Home Depot 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

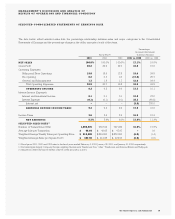

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

RESULTS OF OPERATIONS AND FINANCIAL CONDITION (CONTINUED)

23The Home Depot, Inc. and Subsidiaries

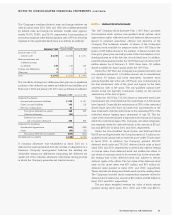

CRITICAL ACCOUNTING POLICIES Our significant accounting

policies are disclosed in Note 1 to our consolidated financial state-

ments.The following discussion addresses our most critical account-

ing policies, which are those that are most important to the portray-

al of our financial condition and results, and that require judgment.

REVENUE RECOGNITION We recognize revenue, net of estimat-

ed returns, at the time the customer takes possession of the

merchandise or receives services. We estimate the liability for

sales returns based on the historical return levels. The methodolo-

gy used is consistent with other retailers. We believe that our esti-

mate for sales returns is an accurate reflection of future returns.

When we collect payment from customers before ownership of the

merchandise has passed or the service has been performed, the

amount received is recorded as a deferred revenue liability.

INVENTORY Our inventory is stated at the lower of cost (first-in,

first-out) or market, with approximately 94% valued under the

retail method and the remainder under the cost method. Under

the retail method, inventory is stated at cost which is determined

by applying a cost-to-retail ratio to the ending retail value of inven-

tory. As our inventory retail value is adjusted regularly to reflect

market conditions, our inventory methodology approximates the

lower of cost or market. Retailers with many different types of mer-

chandise at low unit cost with a large number of transactions fre-

quently use this method. In addition, we reduce our ending inven-

tory value for estimated losses related to shrink. This estimate is

determined based upon analysis of historical shrink losses and

recent shrink trends.

SELF INSURANCE We are self-insured for certain losses related

to general liability, product liability and workers’compensation.

We maintain stop loss coverage with third party insurers to limit

our total exposure. Our liability represents an estimate of the

ultimate cost of claims incurred as of the balance sheet date. The

estimated liability is not discounted and is established based

upon analysis of historical data and actuarial estimates, and is

reviewed by management and third party actuaries on a quar-

terly basis to ensure that the liability is appropriate. While we

believe these estimates are reasonable based on the information

currently available, if actual trends, including the severity or

frequency of claims or fluctuations in premiums, differ from our

estimates, our financial results could be impacted. In an attempt to

mitigate our risks of workers’compensation and general liability

claims, we have significantly enhanced our store safety proce-

dures with SPI and other safety awareness programs.

USE OF ESTIMATES We have made a number of estimates and

assumptions relating to the reporting of assets and liabilities, the

disclosure of contingent assets and liabilities, and reported

amounts of revenue and expenses in preparing our financial state-

ments in conformity with generally accepted accounting princi-

ples. Actual results could differ from these estimates.

RECENT ACCOUNTING PRONOUNCEMENTS In July 2001, the

Financial Accounting Standards Board (“FASB”) issued Statement

of Financial Accounting Standards (“SFAS”) 142, “Goodwill and

Other Intangible Assets.”Under SFAS 142, which we will adopt on

February 4, 2002, goodwill will no longer be amortized and will

instead be evaluated for impairment at least annually. Without this

change, amortization expense for goodwill in fiscal 2002 would

have been approximately $11 million. We have reviewed our

goodwill and completed our impairment analysis and, according-

ly, have determined that the adoption of SFAS 142 will not have a

material impact on our consolidated financial statements.

In October 2001, the FASB issued SFAS 144, “Accounting for

the Impairment or Disposal of Long-Lived Assets,”which amends

Accounting Principles Board Opinion No. 30 (“APB 30”),

“Reporting the Results of Operations - Reporting the Effects of

Disposal of a Segment of a Business, and Extraordinary, Unusual

and Infrequently Occurring Events and Transactions.”SFAS 144

retains the fundamental provisions of SFAS 121,“Accounting for the

Impairment of Long-Lived Assets and for Long-Lived Assets to be

Disposed Of,”for recognizing and measuring impairment losses

on long-lived assets held for use and long-lived assets to be dis-

posed of by sale, while resolving significant implementation

issues. SFAS 144 retains the basic provisions of APB 30 on the pres-

entation of discontinued operations in the income statement, but

expands the scope to include all distinguishable components of an

entity that will be eliminated from ongoing operations in a dispos-

al transaction. We plan to adopt SFAS 144 on February 4, 2002 and

do not expect the adoption to have a material impact on our con-

solidated financial statements.