Home Depot 2000 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2000 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

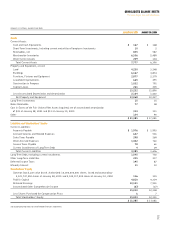

Notes to Consolidated Financial Statements

The Home Depot, Inc. and Subsidiaries

Note 1. Summary of Significant Accounting Policies

The Company operates Home Depot stores, which are full-service,

warehouse-style stores averaging approximately 108,000 square feet

in size. The stores stock approximately 40,000 to 50,000 different

kinds of building materials, home improvement supplies and lawn and

garden products that are sold primarily to do-it-yourselfers, but also

to home improvement contractors, tradespeople and building main-

tenance professionals. In addition, the Company operates EXPO

Design Center stores, which offer products and services primarily

related to design and renovation projects. The Company is currently

testing Villager’s Hardware with four stores, which offer products and

services for home enhancement and smaller project needs in a conven-

ience hardware store format. Additionally, the Company operates one

Home Depot Floor Store, a test store that offers only flooring products

and installation services. At the end of fiscal 2000, the Company was

operating 1,134 stores, including 1,027 Home Depot stores, 26 EXPO

Design Center stores, 4 Villager’s Hardware stores and 1 Home Depot

Floor Store in the United States; 67 Home Depot stores in Canada;

5 Home Depot stores in Chile; 2 Home Depot stores in Argentina; and

2 Home Depot stores in Puerto Rico. Included in the Company’s

Consolidated Balance Sheet at January 28, 2001 were $871 million

of net assets of the Canada, Chile and Argentina operations.

Fiscal Year The Company’s fiscal year is a 52- or 53-week period

ending on the Sunday nearest to January 31. Fiscal years 2000, 1999

and 1998, which ended January 28, 2001, January 30, 2000 and

January 31, 1999, respectively, consisted of 52 weeks.

Basis of Presentation The consolidated financial statements include

the accounts of the Company, its wholly-owned subsidiaries and its

majority-owned partnership. All significant intercompany transactions

have been eliminated in consolidation.

Stockholders’ equity, share and per share amounts for all periods

presented have been adjusted for a three-for-two stock split effected in

the form of a stock dividend on December 30, 1999 and a two-for-one

stock split effected in the form of a stock dividend on July 2, 1998.

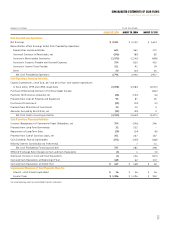

Cash Equivalents The Company considers all highly liquid invest-

ments purchased with a maturity of three months or less to be cash

equivalents. The Company’s cash and cash equivalents are carried at

fair market value and consist primarily of commercial paper, money

market funds, U.S. government agency securities and tax-exempt

notes and bonds.

Merchandise Inventories Inventories are stated at the lower of

cost (first-in, first-out) or market, as determined by the retail

inventory method.

Investments The Company’s investments, consisting primarily of

high-grade debt securities, are recorded at fair value and are classi-

fied as available-for-sale.

Income Taxes The Company provides for federal, state and foreign

income taxes currently payable, as well as for those deferred because

of timing differences between reporting income and expenses for

financial statement purposes versus tax purposes. Federal, state and

foreign incentive tax credits are recorded as a reduction of income

taxes. Deferred tax assets and liabilities are recognized for the future

tax consequences attributable to differences between the financial

statement carrying amounts of existing assets and liabilities and their

respective tax bases. Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable income in the

years in which those temporary differences are expected to be recov-

ered or settled. The effect of a change in tax rates is recognized as

income or expense in the period that includes the enactment date.

The Company and its eligible subsidiaries file a consolidated U.S.

federal income tax return. Non-U.S. subsidiaries, which are con-

solidated for financial reporting, are not eligible to be included in

consolidated U.S. federal income tax returns, and separate provisions

for income taxes have been determined for these entities. The

Company intends to reinvest the unremitted earnings of its non-U.S.

subsidiaries and postpone their remittance indefinitely. Accordingly,

no provision for U.S. income taxes for non-U.S. subsidiaries was

required for any year presented.

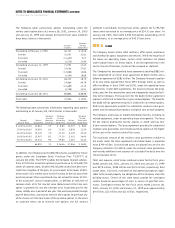

Depreciation and Amortization The Company’s buildings, furni-

ture, fixtures and equipment are depreciated using the straight-line

method over the estimated useful lives of the assets. Improvements to

leased premises are amortized using the straight-line method over the

life of the lease or the useful life of the improvement, whichever is

shorter. The Company’s property and equipment is depreciated using

the following estimated useful lives:

Life

Buildings 10 – 45 years

Furniture, fixtures and equipment 5 – 20 years

Leasehold improvements 5 – 30 years

Computer software 3 – 5 years

Advertising Television and radio advertising production costs are

amortized over the fiscal year in which the advertisements first appear.

All media placement costs are expensed in the month the advertisement

appears. Included in current assets are $20.2 million and $24.4 mil-

lion at the end of fiscal 2000 and 1999, respectively, relating to

prepayments of production costs for print and broadcast advertising.