Home Depot 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Home Depot, Inc. | 33

Notes to Consolidated Financial Statements

The Home Depot, Inc. and Subsidiaries

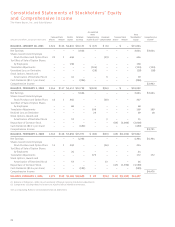

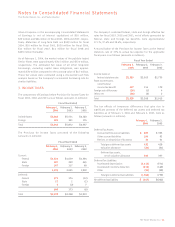

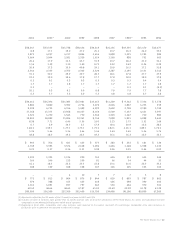

The following table summarizes stock options outstanding at

February 1, 2004, February 2, 2003 and February 3, 2002, and

changes during the fiscal years ended on these dates (shares

in thousands):

Weighted

Number Average

of Shares Option Price

Outstanding at January 28, 2001 65,801 $26.46

Granted 25,330 40.33

Exercised (16,614) 15.03

Canceled (5,069) 39.20

Outstanding at February 3, 2002 69,448 $33.33

Granted 31,656 40.86

Exercised (9,908) 18.27

Canceled (8,030) 42.74

Outstanding at February 2, 2003 83,166 $37.09

Granted 19,234 24.97

Exercised (4,708) 16.03

Canceled (9,913) 38.54

Outstanding at February 1, 2004 87,779 $35.40

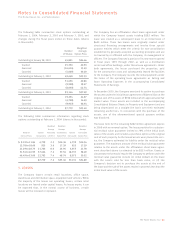

The following table summarizes information regarding stock

options outstanding at February 1, 2004 (shares in thousands):

Weighted Weighted Weighted

Average Average Average

Range of Options Remaining Outstanding Options Exercisable

Exercise Prices Outstanding Life (Yrs) Option Price Exercisable Option Price

$ 8.19 to 11.86 4,739 2.5 $10.36 4,739 $10.36

12.78 to 18.60 925 3.6 17.29 925 17.29

21.29 to 28.79 21,746 8.0 23.96 4,655 21.78

31.56 to 40.95 37,666 7.2 37.56 18,737 38.49

46.49 to 53.00 22,703 7.4 48.74 8,075 50.52

87,779 7.2 $35.40 37,131 $34.89

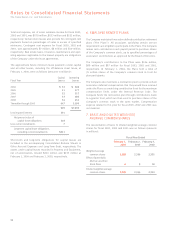

5. LEASES

The Company leases certain retail locations, office space,

warehouse and distribution space, equipment and vehicles. While

the majority of the leases are operating leases, certain retail

locations are leased under capital leases. As leases expire, it can

be expected that, in the normal course of business, certain

leases will be renewed or replaced.

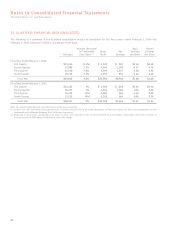

The Company has an off-balance sheet lease agreement under

which the Company leased assets totaling $282 million. The

lease was created as a subsequent lease to an initial lease of

$600 million. These two leases were originally created under

structured financing arrangements and involve three special

purpose entities which meet the criteria for non-consolidation

established by generally accepted accounting principles and are

not owned by or affiliated with the Company, its management or

officers. The Company financed a portion of its new stores opened

in fiscal years 1997 through 2002, as well as a distribution

center and office buildings, under these lease agreements. Under

both agreements, the lessor purchased the properties, paid

for the construction costs and subsequently leased the facilities

to the Company. The Company records the rental payments under

the terms of the operating lease agreements as Selling and

Store Operating Expenses in the accompanying Consolidated

Statements of Earnings.

In December 2003, the Company exercised its option to purchase

the assets under the initial lease agreement of $600 million at the

original cost of the assets of $598 million which approximated fair

market value. These assets are included in the accompanying

Consolidated Balance Sheets in Property and Equipment and are

being depreciated on a straight-line basis over their estimated

remaining useful lives. In connection with the purchase of the

assets, one of the aforementioned special purpose entities

was dissolved.

The lease term for the remaining $282 million agreement expires

in 2008 with no renewal option. The lease provides for a substan-

tial residual value guarantee limited to 79% of the initial book

value of the assets and includes a purchase option at the original

cost of each property. As the leased assets were placed into serv-

ice, the Company estimated its liability under the residual value

guarantee. The maximum amount of the residual value guarantee

relative to the assets under the off-balance sheet lease agree-

ment described above is estimated to be $223 million. Events or

circumstances that would require the Company to perform under the

residual value guarantee include (1) initial default on the lease

with the assets sold for less than book value, or (2) the

Company’s decision not to purchase the assets at the end of

the lease and the sale of the assets results in proceeds less than the

initial book value of the assets.