GE 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2009 ANNUAL REPORT 85

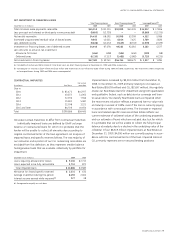

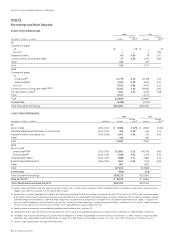

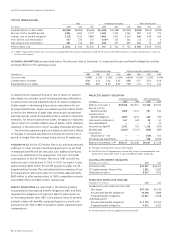

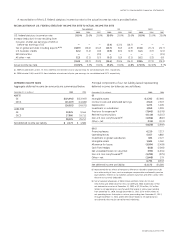

(g) Included $1,649 million of covered bonds at December 31, 2009. If the short-term credit rating of GE Capital were reduced below A–1/P–1, GE Capital would be required to

partially cash collateralize these bonds in an amount up to $775 million.

(h) Included $452 million and $2,104 million of asset-backed senior notes, issued by consolidated, liquidating securitization entities at December 31, 2009 and 2008, respectively.

See Note 23.

(i) Included $417 million and $750 million of subordinated notes guaranteed by GE at December 31, 2009 and 2008, respectively.

(j) Subordinated debentures receive rating agency equity credit and were hedged at issuance to the U.S. dollar equivalent of $7,725 million.

(k) Included $21,252 million and $12,314 million of deposits in non-U.S. banks at December 31, 2009 and 2008, respectively, and $10,476 million and $6,699 million of certificates

of deposits distributed by brokers with maturities greater than one year at December 31, 2009 and 2008, respectively.

When insurance affiliates cede insurance to third parties, such

as reinsurers, they are not relieved of their primary obligation

to policyholders. Losses on ceded risks give rise to claims for

recovery; we establish allowances for probable losses on such

receivables from reinsurers as required. Reinsurance recoverables

are included in the caption “Other GECS receivables” on our

Statement of Financial Position, and amounted to $1,188 million

and $1,062 million at December 31, 2009 and 2008, respectively.

We recognize reinsurance recoveries as a reduction of the

Statement of Earnings caption “Investment contracts, insurance

losses and insurance annuity benefits.” Reinsurance recoveries

were $219 million, $221 million and $104 million for the years

ended December 31, 2009, 2008 and 2007, respectively.

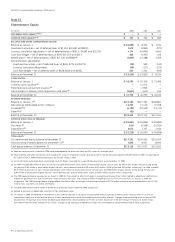

Note 12.

Postretirement Benefit Plans

Pension Benefits

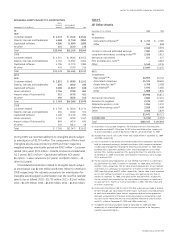

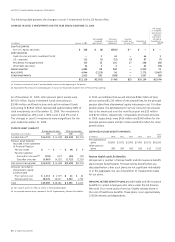

We sponsor a number of pension plans. Principal pension plans,

together with affiliate and certain other pension plans (other pen-

sion plans) detailed in this note, represent about 99% of our total

pension assets. We use a December 31 measurement date for

our plans.

PRINCIPAL PENSION PLANS are the GE Pension Plan and the GE

Supplementary Pension Plan.

The GE Pension Plan provides benefits to certain U.S. employees

based on the greater of a formula recognizing career earnings or

a formula recognizing length of service and final average earnings.

Certain benefit provisions are subject to collective bargaining.

The GE Supplementary Pension Plan is an unfunded plan

providing supplementary retirement benefits primarily to higher-

level, longer-service U.S. employees.

OTHER PENSION PLANS in 2009 included 32 U.S. and non-U.S.

pension plans with pension assets or obligations greater than

$50 million. These defined benefit plans provide benefits to

employees based on formulas recognizing length of service and

earnings.

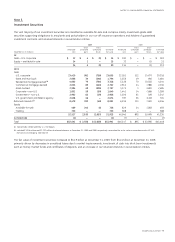

PENSION PLAN PARTICIPANTS

December 31, 2009 Total

Principal

pension

plans

Other

pension

plans

Active employees 157,000 120,000 37,000

Vested former employees 239,000 200,000 39,000

Retirees and beneficiaries 239,000 215,000 24,000

Total 635,000 535,000 100,000

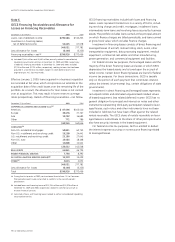

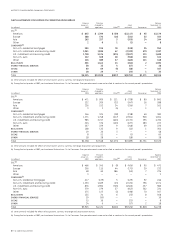

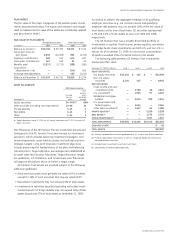

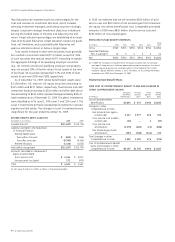

Our borrowings are addressed below from the perspectives of

liquidity, interest rate and currency risk management. Additional

information about borrowings and associated swaps can be

found in Note 22.

LIQUIDITY is affected by debt maturities and our ability to repay

or refinance such debt. Long-term debt maturities over the next

five years follow.

(In millions) 2010 2011 2012 2013 2014

GE $ 27 $ 2,011 $ 32 $ 5,033 $ 108

GECS 70,262

(a) 65,532 83,311 29,551 27,369

(a) Fixed and floating rate notes of $632 million contain put options with exercise

dates in 2010, and which have final maturity beyond 2014.

Committed credit lines totaling $51.7 billion had been extended

to us by 59 banks at year-end 2009. Availability of these lines is

shared between GE and GECS with $9.0 billion and $51.7 billion

available to GE and GECS, respectively. The GECS lines include

$36.8 billion of revolving credit agreements under which we

can borrow funds for periods exceeding one year. Additionally,

$14.4 billion are 364-day lines that contain a term-out feature

that allows GE or GECS to extend the borrowings for one year

from the date of expiration of the lending agreement. We pay

banks for credit facilities, but amounts were insignificant in each

of the past three years.

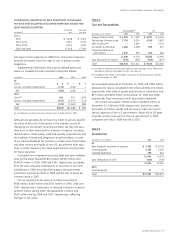

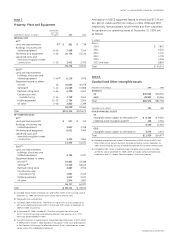

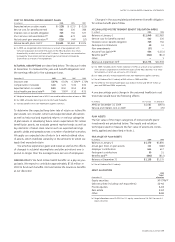

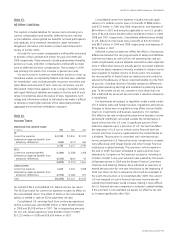

Note 11.

GECS Investment Contracts, Insurance Liabilities

and Insurance Annuity Benefits

GECS investment contracts, insurance liabilities and insurance

annuity benefits comprise mainly obligations to annuitants and

policyholders in our run-off insurance operations and holders

of guaranteed investment contracts.

December 31 (In millions) 2009 2008

Investment contracts $ 3,940 $ 4,212

Guaranteed investment contracts 8,310 10,828

Total investment contracts 12,250 15,040

Life insurance benefits (a) 16,847 16,259

Unpaid claims and claims adjustment expenses 2,102 2,145

Unearned premiums 532 623

Universal life benefits 278 302

Total $32,009 $34,369

(a) Life insurance benefits are accounted for mainly by a net-level-premium method

using estimated yields generally ranging from 3.0% to 8.50% in both 2009 and 2008.