GE 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2009 ANNUAL REPORT 97

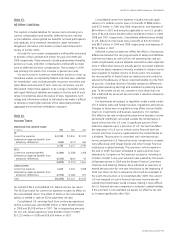

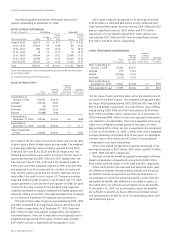

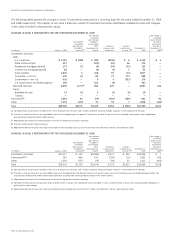

Note 17.

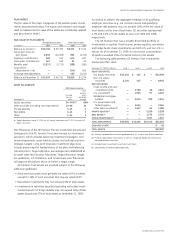

Other Income

(In millions) 2009 2008 2007

GE

Associated companies (a) $ 667 $ 332 $ 671

Purchases and sales of business

interests (b) 363 891 1,541

Licensing and royalty income 217 291 255

Interest income from GECS 173 371 329

Marketable securities and bank deposits 54 196 282

Other items (295) (116) 293

1,179 1,965 3,371

ELIMINATIONS (173) (379) (352)

Total $1,006 $1,586 $ 3,019

(a) Included a gain of $552 million related to dilution of our interest in A&E Television

Network from 25% to 15.8% in 2009.

(b) In 2009, included a gain of $254 million related to our increased ownership in

ATI-Singapore from 49% to 100%. See Note 8. In 2007, included gain on sale of a

business interest to Hitachi of $900 million.

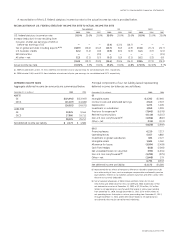

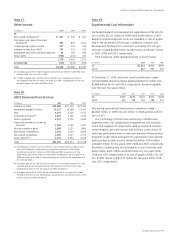

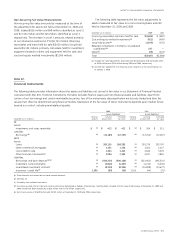

Note 18.

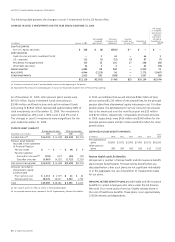

GECS Revenues from Services

(In millions) 2009 2008 2007

Interest on loans $20,080 $27,109 $23,599

Equipment leased to others 12,231 15,568 15,260

Fees 4,634 6,126 6,533

Investment income (a) 3,391 2,191 4,724

Financing leases 3,322 4,374 4,699

Premiums earned by insurance

activities 2,065 2,255 2,232

Net securitization gains 1,589 1,133 1,804

Real estate investments 1,543 3,505 4,669

Associated companies 1,059 2,217 2,172

Other items (b) (c) 3,279 5,036 5,526

Total $53,193 $69,514 $71,218

(a) Included gain on sale of Swiss Re common stock of $566 million in 2007 and net

other-than-temporary impairments on investment securities of $583 million,

$1,420 million and $127 million in 2009, 2008 and 2007, respectively. Of the

$583 million, $33 million related to impairments recognized in the first quarter of

2009 that were reclassified to retained earnings as a result of the amendments to

ASC 320. See Note 3.

(b) Included a gain on the sale of a partial interest in a limited partnership in PTL and

a related gain on the remeasurement of the retained investment to fair value

totaling $296 million in the first quarter of 2009. See Note 23.

(c) Included a gain of $343 million on the remeasurement to fair value of our equity

method investment in BAC, following our acquisition of a controlling interest in the

second quarter of 2009. See Note 8.

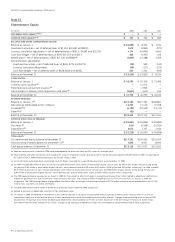

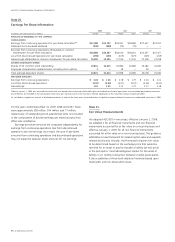

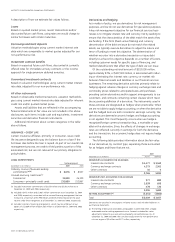

Note 19.

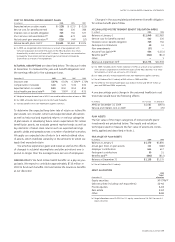

Supplemental Cost Information

We funded research and development expenditures of $3,324 mil-

lion in 2009, $3,113 million in 2008 and $3,048 million in 2007.

Research and development costs are classified in cost of goods

sold in the Statement of Earnings. In addition, research and

development funding from customers, principally the U.S. gov-

ernment, totaled $1,050 million, $1,287 million and $1,067 million

in 2009, 2008 and 2007, respectively.

Rental expense under operating leases is shown below.

(In millions) 2009 2008 2007

GE $1,012 $912 $929

GECS 817 992 955

At December 31, 2009, minimum rental commitments under

noncancellable operating leases aggregated $2,674 million and

$2,888 million for GE and GECS, respectively. Amounts payable

over the next five years follow.

(In millions) 2010 2011 2012 2013 2014

GE $592 $495 $416 $334 $278

GECS 609 498 436 288 211

GE’s selling, general and administrative expenses totaled

$14,842 million in 2009, $14,401 million in 2008 and $14,148 mil-

lion in 2007.

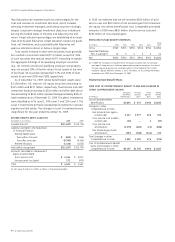

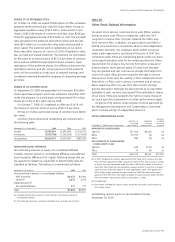

Our Technology Infrastructure and Energy Infrastructure

segments enter into collaborative arrangements with manufac-

turers and suppliers of components used to build and maintain

certain engines, aero-derivatives, and turbines, under which GE

and these participants share in risks and rewards of these product

programs. Under these arrangements, participation fees earned

and recorded as other income totaled $1 million, $394 million

and $481 million for the years 2009, 2008 and 2007, respectively.

Payments to participants are recorded as costs of services sold

($504 million, $423 million and $320 million for the years 2009,

2008 and 2007, respectively) or as cost of goods sold ($1,731 mil-

lion, $1,882 million and $1,573 million for the years 2009, 2008

and 2007, respectively).