GE 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.’

GE 2009 ANNUAL REPORT 49

from an obligation rated “AAA” only to a small degree in that

the obligor’s capacity to meet its financial commitment on the

obligation is very strong. An S&P rating outlook assesses the

potential direction of a long-term credit rating over the interme-

diate term. In determining a rating outlook, consideration is given

to any changes in the economic and/or fundamental business

conditions. Stable means that a rating is not likely to change in

the next six months to two years.

On March 23, 2009, Moody’s Investors Service (Moody’s)

downgraded GE and GE Capital’s long-term rating by two notches

from “Aaa” to “Aa2” with a stable outlook and removed us from

review for possible downgrade. Under Moody’s definitions, obliga-

tions rated “Aaa” are judged to be of the highest quality, with

minimal credit risk. Obligations rated “Aa” are judged to be of high

quality and are subject to very low credit risk.

In 2009, the short-term ratings of “A–1+/P–1” were affirmed

by both rating agencies at the same time with respect to GE,

GE Capital Services and GE Capital. These short-term ratings are

in the highest rating categories available from S&P and Moody’s.

Under the S&P definitions, a short-term obligation rated “A–1+”

indicates that the obligor’s capacity to meet its financial commit-

ment is extremely strong. Under the Moody’s definitions, an issuer

that is rated “P–1” has a superior ability to repay short-term debt

obligations.

We do not believe that the downgrades by S&P and Moody’s

have had a material impact on our cost of funding or liquidity as

the downgrades had been widely anticipated in the market and

were already reflected in the spreads on our debt.

GE, GECS and GE Capital have distinct business characteristics

that the major debt rating agencies evaluate both quantitatively

and qualitatively.

Quantitative measures include:

• Earnings and profitability, revenue growth, the breadth and

diversity of sources of income and return on assets

• Asset quality, including delinquency and write-off ratios and

reserve coverage

• Funding and liquidity, including cash generated from operating

activities, leverage ratios such as debt-to-capital, retained

cash flow to debt, market access, back-up liquidity from banks

and other sources, composition of total debt and interest

coverage

• Capital adequacy, including required capital and tangible

leverage ratios

Qualitative measures include:

• Franchise strength, including competitive advantage and

market conditions and position

• Strength of management, including experience, corporate

governance and strategic thinking

• Financial reporting quality, including clarity, completeness and

transparency of all financial performance communications

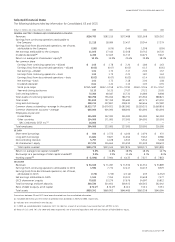

PRINCIPAL DEBT CONDITIONS are described below.

The following conditions relate to GE and GECS:

• Swap, forward and option contracts are executed under

standard master agreements that typically contain mutual

downgrade provisions that provide the ability of the counter-

party to require termination if the long-term credit rating of

the applicable GE entity were to fall below A–/A3. In certain of

these master agreements, the counterparty also has the ability

to require termination if the short-term rating of the applicable

GE entity were to fall below A–1/P–1. The net derivative liability

after consideration of netting arrangements and collateral

posted by us under these master agreements was estimated

to be $1.3 billion at December 31, 2009. See Note 22.

• If GE Capital’s ratio of earnings to fixed charges were to dete-

riorate to below 1.10:1, GE has committed to make payments

to GE Capital. See Income Maintenance Agreement section for

further discussion. GE also guaranteed certain issuances of

GECS subordinated debt having a face amount of $0.4 billion

at December 31, 2009 and 2008.

• In connection with certain subordinated debentures for which

GECC receives equity credit by rating agencies, GE has agreed

to promptly return to GECC dividends, distributions or other

payments it receives from GECC during events of default or

interest deferral periods under such subordinated debentures.

There were $7.6 billion of such debentures outstanding at

December 31, 2009. See Note 10.

The following conditions relate to consolidated entities:

• If the short-term credit rating of GE Capital or certain consoli-

dated entities were to be reduced below A–1/P–1, GE Capital

would be required to provide substitute liquidity for those

entities or provide funds to retire the outstanding commercial

paper. The maximum net amount that GE Capital would be

required to provide in the event of such a downgrade is deter-

mined by contract, and amounted to $2.5 billion at December 31,

2009. See Note 23.

• One group of consolidated entities holds investment securities

funded by the issuance of GICs. If the long-term credit rating

of GE Capital were to fall below AA–/Aa3 or its short-term

credit rating were to fall below A–1+/P–1, GE Capital would be

required to provide approximately $2.4 billion to such entities

as of December 31, 2009, pursuant to letters of credit issued

by GE Capital. To the extent that the entities’ liabilities exceed

the ultimate value of the proceeds from the sale of their assets

and the amount drawn under the letters of credit, GE Capital

could be required to provide such excess amount. As of

December 31, 2009, the value of these entities’ liabilities was

$8.5 billion and the fair value of their assets was $7.3 billion

(which included unrealized losses on investment securities of

$1.4 billion). With respect to these investment securities, we

intend to hold them at least until such time as their individual

fair values exceed their amortized cost and we have the ability

to hold all such debt securities until maturity.