GE 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2009 ANNUAL REPORT 99

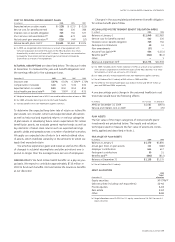

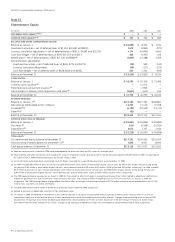

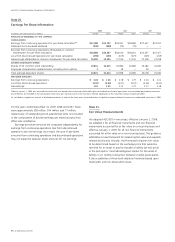

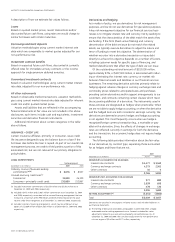

The following tables present our assets and liabilities measured at fair value on a recurring basis. Included in the tables are invest-

ment securities of $25,729 million and $21,967 million at December 31, 2009 and 2008, respectively, primarily supporting obligations to

annuitants and policyholders in our run-off insurance operations, and $6,629 million and $8,190 million at December 31, 2009 and

2008, respectively, supporting obligations to holders of guaranteed investment contracts. Such securities are mainly investment grade.

(In millions) Level 1 Level 2 Level 3 (a) Netting

adjustment (b) Net

balance

DECEMBER 31, 2009

ASSETS

Investment securities

Debt

U.S. corporate $ 723 $19,669 $ 3,258 $ — $23,650

State and municipal — 1,621 173 — 1,794

Residential mortgage-backed — 3,195 123 — 3,318

Commercial mortgage-backed — 2,647 55 — 2,702

Asset-backed — 860 1,877 — 2,737

Corporate — non-U.S. 159 692 989 — 1,840

Government — non-U.S. 1,277 1,483 176 — 2,936

U.S. government and federal agency 85 2,307 282 — 2,674

Retained interests — — 8,831 — 8,831

Equity

Available-for-sale 536 184 19 — 739

Trading 720 — — — 720

Derivatives (c) — 11,056 804 (3,851) 8,009

Other (d) — — 1,006 — 1,006

Total $3,500 $43,714 $17,593 $ (3,851) $60,956

LIABILITIES

Derivatives $ — $ 7,295 $ 222 $ (3,860) $ 3,657

Other (e) — 798 — — 798

Total $ — $ 8,093 $ 222 $ (3,860) $ 4,455

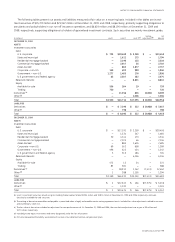

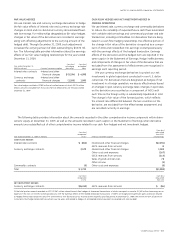

DECEMBER 31, 2008

ASSETS

Investment securities

Debt

U.S. corporate $ — $17,191 $ 3,209 $ — $20,400

State and municipal — 1,234 247 — 1,481

Residential mortgage-backed 30 4,141 173 — 4,344

Commercial mortgage-backed — 2,070 66 — 2,136

Asset-backed — 880 1,605 — 2,485

Corporate — non-U.S. 69 562 658 — 1,289

Government — non-U.S. 496 422 424 — 1,342

U.S. government and federal agency 5 515 184 — 704

Retained interests — — 6,356 — 6,356

Equity

Available-for-sale 475 12 34 — 521

Trading 83 305 — — 388

Derivatives (c) — 18,911 1,142 (7,411) 12,642

Other (d) 1 288 1,105 — 1,394

Total $1,159 $46,531 $15,203 $ (7,411) $55,482

LIABILITIES

Derivatives $ 2 $12,643 $ 166 $ (7,575) $ 5,236

Other (e) — 1,031 — — 1,031

Total $ 2 $13,674 $ 166 $ (7,575) $ 6,267

(a) Level 3 investment securities valued using non-binding broker quotes totaled $1,055 million and $2,074 million at December 31, 2009 and 2008, respectively, and were

classified as available-for-sale securities.

(b) The netting of derivative receivables and payables is permitted when a legally enforceable master netting agreement exists. Included fair value adjustments related to our own

and counterparty credit risk.

(c) The fair value of derivatives included an adjustment for non-performance risk. At December 31, 2009 and 2008, the cumulative adjustment was a gain of $9 million and

$177 million, respectively.

(d) Included private equity investments and loans designated under the fair value option.

(e) Primarily represented the liability associated with certain of our deferred incentive compensation plans.