Home Depot 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

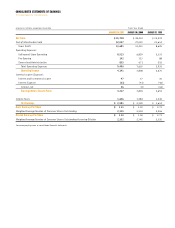

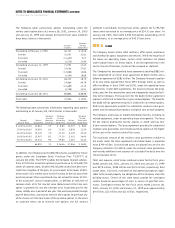

The following table summarizes options outstanding under the

various stock option plans at January 28, 2001, January 30, 2000

and January 31, 1999 and changes during the fiscal years ended on

these dates (shares in thousands):

Weighted

Number Average

of Shares Option Price

Outstanding at February 1, 1998 65,727 $ 10.08

Granted 21,041 21.63

Exercised (11,640) 9.07

Cancelled (3,536) 13.89

Outstanding at January 31, 1999 71,592 13.45

Granted 14,006 37.81

Exercised (13,884) 10.88

Cancelled (3,295) 18.88

Outstanding at January 30, 2000 68,419 18.79

Granted 14,869 49.78

Exercised (14,689) 13.15

Cancelled (2,798) 30.51

Outstanding at January 28, 2001

65,801 $ 26.46

Exercisable 27,856 $ 15.80

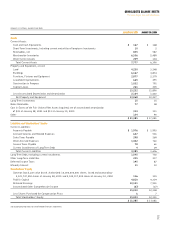

The following table summarizes information regarding stock options

outstanding as of January 28, 2001 (shares in thousands):

Weighted Weighted Weighted

Average Average Average

Range of Options Remaining Outstanding Options Exercisable

Exercise Prices Outstanding Life (Years) Option Price Exercisable Option Price

$ 6.00 to 10.00 12,814 3.9 $ 8.80 12,073 $ 8.80

10.00 to 16.00 10,919 6.0 11.50 5,876 11.50

16.00 to 24.00 15,170 7.0 21.00 6,329 20.40

24.00 to 40.00 12,457 8.1 37.30 2,021 36.90

40.00 to 60.00 14,441 9.6 49.80 1,557 41.20

65,801 7.0 $ 26.46 27,856 $ 15.80

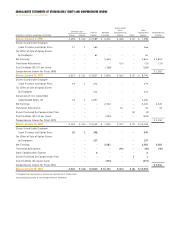

In addition, the Company had 30,856,904 shares available for future

grants under the Employee Stock Purchase Plan (“ESPP”) at

January 28, 2001. The ESPP enables the Company to grant substan-

tially all full-time associates options to purchase up to 129,618,750

shares of common stock, of which 98,761,846 shares have been exer-

cised from inception of the plan, at a price equal to the lower of 85%

of the stock’s fair market value on the first day or the last day of the

purchase period. Shares purchased may not exceed the lesser of 20%

of the associate’s annual compensation, as defined, or $25,000 of

common stock at its fair market value (determined at the time such

option is granted) for any one calendar year. Associates pay for the

shares ratably over a period of one year (the purchase period) through

payroll deductions, and cannot exercise their option to purchase any

of the shares until the conclusion of the purchase period. In the event

an associate elects not to exercise such options, the full amount

withheld is refundable. During fiscal 2000, options for 5,395,900

shares were exercised at an average price of $34.33 per share. At

January 28, 2001, there were 2,924,541 options outstanding, net of

cancellations, at an average price of $42.57 per share.

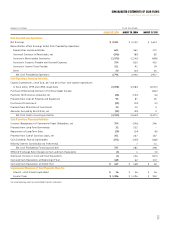

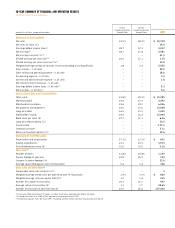

Note 5. Leases

The Company leases certain retail locations, office space, warehouse

and distribution space, equipment and vehicles. While the majority of

the leases are operating leases, certain retail locations are leased

under capital leases. As leases expire, it can be expected that in the

normal course of business, leases will be renewed or replaced.

The Company has two operating lease agreements totaling $882 mil-

lion comprised of an initial lease agreement of $600 million and a

follow-on agreement of $282 million. The Company financed a portion

of its new stores opened from fiscal 1997 through 2000, as well as

office buildings in fiscal 1999 and 2000, under the operating lease

agreements. Under both agreements, the lessor purchases the prop-

erties, pays for the construction costs and subsequently leases the facil-

ities to the Company. The lease term for the $600 million agreement

expires in 2004 and includes four 2-year renewal options. The lease for

the $282 million agreement expires in 2008 with no renewal options.

Both lease agreements provide for substantial residual value guar-

antees and include purchase options at original cost on each property.

The Company also leases an import distribution facility, including its

related equipment, under an operating lease arrangement. The lease

for the import distribution facility expires in 2005 and has four

5-year renewal options. The lease agreement provides for substantial

residual value guarantees and includes purchase options at the higher

of the cost or fair market value of the assets.

The maximum amount of the residual value guarantees relative to

the assets under the lease agreements described above is projected

to be $799 million. As the leased assets are placed into service, the

Company estimates its liability under the residual value guarantees

and records additional rent expense on a straight-line basis over the

remaining lease terms.

Total rent expense, net of minor sublease income for the fiscal years

ended January 28, 2001, January 30, 2000 and January 31, 1999

was $479 million, $389 million and $321 million, respectively. Real

estate taxes, insurance, maintenance and operating expenses appli-

cable to the leased property are obligations of the Company under the

building leases. Certain of the store leases provide for contingent

rentals based on percentages of sales in excess of specified mini-

mums. Contingent rentals for the fiscal years ended January 28,

2001, January 30, 2000 and January 31, 1999 were approximately

$9 million, $11 million and $11 million, respectively.