Home Depot 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

RESULTS OF OPERATIONS AND FINANCIAL CONDITION (CONTINUED)

The Home Depot, Inc. and Subsidiaries22

As of February 3, 2002, we had $2.5 billion in cash and cash

equivalents. We believe that our current cash position, internally

generated funds, funds available from the $1 billion commercial

paper program and the ability to obtain alternate sources of

financing should be sufficient to enable us to complete our capi-

tal expenditure programs through the next several fiscal years.

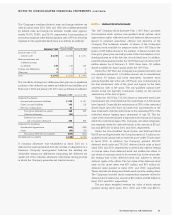

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT

MARKET RISK Our exposure to market risks results primarily

from fluctuations in interest rates. Although we have international

operating entities, our exposure to foreign currency rate fluctua-

tions is not significant to our financial condition and results. Our

objective for holding derivative instruments is to decrease the

volatility of earnings and cash flow associated with fluctuations in

these rates.

We have financial instruments that are sensitive to changes in

interest rates. These instruments include fixed rate debt and other

contractual arrangements. We issued $500 million of 53/8% Senior

Notes in fiscal 2001 maturing on April 1, 2006 and $500 million of

61/2% Senior Notes in fiscal 1999 maturing on September 15, 2004.

As of February 3, 2002, the market values of the publicly traded

53/8% and 61/2% Senior Notes were approximately $511 million and

$531 million, respectively. We have two interest rate swap agree-

ments, both designed to hedge the market risk associated with

interest rate volatility. We have one agreement in the notional

amount of $300 million that swaps fixed rate interest on $300

million of our $500 million 53/8% Senior Notes for a variable interest

rate equal to LIBOR plus 30 basis points and expires on April 1,

2006. We have another agreement expiring January 31, 2003 in

the notional amount of $690 million that swaps a variable interest

rate for a fixed rate of 63/4%, designed to mitigate the interest rate

risk related to the portfolio of our proprietary credit card, which is

serviced by a third party.

IMPACT OF INFLATION AND CHANGING PRICES Although we

cannot accurately determine the precise effect of inflation on

operations, we do not believe inflation has had a material effect on

sales or results of operations.

Cash used in financing activities in fiscal 2001 was $173 mil-

lion compared with cash provided by financing activities of $737

million in fiscal 2000. The increase in cash used was primarily due

to the net effect of repaying $754 million of commercial paper and

issuing $500 million of 53/8% Senior Notes during fiscal 2001.

We have a commercial paper program that allows borrowings

up to a maximum of $1 billion. As of February 3, 2002, there were

no borrowings outstanding under the program. In connection with

the program, we have a back-up credit facility with a consortium

of banks for up to $800 million. The credit facility, which expires in

September 2004, contains various restrictive covenants, none of

which are expected to impact our liquidity or capital resources.

We use capital, operating and other off-balance sheet leases to

finance about 20% of our real estate. Off-balance sheet leases

include three leases created under structured financing arrange-

ments to fund the construction of certain stores, office buildings and

distribution centers. Two of these lease agreements involve a special

purpose entity which meets the criteria established by generally

accepted accounting principles and is not owned by or affiliated with

the Company, its management or officers. Operating and off-balance

sheet leases are not reflected in our balance sheet in accordance

with generally accepted accounting principles.The net present value

of capital lease obligations is reflected in our balance sheet in long-

term debt. As of the end of fiscal 2001, our debt to equity ratio was

6.9%. If the estimated present value of future payments under the

operating and other off-balance sheet leases were capitalized, our

debt to equity ratio would increase to approximately 30%.

