Home Depot 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

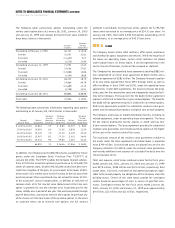

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

26

27

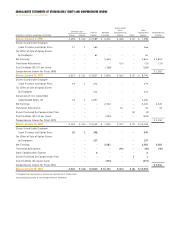

Note 4. Employee Stock Plans

The 1997 Omnibus Stock Incentive Plan (“1997 Plan”) provides that

incentive stock options, non-qualified stock options, stock apprecia-

tion rights, restricted stock and deferred shares may be issued to

selected associates, officers and directors of the Company. The maxi-

mum number of shares of the Company’s common stock available for

issuance under the 1997 Plan is the lesser of 225 million shares or

the number of shares carried over from prior plans plus one-half

percent of the total number of outstanding shares as of the first day

of each fiscal year. In addition, restricted shares issued under the

1997 Plan may not exceed 22.5 million shares. As of January 28,

2001, there were 130,691,447 shares available for future grants

under the 1997 Plan.

Under the 1997 Plan and prior plans, the Company has granted

incentive and non-qualified options for 126,219,271 shares, net of

cancellations (of which 62,918,031 had been exercised). Incentive

stock options vest at the rate of 25% per year commencing on the

first anniversary date of the grant and expire on the tenth anniversary

date of the grant. The non-qualified options have similar terms; however,

vesting does not generally begin until the second anniversary date

of the grant.

Under the 1997 Plan and prior plans, 92,495 shares of restricted

stock, net of cancellations (of which 2,268 had been exercised) have

been granted. The restricted shares vest over varying terms and are

generally based on the attainment of certain performance goals. The

expected fair value of the restricted shares on the vesting dates will

be charged to expense ratably over the vesting periods unless it is

determined that the performance goals will not be met.

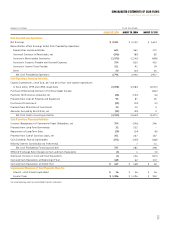

In December 2000, the Company entered into an agreement with a

key officer. Under the Non-Qualified Stock Option and Deferred Stock

Units Plan and Agreement, the Company issued 2,500,000 non-

qualified stock options with an exercise price of $40.75 per share and

also issued 750,000 deferred stock units. Both the non-qualified options

and deferred units vest 20% per year commencing on the grant date.

The non-qualified options expire on the tenth anniversary of the vest-

ing date. Each deferred stock unit entitles the officer to one share of

common stock to be received approximately two years after the vest-

ing date of the deferred stock unit, subject to certain deferral rights

of the officer. The fair value of the 750,000 deferred stock units granted

is being amortized based upon the vesting dates. The Company recorded

stock compensation expense of approximately $6 million in fiscal 2000.

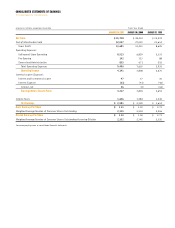

The per share weighted average fair value of stock options granted

during fiscal years 2000, 1999 and 1998 was $31.96, $18.86 and

$9.94, respectively. The fair value of these options was determined at

the date of grant using the Black-Scholes option-pricing model with

the following assumptions:

Stock Options

Granted in Fiscal Year

2000 1999 1998

Risk-free interest rate

6.4%

5.1% 5.6%

Expected volatility of common stock

54.6%

51.6% 45.7%

Dividend yield

0.3%

0.3% 0.4%

Expected option term

7 years

5 years 5 years

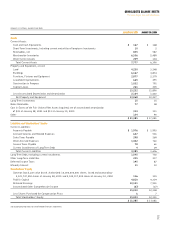

The Company applies APB 25 in accounting for its stock plans and,

accordingly, no compensation costs have been recognized in the

Company’s financial statements for incentive or non-qualified stock

options granted. If, under SFAS 123, the Company determined com-

pensation costs based on the fair value at the grant date for its stock

options, net earnings and earnings per share would have been reduced

to the pro forma amounts below (in millions, except per share data):

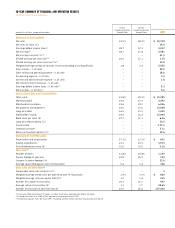

Fiscal Year Ended

January 28, 2001 January 30, 2000 January 31, 1999

Net Earnings

As reported

$ 2,581

$ 2,320 $ 1,614

Pro forma

$ 2,364

$ 2,186 $ 1,527

Basic Earnings per Share

As reported

$1.11

$ 1.03 $ 0.73

Pro forma

$1.02

$ 0.97 $ 0.69

Diluted Earnings per Share

As reported

$1.10

$ 1.00 $ 0.71

Pro forma

$1.01

$ 0.94 $ 0.67