GE 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 GE 2009 ANNUAL REPORT

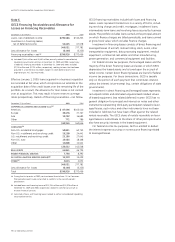

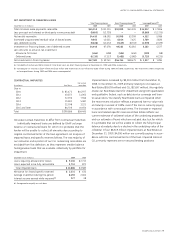

Note 6.

GECS Financing Receivables and Allowance for

Losses on Financing Receivables

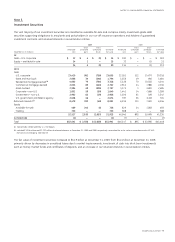

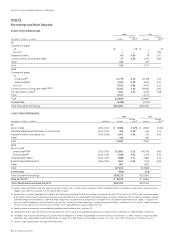

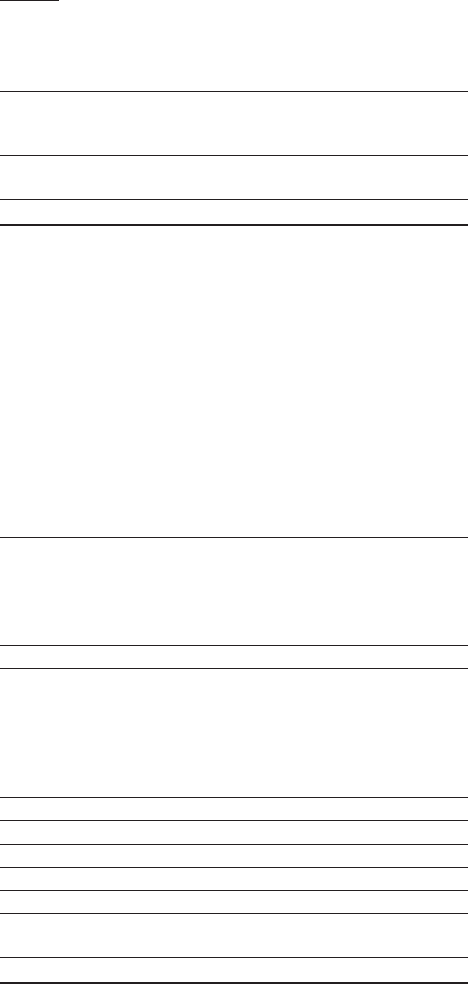

December 31 (In millions) 2009 2008

Loans, net of deferred income $290,586 $310,203

Investment in financing leases,

net of deferred income 54,445 67,578

345,031 377,781

Less allowance for losses (8,105) (5,325)

Financing receivables — net (a) $336,926 $372,456

(a) Included $3,444 million and $6,461 million primarily related to consolidated,

liquidating securitization entities at December 31, 2009 and 2008, respectively.

In addition, financing receivables at December 31, 2009 and 2008, included

$2,704 million and $2,736 million, respectively, relating to loans that had been

acquired in a transfer but have been subject to credit deterioration since

origination per ASC 310, Receivables.

Effective January 1, 2009, loans acquired in a business acquisition

are recorded at fair value, which incorporates our estimate at the

acquisition date of the credit losses over the remaining life of the

portfolio. As a result, the allowance for loan losses is not carried

over at acquisition. This may result in lower reserve coverage

ratios prospectively. Details of financing receivables — net follow.

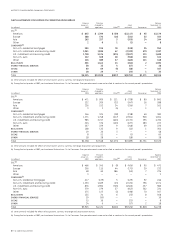

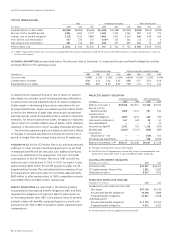

December 31 (In millions) 2009 2008

COMMERCIAL LENDING AND LEASING (CLL) (a)

Americas $ 87,496 $105,410

Europe 39,476 37,767

Asia 13,202 16,683

Other 771 786

140,945 160,646

CONSUMER (a)

Non-U.S. residential mortgages 58,831 60,753

Non-U.S. installment and revolving credit 25,208 24,441

U.S. installment and revolving credit 23,190 27,645

Non-U.S. auto 13,485 18,168

Other 12,808 11,541

133,522 142,548

REAL ESTATE 44,841 46,735

ENERGY FINANCIAL SERVICES 7,790 8,392

GE CAPITAL AVIATION SERVICES (GECAS) (b) 15,319 15,429

OTHER (c) 2,614 4,031

345,031 377,781

Less allowance for losses (8,105) (5,325)

Total $336,926 $372,456

(a) During the first quarter of 2009, we transferred Artesia from CLL to Consumer.

Prior-period amounts were reclassified to conform to the current-period’s

presentation.

(b) Included loans and financing leases of $13,254 million and $13,078 million at

December 31, 2009 and 2008, respectively, related to commercial aircraft at

Aviation Financial Services.

(c) Consisted of loans and financing leases related to certain consolidated, liquidating

securitization entities.

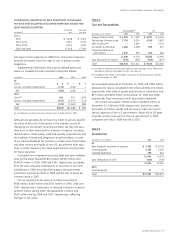

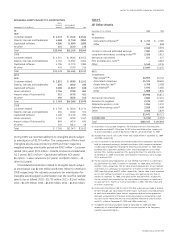

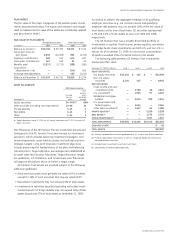

GECS financing receivables include both loans and financing

leases. Loans represent transactions in a variety of forms, includ-

ing revolving charge and credit, mortgages, installment loans,

intermediate-term loans and revolving loans secured by business

assets. The portfolio includes loans carried at the principal amount

on which finance charges are billed periodically, and loans carried

at gross book value, which includes finance charges.

Investment in financing leases consists of direct financing and

leveraged leases of aircraft, railroad rolling stock, autos, other

transportation equipment, data processing equipment, medical

equipment, commercial real estate and other manufacturing,

power generation, and commercial equipment and facilities.

For federal income tax purposes, the leveraged leases and the

majority of the direct financing leases are leases in which GECS

depreciates the leased assets and is taxed upon the accrual of

rental income. Certain direct financing leases are loans for federal

income tax purposes. For these transactions, GECS is taxable

only on the portion of each payment that constitutes interest,

unless the interest is tax-exempt (e.g., certain obligations of state

governments).

Investment in direct financing and leveraged leases represents

net unpaid rentals and estimated unguaranteed residual values

of leased equipment, less related deferred income. GECS has no

general obligation for principal and interest on notes and other

instruments representing third-party participation related to lever-

aged leases; such notes and other instruments have not been

included in liabilities but have been offset against the related

rentals receivable. The GECS share of rentals receivable on lever-

aged leases is subordinate to the share of other participants who

also have security interests in the leased equipment.

For federal income tax purposes, GECS is entitled to deduct

the interest expense accruing on nonrecourse financing related

to leveraged leases.