Home Depot 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Home Depot, Inc. | 19

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

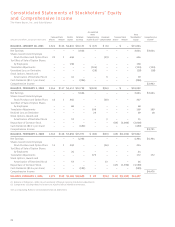

The Home Depot, Inc. and Subsidiaries

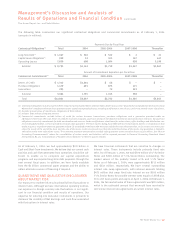

The following table summarizes our significant contractual obligations and commercial commitments as of February 1, 2004

(amounts in millions):

Payments Due by Fiscal Year

Contractual Obligations(1)Total 2004 2005-2006 2007-2008 Thereafter

Long-Term Debt(2)$ 1,047 $ 502 $ 522 $ 2 $ 21

Capital Lease Obligations(3)909 52 103 107 647

Operating Leases 7,839 608 1,094 938 5,199

Subtotal $ 9,795 $1,162 $1,719 $1,047 $5,867

Amount of Commitment Expiration per Fiscal Year

Commercial Commitments(4)Total 2004 2005-2006 2007-2008 Thereafter

Letters of Credit $ 1,312 $1,244 $ 68 $ – $ –

Purchase Obligations 1,479 491 873 115 –

Guarantees 295 – 72 223 –

Subtotal 3,086 1,735 1,013 338 –

Total $12,881 $2,897 $2,732 $1,385 $5,867

(1) Contractual obligations include Long-Term Debt comprised primarily of $1billion of Senior Notes further discussed in “Quantitative and Qualitative Disclosures about

Market Risk” and future minimum lease payments under capital and operating leases, including an off-balance sheet lease, used in the normal course of business.

(2) Excludes present value of capital lease obligations of $318 million.

(3) Includes $591 million of imputed interest.

(4) Commercial commitments include letters of credit for certain business transactions, purchase obligations and a guarantee provided under an

off-balance sheet lease. We issue letters of credit for insurance programs, purchases of import merchandise inventories and construction contracts. Our purchase

obligations consist of commitments for both merchandise and services. Under an off-balance sheet lease for certain stores, office buildings and distribution cen-

ters totaling $282 million, we have provided a residual value guarantee. The lease expires during fiscal 2008 with no renewal option. Events or circumstances that

would require us to perform under the guarantee include (1) our default on the lease with the assets sold for less than the book value, or (2) our decision not to pur-

chase the assets at the end of the lease and the sale of the assets results in proceeds less than the initial book value of the assets. Our guarantee is limited to

79% of the initial book value of the assets. The estimated maximum amount of the residual value guarantee at the end of the lease is $223 million. See “Recent

Accounting Pronouncements” where the consolidation of certain assets and liabilities will be required pursuant to Financial Accounting Standards Board

Interpretation No. 46, “Consolidation of Variable Interest Entitites” in the first quarter of 2004.

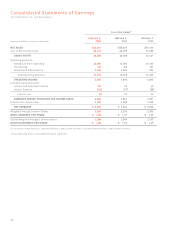

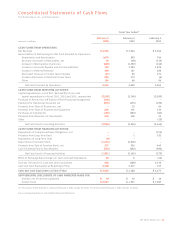

As of February 1, 2004, we had approximately $2.9 billion in

Cash and Short-Term Investments. We believe that our current cash

position and cash flow generated from operations should be suf-

ficient to enable us to complete our capital expenditure

programs and any required long-term debt payments through the

next several fiscal years. In addition, we have funds available

from the $1billion commercial paper program and the ability to

obtain alternate sources of financing if required.

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

Our exposure to market risk results primarily from fluctuations in

interest rates. Although we have international operating entities,

our exposure to foreign currency rate fluctuations is not signifi-

cant to our financial condition and results of operations. Our

objective for entering into derivative instruments is primarily to

decrease the volatility of Net Earnings and cash flow associated

with fluctuations in interest rates.

We have financial instruments that are sensitive to changes in

interest rates. These instruments include primarily fixed rate

debt. As of February 1, 2004, we had $500 million of 61

/2% Senior

Notes and $500 million of 53/8% Senior Notes outstanding. The

market values of the publicly traded 61

/2% and 53/8% Senior

Notes as of February 1, 2004, were approximately $515 million

and $532 million, respectively. We have several outstanding

interest rate swap agreements, with notional amounts totaling

$475 million that swap fixed rate interest on our $500 million

53/8% Senior Notes for variable interest rates equal to LIBOR plus

30 to 245 basis points and expire on April 1, 2006. At February 1,

2004, the fair market value of these agreements was $19 million,

which is the estimated amount that we would have received to

sell similar interest rate agreements at current interest rates.