Home Depot 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

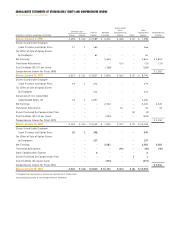

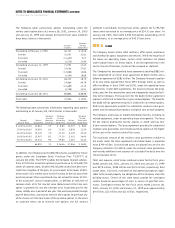

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

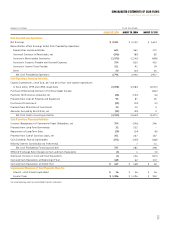

During fiscal 1999, the Company issued $500 million of 61⁄2% Senior

Notes (“Senior Notes”). The Senior Notes may be redeemed by the

Company at any time, in whole or in part, at a redemption price plus

accrued interest up to the redemption date. The redemption price is

equal to the greater of (1) 100% of the principal amount of the Senior

Notes to be redeemed or (2) the sum of the present values of the

remaining scheduled payments of principal and interest to maturity.

The Senior Notes are not subject to sinking fund requirements.

During 1999, the Company redeemed its 31⁄4% Convertible

Subordinated Notes (“31⁄4% Notes”). A total principal amount of

$1.1 billion was converted into 72 million shares of the Company’s

common stock.

Interest expense in the accompanying Consolidated Statements of

Earnings is net of interest capitalized of $73 million in fiscal 2000,

$45 million in fiscal 1999 and $31 million in fiscal 1998.

Maturities of long-term debt are $4 million for fiscal 2001, $42 mil-

lion for fiscal 2002, $5 million for fiscal 2003, $507 million for

fiscal 2004 and $761 million for fiscal 2005.

As of January 28, 2001, the market value of the publicly traded

Senior Notes was approximately $515 million. The estimated fair

value of commercial paper borrowings approximates their carry-

ing value. The estimated fair value of all other long-term borrowings,

excluding capital lease obligations, was approximately $67 million

compared to the carrying value of $65 million. These fair values were

estimated using a discounted cash flow analysis based on the

Company’s incremental borrowing rate for similar liabilities.

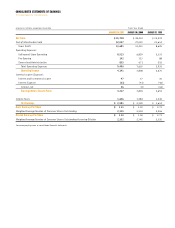

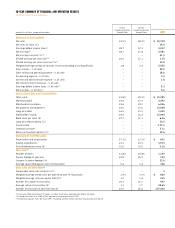

Note 3. Income Taxes

The provision for income taxes consisted of the following (in millions):

Fiscal Year Ended

January 28, 2001 January 30, 2000 January 31, 1999

Current:

U.S.

$ 1,267

$ 1,209 $ 823

State

216

228 150

Foreign

45

45 20

1,528

1,482 993

Deferred:

U.S.

98

946

State

9

(4) (1)

Foreign

1

(3) 2

108

247

Total

$ 1,636

$ 1,484 $ 1,040

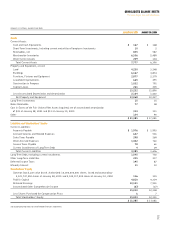

The Company’s combined federal, state and foreign effective tax rates

for fiscal years 2000, 1999 and 1998, net of offsets generated by

federal, state and foreign tax incentive credits, were approximately

38.8%, 39.0% and 39.2%, respectively. A reconciliation of income

tax expense at the federal statutory rate of 35% to actual tax expense

for the applicable fiscal years follows (in millions):

Fiscal Year Ended

January 28, 2001 January 30, 2000 January 31, 1999

Income taxes at U.S.

statutory rate

$ 1,476

$ 1,331 $ 929

State income taxes, net of

federal income tax benefit

146

145 96

Foreign rate differences

5

2–

Other, net

9

615

Total

$ 1,636

$ 1,484 $ 1,040

The tax effects of temporary differences that give rise to significant

portions of the deferred tax assets and deferred tax liabilities as of

January 28, 2001 and January 30, 2000 were as follows (in millions):

January 28, 2001 January 30, 2000

Deferred Tax Assets:

Accrued self-insurance liabilities

$ 151

$ 154

Other accrued liabilities

118

142

Total gross deferred tax assets

269

296

Deferred Tax Liabilities:

Accelerated depreciation

(389)

(321)

Other

(75)

(62)

Total gross deferred tax liabilities

(464)

(383)

Net deferred tax liability

$ (195)

$ (87)

No valuation allowance was recorded against the deferred tax assets

at January 28, 2001 and January 30, 2000. Company management

believes the existing net deductible temporary differences comprising

the total gross deferred tax assets will reverse during periods in which

the Company generates net taxable income.