Home Depot 2003 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2003 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

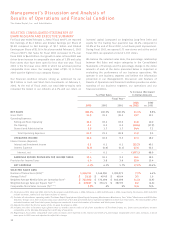

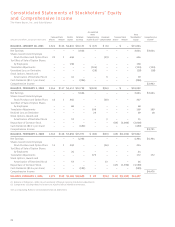

SELECTED CONSOLIDATED STATEMENTS OF

EARNINGS DATA AND EXECUTIVE SUMMARY

For fiscal year ended February 1, 2004 (“fiscal 2003”), we reported

Net Earnings of $4.3 billion and Diluted Earnings per Share of

$1.88 compared to Net Earnings of $3.7 billion and Diluted

Earnings per Share of $1.56 in fiscal year ended February 2, 2003

(“fiscal 2002”). Net Sales for fiscal 2003 increased 11.3% over

fiscal 2002 to $64.8 billion. Our growth in sales in fiscal 2003 was

driven by an increase in comparable store sales of 3.8% and sales

from stores that have been open for less than one year. Fiscal

2003 is the first year since 2000 in which we achieved positive

comparable store sales. Our average ticket of $51.15 in fiscal

2003 was the highest in our company history.

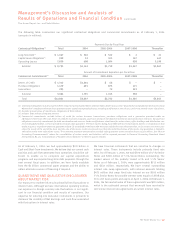

Our financial condition remains strong as evidenced by our

$2.9 billion in Cash and Short-Term Investments at February 1,

2004. At the end of fiscal 2003, our total debt-to-equity ratio

remained the lowest in our industry at 6.1% and our return on

invested capital (computed on beginning Long-Term Debt and

equity for the trailing four quarters) was 20.4% compared to

18.8% at the end of fiscal 2002, a 160 basis point improvement.

During fiscal 2003, we opened 175 new stores and at the end of

fiscal 2003, we operated a total of 1,707 stores.

We believe the selected sales data, the percentage relationship

between Net Sales and major categories in the Consolidated

Statements of Earnings and the percentage change in the dollar

amounts of each of the items presented below is important in

evaluating the performance of our business operations. We

operate in one business segment and believe the information

presented in our Management’s Discussion and Analysis of

Results of Operations and Financial Condition provides an under-

standing of our business segment, our operations and our

financial condition.

Management’s Discussion and Analysis of

Results of Operations and Financial Condition

The Home Depot, Inc. and Subsidiaries

14

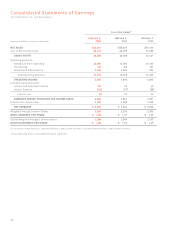

% Increase (Decrease)

% of Net Sales In Dollar Amounts

Fiscal Year(1)

2003 2002

2003 2002 2001 vs. 2002 vs. 2001

NET SALES 100.0% 100.0% 100.0% 11.3% 8.8%

Gross Profit 31.8 31.1 30.2 13.7 12.1

Operating Expenses:

Selling and Store Operating 19.3 19.2 19.0 11.8 10.0

Pre-Opening 0.1 0.2 0.2 (10.4) (17.9)

General and Administrative 1.8 1.7 1.7 14.4 7.2

Total Operating Expenses 21.2 21.1 20.9 11.9 9.5

OPERATING INCOME 10.6 10.0 9.3 17.4 18.2

Interest Income (Expense):

Interest and Investment Income 0.1 0.1 0.1 (25.3) 49.1

Interest Expense (0.1) (0.0) (0.1) 67.6 32.1

Interest, net –0.1 – (107.1) 68.0

EARNINGS BEFORE PROVISION FOR INCOME TAXES 10.6 10.1 9.3 16.5 18.5

Provision for Income Taxes 4.0 3.8 3.6 15.0 15.4

NET EARNINGS 6.6% 6.3% 5.7% 17.5% 20.4%

SELECTED SALES DATA

Number of Transactions (000s)(2)1,245,721 1,160,994 1,090,975 7.3% 6.4%

Average Ticket(2)$ 51.15 $ 49.43 $ 48.64 3.5 1.6

Weighted Average Weekly Sales per Operating Store(2)$ 763,000 $ 772,000 $ 812,000 (1.2) (4.9)

Weighted Average Sales per Square Foot(2) (3)$ 370.87 $ 370.21 $ 387.93 0.2 (4.6)

Comparable Store Sales Increase (%)(3) (4) (5)3.8% 0% 0% N/A N/A

(1) Fiscal years 2003, 2002 and 2001 refer to the fiscal years ended February 1, 2004, February 2, 2003 and February 3, 2002, respectively. Fiscal years 2003 and 2002

include 52 weeks, while fiscal year 2001 includes 53 weeks.

(2) Excludes all subsidiaries operating under The Home Depot Supply brand (Apex Supply Company, Maintenance Warehouse, Your “other” Warehouse and HD Builder

Solutions Group) since their inclusion may cause distortion of the data presented due to operational differences from our retail stores. The total number of the

excluded locations and their total square footage are immaterial to our total number of locations and total square footage.

(3) Adjusted to reflect the first 52 weeks of the 53-week fiscal year in 2001.

(4) Includes net sales at locations open greater than 12 months and net sales of all of the subsidiaries of The Home Depot, Inc. Stores and subsidiaries become

comparable on the Monday following their 365th day of operation.

(5) Beginning in fiscal 2003, comparable store sales increases were reported to the nearest one-tenth of a percentage. Comparable store sales increases in fiscal

years prior to 2003 were not adjusted to reflect this change.