Home Depot 2000 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2000 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

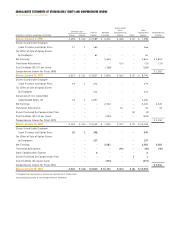

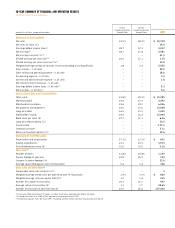

Consolidated Statements of Stockholders’ Equity and Comprehensive Income

The Home Depot, Inc. and Subsidiaries

Accumulated

Other Total

Common Stock Paid-In Retained Comprehensive Stockholders’ Comprehensive

amounts in millions, except per share data Shares Amount Capital Earnings Income Other Equity Income(1)

Balance, February 1, 1998

2,196 $ 110 $ 2,589 $ 4,430 $ (28) $ (3) $ 7,098

Shares Issued Under Employee

Stock Purchase and Option Plans 17 1 165 – – – 166

Tax Effect of Sale of Option Shares

by Employees – – 63 – – – 63

Net Earnings – – – 1,614 – – 1,614 $ 1,614

Translation Adjustments – – – – (33) – (33) (33)

Cash Dividends ($0.077 per share) – – – (168) – – (168)

Comprehensive Income for Fiscal 1998 $ 1,581

Balance, January 31, 1999

2,213 $ 111 $ 2,817 $ 5,876 $ (61) $ (3) $ 8,740

Shares Issued Under Employee

Stock Purchase and Option Plans 19 1 273 – – – 274

Tax Effect of Sale of Option Shares

by Employees – – 132 – – – 132

Conversion of 31⁄4% Convertible

Subordinated Notes, net 72 3 1,097 – – – 1,100

Net Earnings – – – 2,320 – – 2,320 2,320

Translation Adjustments – – – – 34 – 34 34

Shares Purchased for Compensation Plans – – – – – (4) (4)

Cash Dividends ($0.113 per share) – – – (255) – – (255)

Comprehensive Income for Fiscal 1999 $ 2,354

Balance, January 30, 2000

2,304 $ 115 $ 4,319 $ 7,941 $ (27) $ (7) $ 12,341

Shares Issued Under Employee

Stock Purchase and Option Plans

20 1 348 – – – 349

Tax Effect of Sale of Option Shares

by Employees

– – 137 – – – 137

Net Earnings

– – – 2,581 – – 2,581 2,581

Translation Adjustments

– – – – (40) – (40) (40)

Stock Compensation Expense

–– 6 – – – 6

Shares Purchased for Compensation Plans

–– – – – 1 1

Cash Dividends ($0.16 per share)

– – – (371) – – (371)

Comprehensive Income for Fiscal 2000

$ 2,541

Balance, January 28, 2001

2,324 $ 116 $ 4,810 $ 10,151 $ (67) $ (6) $ 15,004

(1)Components of comprehensive income are reported net of related taxes.

See accompanying notes to consolidated financial statements.