GE 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 GE 2009 ANNUAL REPORT

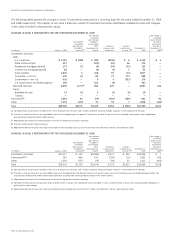

For cash flow hedges, the amount of ineffectiveness in the

hedging relationship and amount of the changes in fair value of

the derivative that are not included in the measurement of

ineffectiveness are both reflected in earnings each reporting

period. These amounts totaled $49 million, of which $(18) million

represents amounts excluded from the assessment of effective-

ness for the year ended December 31, 2009, and primarily

appear in “GECS revenues from services.” Ineffectiveness from

net investment hedges was $(899) million for the year ended

December 31, 2009, which primarily related to changes in value

of the forward points. These amounts appear in the “Interest and

other financial charges” caption in the Statement of Earnings.

FREE-STANDING DERIVATIVES

Changes in the fair value of derivatives that are not designated

as hedges are recorded in earnings each period. As discussed

above, these derivatives are typically entered into as economic

hedges of changes in interest rates, currency exchange rates,

commodity prices and other risks. Gains or losses related to the

derivative are recorded in predefined captions in the Statement

of Earnings, typically “GECS revenues from services” or “Other

income,” based on our accounting policy. In general, the earnings

effects of the item that represent the economic risk exposure

are recorded in the same caption as the derivative. Gains for 2009

on derivatives not designated as hedges were $1,018 million

and related to interest rate contracts of $208 million, currency

exchange contracts of $499 million, and commodity derivatives

and other of $311 million. The vast majority of the $1,018 million

was offset by the earnings effects from the underlying items that

were economically hedged.

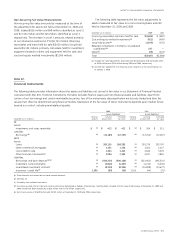

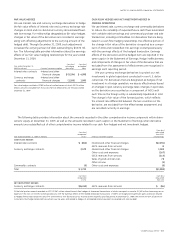

Counterparty credit risk

Fair values of our derivatives can change significantly from period

to period based on, among other factors, market movements and

changes in our positions. Accordingly, we actively monitor these

exposures and take appropriate actions in response. We man-

age counterparty credit risk (the risk that counterparties will

default and not make payments to us according to the terms of

our standard master agreements) on an individual counterparty

basis. Where we have agreed to netting of derivative exposures

with a counterparty, we offset our exposures with that counter-

party and apply the value of collateral posted to us to determine

the exposure. When net exposure to a counterparty, based on

the current market values of agreements and collateral, exceeds

credit exposure limits (see following table), we typically take action

to reduce such exposures. These actions may include prohibiting

additional transactions with the counterparty, requiring additional

collateral from the counterparty (as described below) and termi-

nating or restructuring transactions.

As discussed above, we have provisions in certain of our

master agreements that require counterparties to post collateral

(typically, cash or U.S. Treasuries) when our receivable due from

the counterparty, measured at current market value, exceeds a

specified limit. At December 31, 2009, our exposure to counter-

parties, net of collateral we hold, was $1,196 million. The fair

value of such collateral was $8,454 million, of which $2,387 mil-

lion was cash and $6,067 million was in the form of securities

held by a custodian for our benefit. Under certain of these same

agreements, we post collateral to our counterparties for our

derivative obligations, the fair value of which was $1,855 million

at December 31, 2009.

Following is GECS policy relating to initial credit rating

requirements and to exposure limits to counterparties.

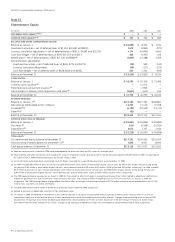

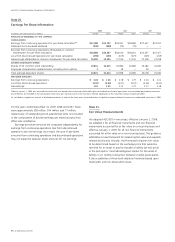

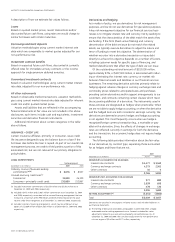

COUNTERPARTY CREDIT CRITERIA

Credit rating

Moody’s S&P

Foreign exchange forwards (less than

one year) P–1 A–1

All derivatives between one and five years Aa3 (a) AA– (a)

All derivatives greater than five years Aaa (a) AAA (a)

(a) Counterparties that have an obligation to provide collateral to cover credit

exposure in accordance with a credit support agreement typically have a minimum

A3/A– rating.

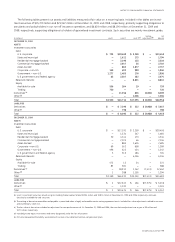

EXPOSURE LIMITS

(In millions)

Minimum rating Exposure (a)

Moody’s S&P

With

collateral

arrangements

Without

collateral

arrangements

Aaa AAA $100 $75

Aa3 AA– 50 50

A3 A– 5 —

(a) For derivatives with exposures less than one year, counterparties are permitted to

have unsecured exposure up to $150 million with a minimum rating of A–1/P–1.

Exposure to a counterparty is determined net of collateral.

Additionally, our standard master agreements typically contain

mutual downgrade provisions that provide the ability of each

party to require termination if the long-term credit rating of the

counterparty were to fall below A–/A3. In certain of these master

agreements, each party also has the ability to require termination

if the short-term rating of the counterparty were to fall below

A–1/P–1. The net amount relating to our derivative liability of

$3,657 million subject to these provisions, after consideration of

collateral posted by us, was $1,281 million at December 31, 2009.