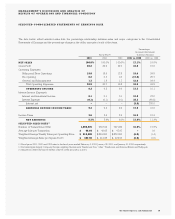

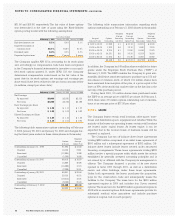

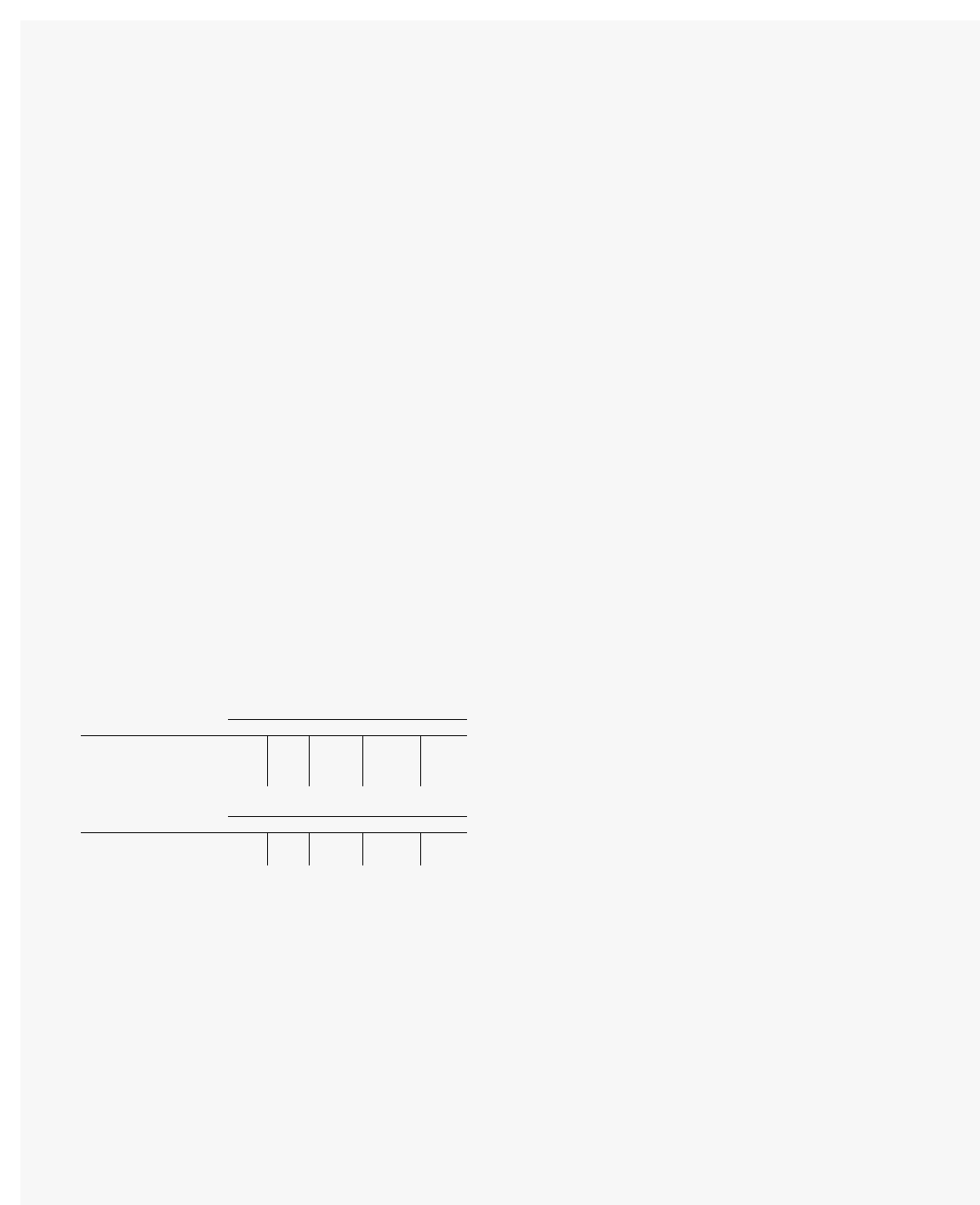

The following table summarizes our significant contractual

obligations and commercial commitments as of February 3, 2002

(amounts in millions):

Payments Due By Period

Contractual Obligations(1) Total 2002 2003-2004 2005-2006 Thereafter

Long-Term Debt $1,023 $ 1 $ 502 $ 502 $ 18

Capital Leases $ 791 $ 41 $ 85 $ 88 $ 577

Operating Leases $ 7,407 $ 517 $ 942 $ 809 $ 5,139

Amount of Commitment Expiration Per Period

Commercial Commitments(2) Total 2002 2003-2004 2005-2006 Thereafter

Letters of Credit $ 557 $ 551 $ 6 ––

Guarantees $ 799 –$ 504 $ 72 $ 223

(1) Contractual obligations consist of long-term debt comprised primarily

of $1 billion of Senior Notes further discussed in “Quantitative and

Qualitative Disclosures about Market Risk”and future minimum lease

payments under capital and operating leases, including off-balance

sheet leases, used in the normal course of business.

(2) Commercial commitments include letters of credit for certain busi-

ness transactions and guarantees provided under certain off-balance

sheet leases. We issue letters of credit for insurance programs, import

purchases and construction contracts. Under certain off-balance sheet

leases for retail locations, office buildings and distribution centers, we

have provided residual value guarantees. The estimated maximum

amount of the residual value guarantees at the end of the lease terms

is $799 million. The leases expire at various terms from 2004 through

2008 with some carrying renewal options through 2025. The expira-

tion date of the residual value guarantees in the table above is based

on the original lease terms; however, the expiration period will

change if the leases are renewed.