Home Depot 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

The Home Depot, Inc. and Subsidiaries30

COMPREHENSIVE INCOME Comprehensive income includes

net earnings adjusted for certain revenues, expenses, gains and

losses that are excluded from net earnings under generally

accepted accounting principles. Examples include foreign cur-

rency translation adjustments and unrealized gains and losses on

certain hedge transactions.

FOREIGN CURRENCY TRANSLATION The assets and liabilities

denominated in a foreign currency are translated into U.S. dollars

at the current rate of exchange on the last day of the reporting

period, revenues and expenses are translated at the average

monthly exchange rates, and equity transactions are translated

using the actual rate on the day of the transaction.

USE OF ESTIMATES Management of the Company has made a

number of estimates and assumptions relating to the reporting of

assets and liabilities, the disclosure of contingent assets and lia-

bilities, and reported amounts of revenues and expenses in

preparing these financial statements in conformity with generally

accepted accounting principles. Actual results could differ from

these estimates.

RECLASSIFICATIONS Certain amounts in prior fiscal years have

been reclassified to conform with the presentation adopted in the

current fiscal year.

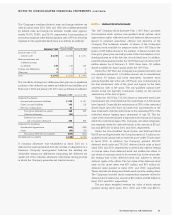

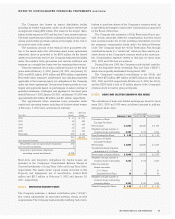

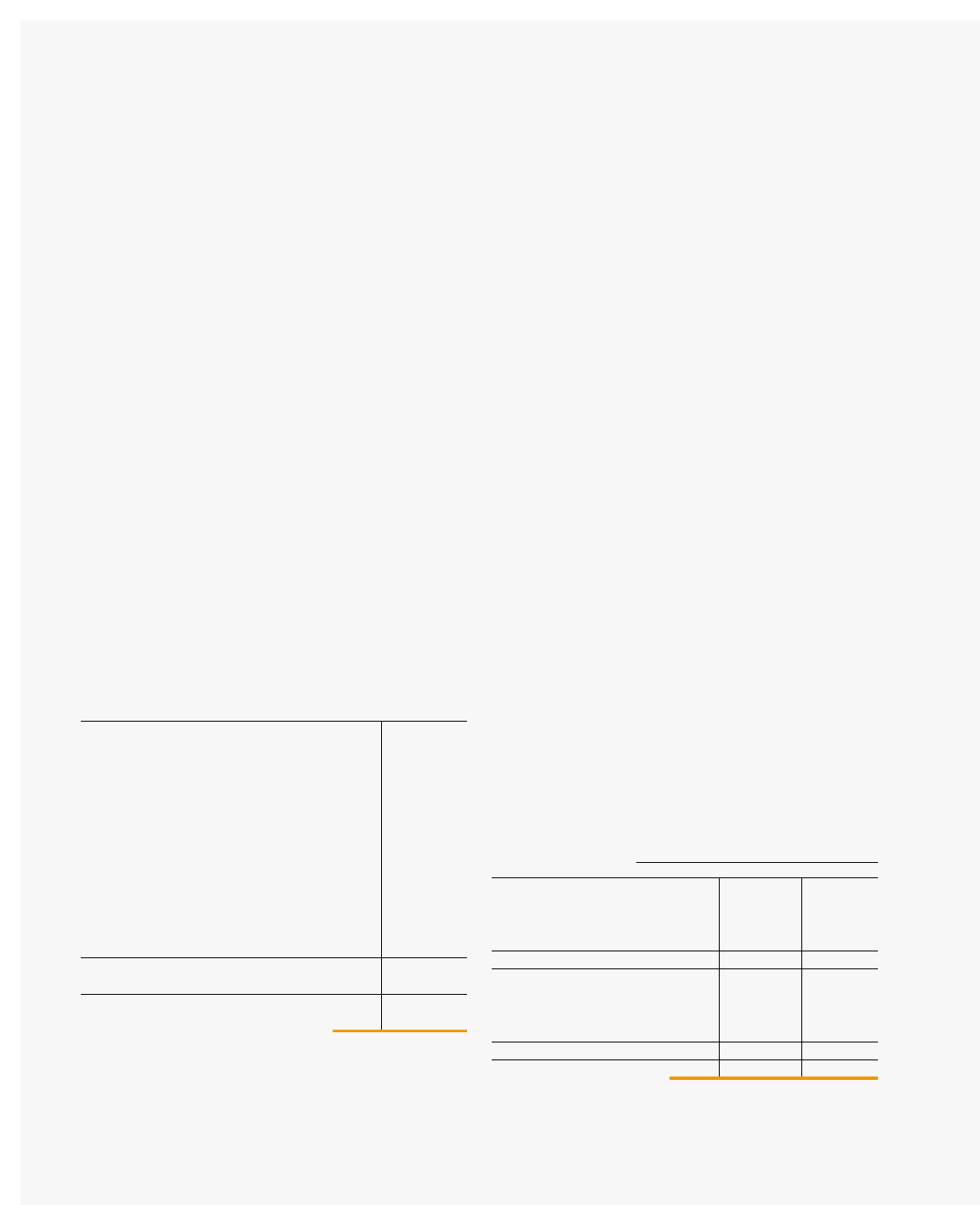

NOTE 2. LONG-TERM DEBT

The Company’s long-term debt at the end of fiscal 2001 and fiscal

2000 consisted of the following (amounts in millions):

February 3, 2002 January 28, 2001

Commercial Paper; weighted

average interest rate of 6.1%

at January 28, 2001 $ – $ 754

61/2% Senior Notes; due September

15, 2004; interest payable semi-annually

on March 15 and September 15 500 500

53/8% Senior Notes; due April 1, 2006;

interest payable semi-annually on

April 1 and October 1 500 –

Capital Lease Obligations; payable

in varying installments through

January 31, 2027 232 230

Other 23 65

Total long-term debt 1,255 1,549

Less current installments 54

Long-term debt, excluding

current installments $1,250 $1,545

The Company has a commercial paper program with maximum

available borrowings up to $1 billion. In connection with the pro-

