Home Depot 2003 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2003 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Home Depot, Inc. | 31

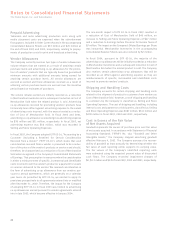

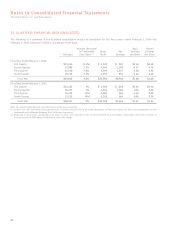

Notes to Consolidated Financial Statements

The Home Depot, Inc. and Subsidiaries

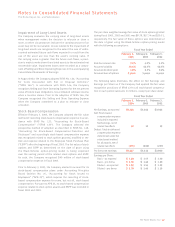

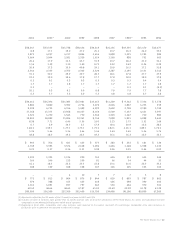

Interest Expense in the accompanying Consolidated Statements

of Earnings is net of interest capitalized of $50 million,

$59 million and $84 million in fiscal 2003, 2002 and 2001, respec-

tively. Maturities of Long-Term Debt are $509 million for fiscal

2004, $10 million for fiscal 2005, $530 million for fiscal 2006,

$12 million for fiscal 2007, $14 million for fiscal 2008 and

$290 million thereafter.

As of February 1, 2004, the market values of the publicly traded

Senior Notes were approximately $515 million and $532 million,

respectively. The estimated fair value of all other long-term

borrowings, excluding capital lease obligations, was approxi-

mately $50 million compared to the carrying value of $47 million.

These fair values were estimated using a discounted cash flow

analysis based on the Company’s incremental borrowing rate for

similar liabilities.

3. INCOME TAXES

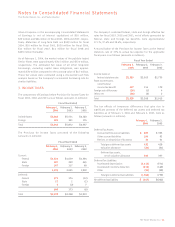

The components of Earnings before Provision for Income Taxes for

fiscal 2003, 2002 and 2001 are as follows (amounts in millions):

Fiscal Year Ended

February 1,February 2, February 3,

2004 2003 2002

United States $6,440 $5,571 $4,783

Foreign 403 301 174

Total $6,843 $5,872 $4,957

The Provision for Income Taxes consisted of the following

(amounts in millions):

Fiscal Year Ended

February 1,February 2, February 3,

2004 2003 2002

Current:

Federal $1,520 $1,679 $1,594

State 307 239 265

Foreign 107 117 60

1,934 2,035 1,919

Deferred:

Federal 573 174 (12)

State 27 1 (1)

Foreign 5(2) 7

605 173 (6)

Total $2,539 $2,208 $1,913

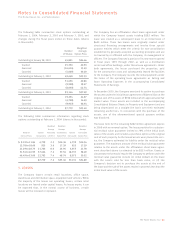

The Company’s combined federal, state and foreign effective tax

rates for fiscal 2003, 2002 and 2001, net of offsets generated by

federal, state and foreign tax benefits, were approximately

37.1%, 37.6% and 38.6%, respectively.

A reconciliation of the Provision for Income Taxes at the federal

statutory rate of 35% to actual tax expense for the applicable

fiscal years is as follows (amounts in millions):

Fiscal Year Ended

February 1,February 2, February 3,

2004 2003 2002

Income taxes at

federal statutory rate $2,395 $2,055 $1,735

State income taxes,

net of federal

income tax benefit 217 156 172

Foreign rate differences (29) (1) 4

Other, net (44) (2) 2

Total $2,539 $2,208 $1,913

The tax effects of temporary differences that give rise to

significant portions of the deferred tax assets and deferred tax

liabilities as of February 1, 2004 and February 2, 2003, were as

follows (amounts in millions):

February 1,February 2,

2004 2003

Deferred Tax Assets:

Accrued self-insurance liabilities $ 205 $ 305

Other accrued liabilities 196 92

Net loss on disposition of business 31 31

Total gross deferred tax assets 432 428

Valuation allowance (31) (31)

Deferred tax assets,

net of valuation allowance 401 397

Deferred Tax Liabilities:

Accelerated depreciation (1,114) (571)

Accelerated inventory deduction (218) (149)

Other (36) (39)

Total gross deferred tax liabilities (1,368) (759)

Net deferred tax liability $ (967) $(362)