GE 2009 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92 GE 2009 ANNUAL REPORT

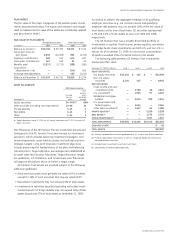

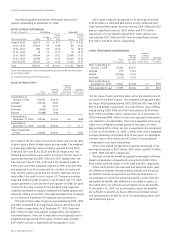

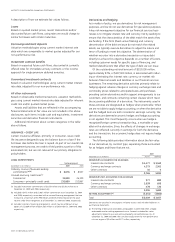

We have not provided U.S. deferred taxes on cumulative

earnings of non-U.S. affiliates and associated companies that have

been reinvested indefinitely. These earnings relate to ongoing

operations and, at December 31, 2009, were approximately

$84 billion. Most of these earnings have been reinvested in active

non-U.S. business operations and we do not intend to repatriate

these earnings to fund U.S. operations. Because of the availability

of U.S. foreign tax credits, it is not practicable to determine the U.S.

federal income tax liability that would be payable if such earnings

were not reinvested indefinitely. Deferred taxes are provided for

earnings of non-U.S. affiliates and associated companies when

we plan to remit those earnings.

During 2009, following the change in our external credit ratings,

funding actions taken and review of our operations, liquidity and

funding, we determined that undistributed prior-year earnings of

non-U.S. subsidiaries of GECS, on which we had previously pro-

vided deferred U.S. taxes, would be indefinitely reinvested outside

the U.S. This change increased the amount of prior-year earnings

indefinitely reinvested outside the U.S. by approximately $2 billion,

resulting in an income tax benefit of $700 million in 2009.

During 2008, because the use of foreign tax credits no longer

required the repatriation of prior-year earnings, we increased

the amount of prior-year earnings that were indefinitely reinvested

outside the U.S. by approximately $1 billion, resulting in a

decrease to the income tax provision of approximately $350 million.

As discussed in Note 1, on January 1, 2007, we adopted

amendments to ASC 740, resulting in a $49 million decrease in

retained earnings, an $89 million decrease in goodwill and a

$40 million decrease in income tax liability.

Annually, we file over 7,000 income tax returns in over 250

global taxing jurisdictions. We are under examination or engaged

in tax litigation in many of these jurisdictions. During 2007, the IRS

completed the audit of our consolidated U.S. income tax returns

for 2000–2002. At December 31, 2009, the IRS was auditing our

consolidated U.S. income tax returns for 2003–2007. In addition,

certain other U.S. tax deficiency issues and refund claims for

previous years were unresolved. It is reasonably possible that

the 2003–2005 U.S. audit cycle will be completed during the next

12 months, which could result in a decrease in our balance of

“unrecognized tax benefits” — that is, the aggregate tax effect of

differences between tax return positions and the benefits recog-

nized in our financial statements. We believe that there are no

other jurisdictions in which the outcome of unresolved issues or

claims is likely to be material to our results of operations, financial

position or cash flows. We further believe that we have made

adequate provision for all income tax uncertainties.

The balance of unrecognized tax benefits, the amount of

related interest and penalties we have provided and what we

believe to be the range of reasonably possible changes in the

next 12 months, were:

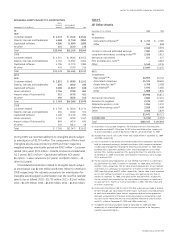

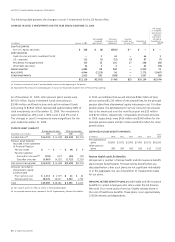

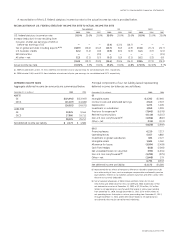

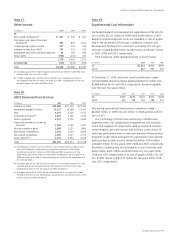

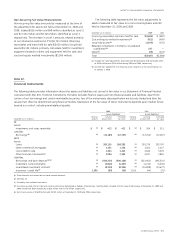

December 31 (In millions) 2009 2008

Unrecognized tax benefits $7,251 $6,692

Portion that, if recognized, would reduce tax

expense and effective tax rate (a) 4,918 4,453

Accrued interest on unrecognized tax benefits 1,369 1,204

Accrued penalties on unrecognized tax benefits 99 96

Reasonably possible reduction to the balance

of unrecognized tax benefits in succeeding

12 months 0–1,800 0–1,500

Portion that, if recognized, would reduce tax

expense and effective tax rate (a) 0–1,400 0–1,100

(a) Some portion of such reduction might be reported as discontinued operations.

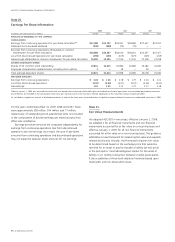

A reconciliation of the beginning and ending amounts of unrec-

ognized tax benefits is as follows:

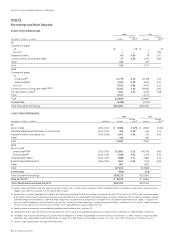

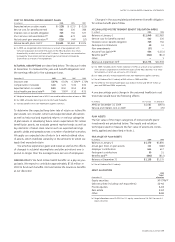

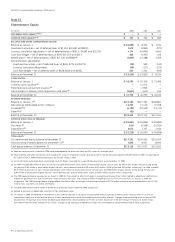

(In millions) 2009 2008

Balance at January 1 $6,692 $6,331

Additions for tax positions of the current year 695 553

Additions for tax positions of prior years 289 516

Reductions for tax positions of prior years (229) (489)

Settlements with tax authorities (146) (173)

Expiration of the statute of limitations (50) (46)

Balance at December 31 $7,251 $6,692

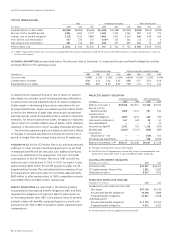

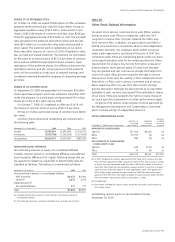

We classify interest on tax deficiencies as interest expense;

we classify income tax penalties as provision for income taxes.

For the year ended December 31, 2009, $172 million of interest

expense and $14 million of tax expense related to penalties

were recognized in the Statement of Earnings, compared with

$268 million and $19 million for the year ended December 31,

2008 and $(279) million and $(34) million for the year ended

December 31, 2007.