gram, the Company has a back-up credit facility with a consortium

of banks for up to $800 million. The credit facility, which expires in

September 2004, contains various restrictive covenants, none of

which are expected to materially impact the Company’s liquidity

or capital resources. Commercial paper borrowings of $754

million outstanding at January 28, 2001, were classified as non-

current pursuant to the Company’s intent and ability to finance this

obligation on a long-term basis.

The Company issued $500 million of 53/8% Senior Notes in

fiscal 2001 and $500 million of 61/2% Senior Notes in fiscal 1999,

collectively referred to as “Senior Notes.”The Senior Notes may

be redeemed by the Company at any time, in whole or in part, at

a redemption price plus accrued interest up to the redemption

date. The redemption price is equal to the greater of (1) 100% of

the principal amount of the Senior Notes to be redeemed or (2)

the sum of the present values of the remaining scheduled pay-

ments of principal and interest to maturity. The Senior Notes

are not subject to sinking fund requirements.

Interest expense in the accompanying Consolidated Statements

of Earnings is net of interest capitalized of $84 million, $73 million

and $45 million in fiscal 2001, 2000 and 1999, respectively.

Maturities of long-term debt are $5 million for fiscal 2002, $6

million for fiscal 2003, $507 million for fiscal 2004, $8 million for

fiscal 2005 and $509 million for fiscal 2006.

As of February 3, 2002, the market values of the publicly trad-

ed 53/8% and 61/2% Senior Notes were approximately $511 million

and $531 million, respectively. The estimated fair value of all other

long-term borrowings, excluding capital lease obligations,

approximated the carrying value of $23 million. These fair values

were estimated using a discounted cash flow analysis based on

the Company’s incremental borrowing rate for similar liabilities.

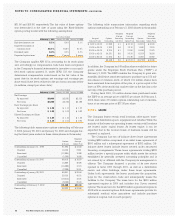

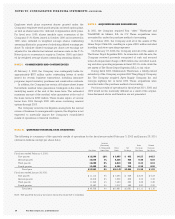

NOTE 3. INCOME TAXES

The provision for income taxes consisted of the following

(in millions):

Fiscal Year Ended

February 3, 2002 January 28, 2001 January 30, 2000

Current:

U.S. $ 1,594 $ 1,267 $ 1,209

State 265 216 228

Foreign 60 45 45

1,919 1,528 1,482

Deferred:

U.S. (12) 98 9

State (1) 9 (4)

Foreign 71 (3)

(6) 108 2

Total $ 1,913 $ 1,636 $ 1,484