GE 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

’

GE 2009 ANNUAL REPORT 45

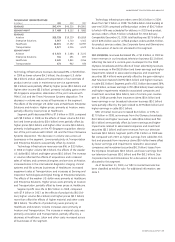

CLL — ASIA. Nonearning receivables of $0.6 billion represented

4.3% of total nonearning receivables at December 31, 2009.

The ratio of allowance for losses as a percent of nonearning

receivables declined from 53.3% at December 31, 2008, to 42.4%

at December 31, 2009, primarily due to an increase in nonearn-

ing receivables in secured exposures, which did not require

significant specific reserves based upon the strength of the

underlying collateral values. The ratio of nonearning receivables

as a percent of financing receivables increased from 1.8% at

December 31, 2008, to 4.4% at December 31, 2009, primarily

from an increase in nonearning receivables at our corporate

asset-based, distribution finance and corporate air secured

financing businesses in Japan, Australia, New Zealand and India

and a lower financing receivables balance.

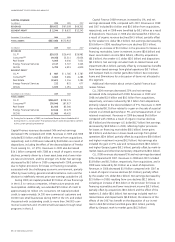

CONSUMER — NON-U.S. RESIDENTIAL MORTGAGES. Nonearning

receivables of $4.6 billion represented 34.3% of total nonearning

receivables at December 31, 2009. The ratio of allowance for

losses as a percent of nonearning receivables increased from

11.5% at December 31, 2008, to 20.9% at December 31, 2009.

In 2009, our nonearning receivables increased primarily as a result

of the continued decline in the U.K. housing market, partially

offset by increased foreclosures. Our non-U.S. mortgage portfolio

has a loan-to-value ratio of approximately 75% at origination

and the vast majority are first lien positions. Our U.K. and France

portfolios, which comprise a majority of our total mortgage

portfolio, have reindexed loan-to-value ratios of 82% and 68%,

respectively. Less than 4% of these loans are without mortgage

insurance and have a reindexed loan-to-value ratio equal to or

greater than 100%. Loan-to-value information is updated on a

quarterly basis for a majority of our loans and considers economic

factors such as the housing price index. At December 31, 2009,

we had in repossession stock approximately 1,200 houses in the

U.K., which had a value of approximately $0.2 billion.

CONSUMER — NON-U.S. INSTALLMENT AND REVOLVING CREDIT.

Nonearning receivables of $0.5 billion represented 3.4% of total

nonearning receivables at December 31, 2009. The ratio of allow-

ance for losses as a percent of nonearning receivables increased

from 254.5% at December 31, 2008, to 261.5% at December 31,

2009, reflecting increases in allowance for loan losses, partially

offset by the effects of loan repayments and reduced originations.

Allowance for losses as a percent of financing receivables increased

from 4.3% at December 31, 2008, to 4.7% at December 31, 2009,

as increases in allowance for loan losses were driven by the effects

of increased delinquencies in Europe and Australia, partially offset

by the effects of business dispositions.

CONSUMER — U.S. INSTALLMENT AND REVOLVING CREDIT.

Nonearning receivables of $0.8 billion represented 6.3% of total

nonearning receivables at December 31, 2009. The ratio of allow-

ance for losses as a percent of nonearning receivables declined

from 224.3% at December 31, 2008, to 201.9% at December 31,

2009, as a result of the effects of loan repayments and better

entry rates, partially offset by increases in the allowance for loan

losses due to the effects of the continued deterioration in our

U.S. portfolio in connection with rising unemployment.

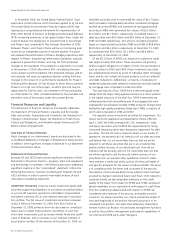

REAL ESTATE. Nonearning receivables of $1.3 billion represented

9.4% of total nonearning receivables at December 31, 2009. The

$1.1 billion increase in nonearning receivables from December 31,

2008, was driven primarily by increased delinquencies in the U.S.

apartment and office loan portfolios, which have been adversely

affected by rent and occupancy declines. The ratio of allowance

for losses as a percent of total financing receivables increased

from 0.6% at December 31, 2008, to 3.3% at December 31, 2009,

driven primarily by continued economic deterioration in the

U.S. and the U.K. markets, which resulted in an increase in both

specific and general credit loss provisions. The ratio of allowance

for losses as a percent of nonearning receivables declined from

155.2% at December 31, 2008, to 119.3% at December 31, 2009,

reflecting a higher proportion of the allowance being attributable

to specific reserves and our estimate of underlying collateral

values. The allowance for losses on our real estate receivables

may continue to be adversely affected as the overall challenging

economic environment continues to pressure underlying property

values. At December 31, 2009, real estate held for investment

included $0.8 billion representing 82 foreclosed commercial real

estate properties.

DELINQUENCY RATES on managed equipment financing loans and

leases and managed consumer financing receivables follow.

Delinquency rates at

December 31 2009 2008 2007

Equipment Financing 2.81% 2.17% 1.21%

Consumer 8.82 7.43 5.38

U.S. 7.66 7.14 5.52

Non-U.S. 9.34 7.57 5.32

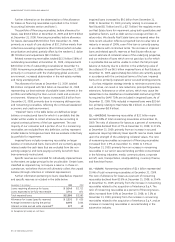

Delinquency rates on equipment financing loans and leases

increased from December 31, 2008 and 2007, to December 31,

2009, as a result of the continuing weakness in the global eco-

nomic and credit environment. In addition, delinquency rates on

equipment financing loans and leases increased nine basis points

from December 31, 2008, to December 31, 2009, as a result of

the inclusion of the CitiCapital acquisition. The challenging credit

environment may continue to lead to a higher level of commercial

delinquencies and provisions for financing receivables and could

adversely affect results of operations at CLL.

Delinquency rates on consumer financing receivables

increased from December 31, 2008 and 2007, to December 31,

2009, primarily because of rising unemployment, a challenging

economic environment and lower volume. In response, we

continued to tighten underwriting standards globally, increased

focus on collection effectiveness and will continue the process

of regularly reviewing and adjusting reserve levels. We expect

the global environment, along with U.S. unemployment levels, to

further show signs of stabilization in 2010; however, a continued

challenging economic environment may continue to result in

higher provisions for loan losses and could adversely affect results

of operations at Consumer. At December 31, 2009, roughly 39%

of our U.S. managed portfolio (excluding delinquent or impaired),

which consisted of credit cards, installment and revolving loans, was

receivable from subprime borrowers. We had no U.S. subprime

residential mortgage loans at December 31, 2009. See Note 6.