Home Depot 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements (continued)

The Home Depot, Inc. and Subsidiaries

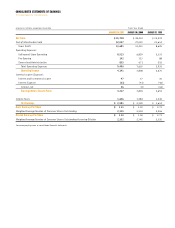

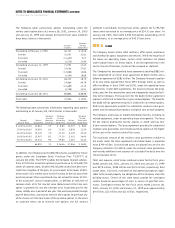

Note 10. Quarterly Financial Data (Unaudited)

The following is a summary of the quarterly results of operations for the fiscal years ended January 28, 2001 and January 30, 2000 (dollars

in millions, except per share data):

Increase Basic Diluted

In Comparable Gross Net Earnings Earnings

Net Sales Store Sales Profit Earnings Per Share Per Share

Fiscal year ended January 28, 2001:

First quarter

$ 11,112 7% $ 3,274 $ 629 $ 0.27 $ 0.27

Second quarter

12,618 6% 3,739 838 0.36 0.36

Third quarter

11,545 4% 3,450 650 0.28 0.28

Fourth quarter

10,463 0% 3,217 465 0.20 0.20

Fiscal year

$ 45,738 4% $ 13,681 $ 2,581 $ 1.11 $ 1.10

Fiscal year ended January 30, 2000:

First quarter $ 8,952 9% $ 2,566 $ 489 $ 0.22 $ 0.21

Second quarter 10,431 11% 3,029 679 0.30 0.29

Third quarter 9,877 10% 2,894 573 0.26 0.25

Fourth quarter 9,174 9% 2,922 579 0.25 0.25

Fiscal year $ 38,434 10% $ 11,411 $ 2,320 $ 1.03 $ 1.00

Note: The quarterly data may not sum to fiscal year totals due to rounding.

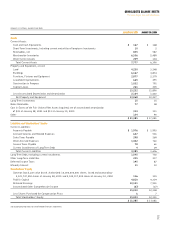

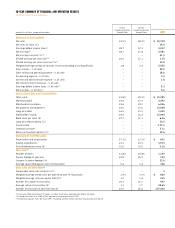

Note 8. Commitments and Contingencies

At January 28, 2001, the Company was contingently liable for

approximately $442 million under outstanding letters of credit issued

in connection with purchase commitments.

The Company is involved in litigation arising from the normal course

of business. In management’s opinion, this litigation is not expected

to materially impact the Company’s consolidated results of operations

or financial condition.

Note 9. Acquisitions

During fiscal 2000, Maintenance Warehouse, a wholly-owned sub-

sidiary of The Home Depot, acquired N-E Thing Supply Company, Inc.

The Company acquired Apex Supply Company, Inc. and Georgia

Lighting, Inc. in fiscal 1999. These acquisitions were recorded under

the purchase method of accounting. Pro forma results of operations

for fiscal years 2000, 1999 and 1998 would not be materially differ-

ent as a result of the acquisitions of N-E Thing Supply Company, Inc.,

Apex Supply Company, Inc. and Georgia Lighting, Inc. and are there-

fore not presented.

During the first quarter of fiscal 1998, the Company purchased, for

$261 million, the remaining 25% partnership interest in The Home

Depot Canada held by The Molson Companies. The excess purchase

price over the estimated fair value of net assets of $117 million as of

the acquisition date was recorded as goodwill and is being amortized

over 40 years.