Home Depot 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Home Depot, Inc. | 21

Management’s Discussion and Analysis of

Results of Operations and Financial Condition (continued)

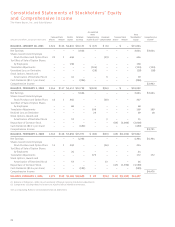

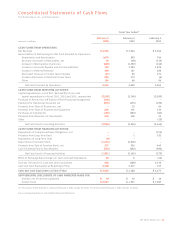

The Home Depot, Inc. and Subsidiaries

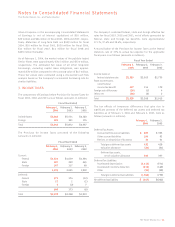

SFAS 149 was effective for contracts entered into or modified

after June 30, 2003. The adoption of SFAS 149 did not have any

impact on our Consolidated Financial Statements.

In December 2003, the FASB issued a revision of Interpretation

No. 46, “Consolidation of Variable Interest Entities” (“FIN 46”).

FIN 46 requires consolidation of a variable interest entity if a

company’s variable interest absorbs a majority of the entity’s

losses or receives a majority of the entity’s expected residual

returns, or both. We are subject to apply the provisions of FIN 46

no later than the end of the first reporting period that ends after

March 15, 2004 and therefore, we will adopt FIN 46 in the first

quarter of 2004.

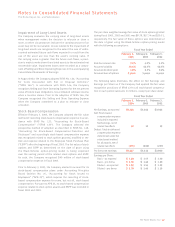

We lease assets totaling $282 million under an off-balance sheet

operating lease agreement that was created under a structured

financing arrangement involving two special purpose entities.

We financed a portion of our new stores, as well as, a distribution

center and two office buildings under this agreement. In accor-

dance with FIN 46, we will be required to consolidate one of the

special purpose entities that, before the effective date of FIN 46,

met the requirements for non-consolidation. The second special

purpose entity that owns the aforementioned assets is not owned

by or affiliated with us, our management or our officers, and

pursuant to FIN 46, we are not deemed to have a variable interest

so therefore, are not required to consolidate this entity.

FIN 46 requires us to measure the assets and liabilities at their

carrying amounts, which amounts would have been recorded if

FIN 46 had been effective at the inception of the transaction.

Accordingly, during the first quarter of 2004, we will record Long-

Term Debt of $282 million and Notes Receivable of $282 million

on our Consolidated Balance Sheets. If we had consolidated these

entities as of the end of fiscal 2003, our total debt-to-equity ratio

would have increased from 6.1% to 7.4%. We will also record the

related Interest Expense and Interest Income on the Long-Term

Debt and Notes Receivable, respectively, which amounts will offset

with no resulting net impact to our Net Earnings. We will continue

to record the rental payments under the operating lease agree-

ment as Selling and Store Operating Expenses in our Consolidated

Statements of Earnings. Although FIN 46 requires a change in

our accounting principles governing consolidation, there is no

economic impact on us.