Home Depot 2000 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2000 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

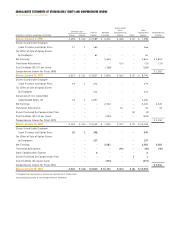

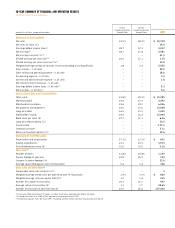

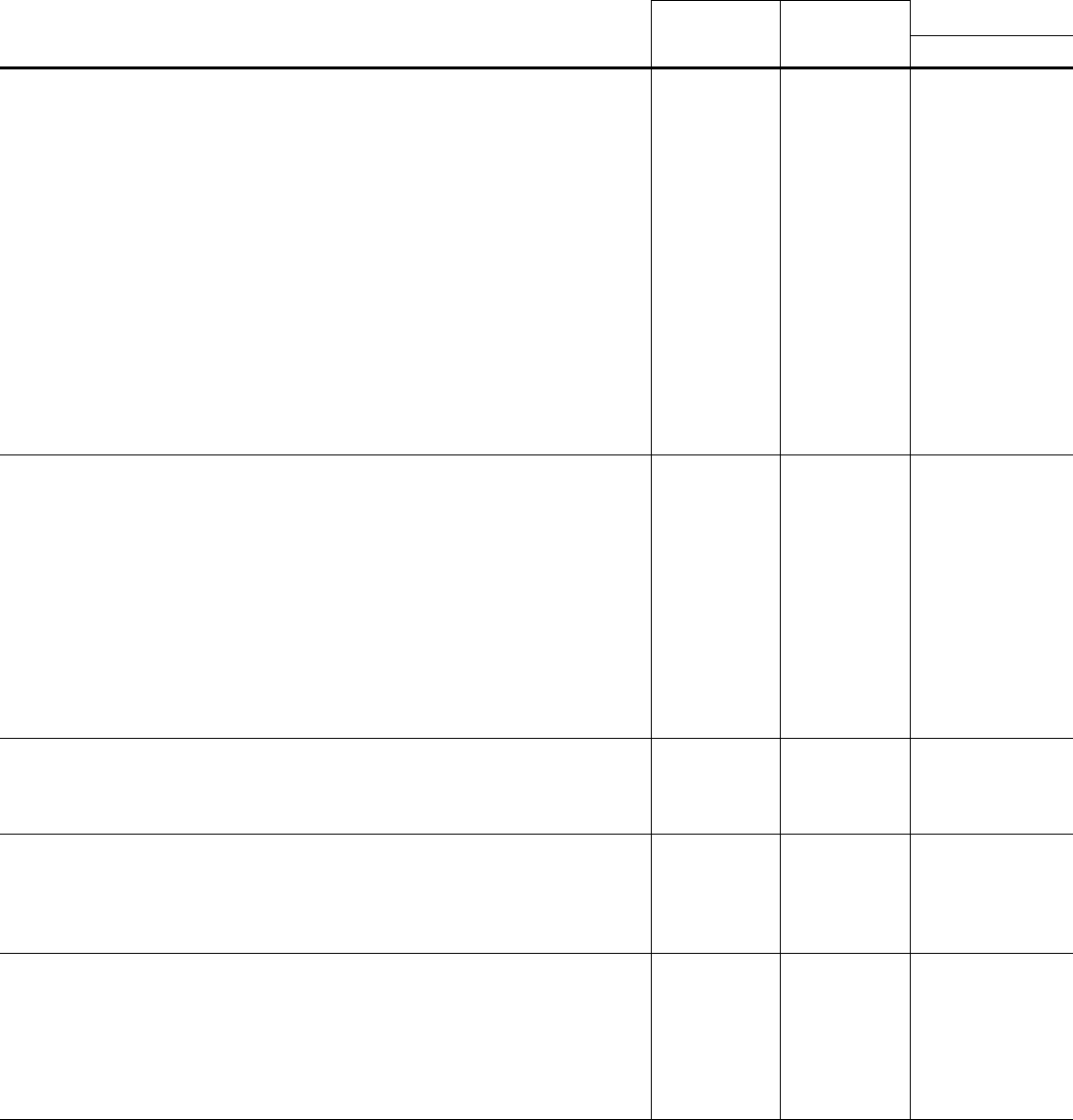

10-Year Summary of Financial and Operating Results

The Home Depot, Inc. and Subsidiaries

5 -Ye a r 1 0 -Ye a r

Compound Annual Compound Annual

amounts in millions, except where noted Growth Rate Growth Rate 2000

Statement of Earnings Data

Net sales 24.2% 28.2%

$ 45,738

Net sales increase (%) ––

19.0

Earnings before income taxes(2) 28.7 32.1

4,217

Net earnings(2) 28.7 31.8

2,581

Net earnings increase (%)(2) ––

11.3

Diluted earnings per share ($)(2,3) 26.5 27.1

1.10

Diluted earnings per share increase (%)(2) ––

10.0

Weighted average number of common shares outstanding assuming dilution 1.8 2.6

2,352

Gross margin – % of sales – –

29.9

Store selling and operating expense – % of sales – –

18.6

Pre-opening expense – % of sales – –

0.3

General and administrative expense – % of sales – –

1.8

Net interest income (expense) – % of sales – –

–

Earnings before income taxes – % of sales(2) ––

9.2

Net earnings – % of sales(2) ––

5.6

Balance Sheet Data and Financial Ratios

Total assets 23.8% 29.3%

$ 21,385

Working capital 22.0 27.4

3,392

Merchandise inventories 24.6 29.1

6,556

Net property and equipment 24.0 31.0

13,068

Long-term debt 16.5 11.3

1,545

Stockholders’ equity 24.6 36.2

15,004

Book value per share ($) 22.7 31.1

6.46

Long-term debt to equity (%) – –

10.3

Current ratio ––

1.77:1

Inventory turnover ––

5.1x

Return on invested capital (%)(2) ––

19.6

Statement of Cash Flows Data

Depreciation and amortization 27.1% 33.3%

$ 601

Capital expenditures 22.3 24.5

3,574

Cash dividends per share ($) 32.0 32.0

0.16

Store Data

(4)

Number of stores 21.8% 22.8%

1,134

Square footage at year-end 22.8 25.2

123

Increase in square footage (%) – –

22.6

Average square footage per store (in thousands) 0.6 1.6

108

Store Sales and Other Data

(4)

Comparable store sales increase (%)(5) ––

4

Weighted average weekly sales per operating store (in thousands) 1.9% 4.3%

$ 864

Weighted average sales per square foot ($)(5) 1.3 2.6

415

Number of customer transactions 20.4 23.7

937

Average sale per transaction ($) 3.1 3.7

48.65

Number of associates at year-end (actual) 23.0 26.6

227,300

(1)Fiscal year 1996 consisted of 53 weeks; all other fiscal years reported consisted of 52 weeks.

(2)Excludes the effect of a $104 million non-recurring charge in fiscal 1997.

(3)Diluted earnings per share for fiscal 1997, including a $104 million non-recurring charge, were $0.52.