Home Depot 2000 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2000 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

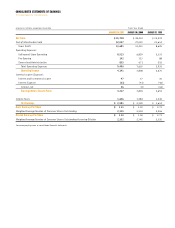

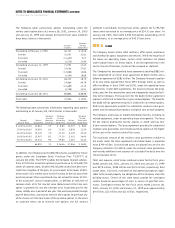

Consolidated Balance Sheets

The Home Depot, Inc. and Subsidiaries

20

21

amounts in millions, except share data

January 28, 2001 January 30, 2000

Assets

Current Assets:

Cash and Cash Equivalents

$ 167

$ 168

Short-Term Investments, including current maturities of long-term investments

10

2

Receivables, net

835

587

Merchandise Inventories

6,556

5,489

Other Current Assets

209

144

Total Current Assets

7,777

6,390

Property and Equipment, at cost:

Land

4,230

3,248

Buildings

6,167

4,834

Furniture, Fixtures and Equipment

2,877

2,279

Leasehold Improvements

665

493

Construction in Progress

1,032

791

Capital Leases

261

245

15,232

11,890

Less Accumulated Depreciation and Amortization

2,164

1,663

Net Property and Equipment

13,068

10,227

Long-Term Investments

15

15

Notes Receivable

77

48

Cost in Excess of the Fair Value of Net Assets Acquired, net of accumulated amortization

of $41 at January 28, 2001 and $33 at January 30, 2000

314

311

Other

134

90

$ 21,385

$ 17,081

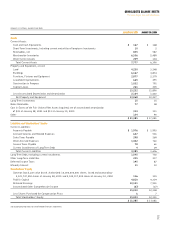

Liabilities and Stockholders’ Equity

Current Liabilities:

Accounts Payable

$ 1,976

$ 1,993

Accrued Salaries and Related Expenses

627

541

Sales Taxes Payable

298

269

Other Accrued Expenses

1,402

763

Income Taxes Payable

78

61

Current Installments of Long-Term Debt

4

29

Total Current Liabilities

4,385

3,656

Long-Term Debt, excluding current installments

1,545

750

Other Long-Term Liabilities

245

237

Deferred Income Taxes

195

87

Minority Interest

11

10

Stockholders’ Equity

Common Stock, par value $0.05. Authorized: 10,000,000,000 shares; issued and outstanding –

2,323,747,000 shares at January 28, 2001 and 2,304,317,000 shares at January 30, 2000

116

115

Paid-In Capital

4,810

4,319

Retained Earnings

10,151

7,941

Accumulated Other Comprehensive Income

(67)

(27)

15,010

12,348

Less Shares Purchased for Compensation Plans

6

7

Total Stockholders’ Equity

15,004

12,341

$ 21,385

$ 17,081

See accompanying notes to consolidated financial statements.