Home Depot 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

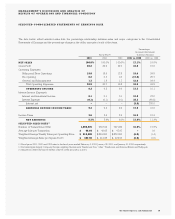

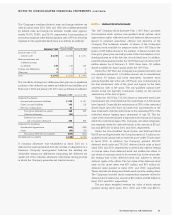

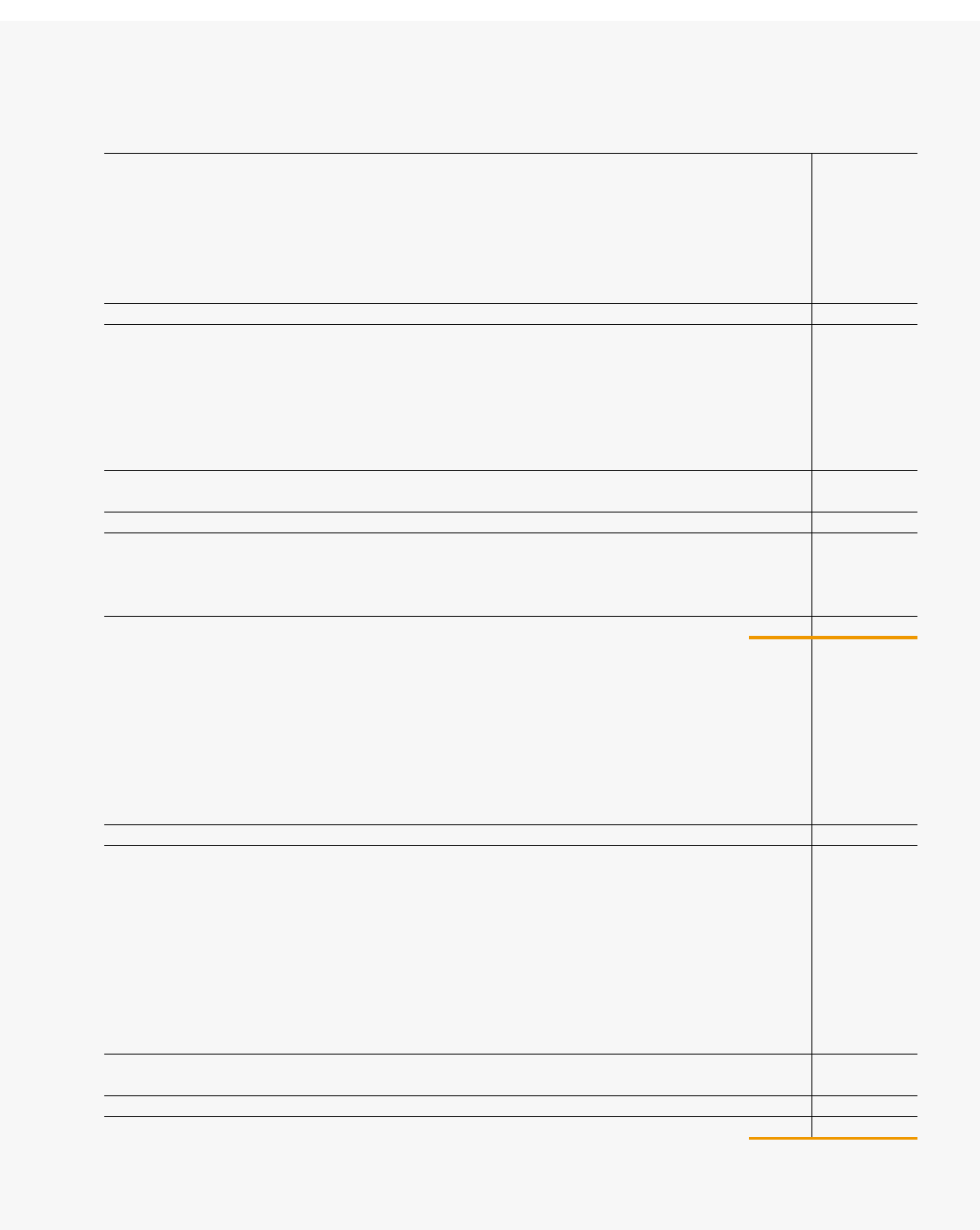

CONSOLIDATED BALANCE SHEETS

25The Home Depot, Inc. and Subsidiaries

amounts in millions, except share data February 3, 2002 January 28, 2001

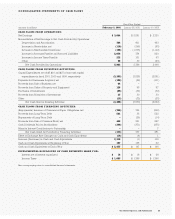

ASSETS

Current Assets:

Cash and Cash Equivalents $ 2,477 $ 167

Short-Term Investments, including current maturities of long-term investments 69 10

Receivables, net 920 835

Merchandise Inventories 6,725 6,556

Other Current Assets 170 209

Total Current Assets 10,361 7,777

Property and Equipment, at cost:

Land 4,972 4,230

Buildings 7,698 6,167

Furniture, Fixtures and Equipment 3,403 2,877

Leasehold Improvements 750 665

Construction in Progress 1,049 1,032

Capital Leases 257 261

18,129 15,232

Less Accumulated Depreciation and Amortization 2,754 2,164

Net Property and Equipment 15,375 13,068

Notes Receivable 83 77

Cost in Excess of the Fair Value of Net Assets Acquired, net of accumulated

amortization of $49 at February 3, 2002 and $41 at January 28, 2001 419 314

Other 156 149

$26,394 $21,385

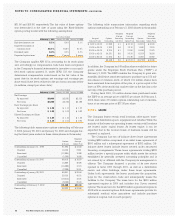

LIABILITIES AND STOCKHOLDERS’EQUITY

Current Liabilities:

Accounts Payable $ 3,436 $ 1,976

Accrued Salaries and Related Expenses 717 627

Sales Taxes Payable 348 298

Other Accrued Expenses 933 752

Deferred Revenue 851 650

Income Taxes Payable 211 78

Current Installments of Long-Term Debt 5 4

Total Current Liabilities 6,501 4,385

Long-Term Debt, excluding current installments 1,250 1,545

Other Long-Term Liabilities 372 249

Deferred Income Taxes 189 195

Minority Interest –7

STOCKHOLDERS’EQUITY

Common Stock, par value $0.05. Authorized: 10,000,000,000 shares; issued and outstanding –

2,345,888,000 shares at February 3, 2002 and 2,323,747,000 shares at January 28, 2001 117 116

Paid-In Capital 5,412 4,810

Retained Earnings 12,799 10,151

Accumulated Other Comprehensive Loss (220) (67)

18,108 15,010

Less Unearned Compensation 26 6

Total Stockholders’Equity 18,082 15,004

$26,394 $21,385

See accompanying notes to consolidated financial statements.