

liability. The expected ultimate cost of claims is estimated based

upon analysis of historical data and actuarial estimates.