Home Depot 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

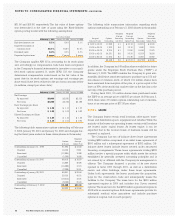

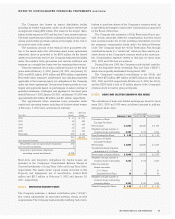

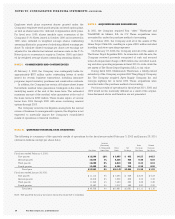

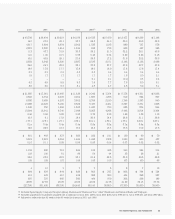

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The Home Depot, Inc. and Subsidiaries

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Home Depot, Inc. and subsidiaries (the “Company”) operates

Home Depot stores, which are full-service, warehouse-style stores

averaging approximately 109,000 square feet in size. The stores

stock approximately 40,000 to 50,000 different kinds of building

materials, home improvement supplies and lawn and garden prod-

ucts that are sold primarily to do-it-yourselfers, but also to home

improvement contractors, tradespeople, and building maintenance

professionals. In addition, the Company operates EXPO Design

Center stores, which offer products and services primarily related

to design and renovation projects, and Villager’s Hardware stores,

which offer products and services for home enhancement and

smaller project needs in a convenience hardware store format.

Additionally, the Company operates one Home Depot Floor Store,

a test store that offers only flooring products and installation serv-

ices. At the end of fiscal 2001, the Company was operating 1,333

stores, including 1,201 Home Depot stores, 41 EXPO Design

Center stores, 4 Villager’s Hardware stores and 1 Home Depot

Floor Store in the United States; 78 Home Depot stores in Canada;

4 Home Depot stores in Argentina, which were sold on February

18, 2002; and 4 Home Depot stores in Mexico. Included in the

Company’s Consolidated Balance Sheet at February 3, 2002, were

$946 million of net assets of the Canada, Argentina and Mexico

operations. Also included in consolidated results are several whol-

ly-owned subsidiaries. The Company offers facilities maintenance

and repair products, as well as wallpaper and custom window

treatments via direct shipment through subsidiaries Maintenance

Warehouse and National Blinds and Wallpaper, Inc. Georgia

Lighting is a specialty lighting designer, distributor and retailer to

both commercial and retail customers. The Company offers

plumbing, HVAC and other professional plumbing products

through wholesale plumbing distributors Apex Supply Company

and Your “other”Warehouse.

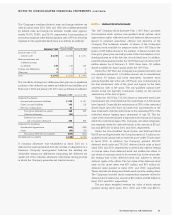

FISCAL YEAR The Company’s fiscal year is a 52- or 53-week peri-

od ending on the Sunday nearest to January 31. Fiscal year 2001,

which ended February 3, 2002, consisted of 53 weeks. Fiscal years

2000 and 1999, which ended January 28, 2001 and January 30,

2000, respectively, consisted of 52 weeks.

BASIS OF PRESENTATION The consolidated financial statements

include the accounts of the Company, its wholly-owned sub-

sidiaries, and its majority-owned partnership, The Home Depot

Chile S.A. In October 2001, the Company sold its interest in The

Home Depot Chile S.A. All significant intercompany transactions

have been eliminated in consolidation.

Stockholders’equity, share and per share amounts for all peri-

ods presented have been adjusted for a three-for-two stock split

effected in the form of a stock dividend on December 30, 1999.

CASH EQUIVALENTS The Company considers all highly liquid

investments purchased with a maturity of three months or less to

be cash equivalents. The Company’s cash and cash equivalents

are carried at fair market value and consist primarily of commer-

cial paper, money market funds, U.S. government agency securi-

ties and tax-exempt notes and bonds.

MERCHANDISE INVENTORIES The majority of the Company’s

inventory is stated at the lower of cost (first-in, first-out) or market,

as determined by the retail inventory method.

Certain subsidiaries and distribution centers value inventories

at the lower of cost (first-in, first-out) or market, as determined by

the cost method. These inventories represent approximately 6% of

total inventory.

INVESTMENTS The Company’s investments, consisting primarily

of high-grade debt securities, are recorded at fair value and are

classified as available-for-sale.

INCOME TAXES The Company provides for federal, state and for-

eign income taxes currently payable, as well as for those deferred

because of timing differences between reporting income and

expenses for financial statement purposes versus tax purposes.

Federal, state and foreign incentive tax credits are recorded as a

reduction of income taxes. Deferred tax assets and liabilities are

recognized for the future tax consequences attributable to differ-

ences between the financial statement carrying amounts of exist-

ing assets and liabilities and their respective tax bases. Deferred

tax assets and liabilities are measured using enacted tax rates

expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled.

The effect of a change in tax rates is recognized as income or

expense in the period that includes the enactment date.

The Company and its eligible subsidiaries file a consolidated

U.S. federal income tax return. Non-U.S. subsidiaries, which are

consolidated for financial reporting, are not eligible to be includ-

ed in consolidated U.S. federal income tax returns. Separate

provisions for income taxes have been determined for these enti-

ties. The Company intends to reinvest the unremitted earnings of

its non-U.S. subsidiaries and postpone their remittance indefinite-

ly. Accordingly, no provision for U.S. income taxes for non-U.S.

subsidiaries was required for any year presented.

28