Home Depot 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

29The Home Depot, Inc. and Subsidiaries

COST IN EXCESS OF THE FAIR VALUE OF NET ASSETS ACQUIRED

Goodwill, which represents the excess of purchase price over fair

value of net assets acquired, is amortized on a straight-line basis

over 40 years. The Company assesses the recoverability of this

intangible asset by determining whether the amortization of the

goodwill balance over its remaining useful life can be recovered

through undiscounted future operating cash flows of the acquired

operation. The amount of goodwill impairment, if any, is measured

based on projected discounted cash flows using a discount rate

reflecting the Company’s average cost of funds.

IMPAIRMENT OF LONG-LIVED ASSETS The Company reviews

long-lived assets for impairment when circumstances indicate the

carrying amount of an asset may not be recoverable. Impairment

is recognized to the extent the sum of undiscounted estimated

future cash flows expected to result from the use of the asset is

less than the carrying value. Accordingly, when the Company

commits to relocate or close a store, the estimated unrecoverable

costs are charged to selling and store operating expense. Such

costs include the estimated loss on the sale of land and buildings,

the book value of abandoned fixtures, equipment and leasehold

improvements, and a provision for the present value of future

lease obligations, less estimated sublease income.

STOCK COMPENSATION Statement of Financial Accounting

Standards No. 123 (“SFAS 123”), “Accounting for Stock-Based

Compensation”encourages the use of a fair-value-based method

of accounting. As allowed by SFAS 123, the Company has elected

to account for its stock-based compensation plans under the intrin-

sic value-based method of accounting prescribed by Accounting

Principles Board Opinion No. 25 (“APB 25”), “Accounting for Stock

Issued to Employees.”Under APB 25, compensation expense is

recorded on the date of grant if the current market price of the

underlying stock exceeds the exercise price. The Company com-

plies with the disclosure requirements of SFAS 123.

DERIVATIVES On January 29, 2001, the Company adopted

Statement of Financial Accounting Standards Nos. 133, 137,

and 138 (collectively “SFAS 133”), “Accounting for Derivative

Instruments and Hedging Activities.”SFAS 133 requires an entity to

measure derivatives at fair value and recognize these assets or lia-

bilities on the balance sheet. Recognition of changes in the fair

value of a derivative in the income statement or other accumulat-

ed comprehensive income (loss) depends on the intended use of

the derivative and its designation. The Company designates its

derivatives based upon criteria established by SFAS 133. The

Company’s objective for holding derivative instruments is to

decrease the volatility of earnings and cash flow associated with

fluctuations in interest rates and foreign currencies.

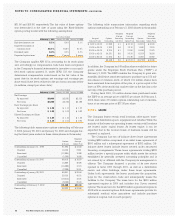

DEPRECIATION AND AMORTIZATION The Company’s build-

ings, furniture, fixtures and equipment are depreciated using the

straight-line method over the estimated useful lives of the assets.

Improvements to leased premises are amortized using the

straight-line method over the life of the lease or the useful life of

the improvement, whichever is shorter. The Company’s proper-

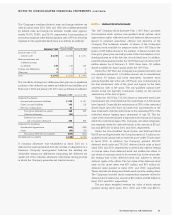

ty and equipment is depreciated using the following estimated

useful lives:

Life

Buildings 10-45 years

Furniture, fixtures and equipment 5-20 years

Leasehold improvements 5-30 years

Computer software 3-5 years

REVENUES The Company recognizes revenue, net of estimated

returns, at the time the customer takes possession of merchandise

or receives services. When the Company collects payment from

customers before ownership of the merchandise has passed or

the service has been performed, the amount received is record-

ed as a deferred revenue liability.

SELF INSURANCE The Company is self-insured for certain

losses related to general liability, product liability and workers’

compensation. The Company has stop loss coverage to limit the

exposure arising from these claims. The expected ultimate cost

for claims incurred as of the balance sheet date is not discounted

and is recognized as a liability. The expected ultimate cost of

claims is estimated based upon analysis of historical data and

actuarial estimates.

ADVERTISING Television and radio advertising production costs

along with media placement costs are expensed when the adver-

tisement appears. Included in current assets are $15 million and

$20 million at the end of fiscal years 2001 and 2000, respectively,

relating to prepayments of production costs for print and broad-

cast advertising.

SHIPPING AND HANDLING COSTS The Company accounts for

certain shipping and handling costs related to the shipment of

product to customers from vendors as cost of goods sold. However,

costs of shipments to customers by the Company are classified as

selling and store operating expenses. The costs of shipments

included in selling and store operating expenses amounted to

$122 million, $73 million and $40 million in fiscal years 2001, 2000

and 1999, respectively.