GE 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. GE 2009 ANNUAL REPORT 71

Annually, we conduct reviews of our primary pricing vendor

to validate that the inputs used in that vendor’s pricing process

are deemed to be market observable as defined in the standard.

While we were not provided access to proprietary models of

the vendor, our reviews have included on-site walk-throughs of

the pricing process, methodologies and control procedures for

each asset class and level for which prices are provided. Our

review also included an examination of the underlying inputs and

assumptions for a sample of individual securities across asset

classes, credit rating levels and various durations, a process we

continue to perform for each reporting period. In addition, the

pricing vendor has an established challenge process in place for

all security valuations, which facilitates identification and resolu-

tion of potentially erroneous prices. We believe that the prices

received from our pricing vendor are representative of prices that

would be received to sell the assets at the measurement date

(exit prices) and are classified appropriately in the hierarchy.

We use non-binding broker quotes as our primary basis for

valuation when there is limited, or no, relevant market activity for

a specific instrument or for other instruments that share similar

characteristics. We have not adjusted the prices we have obtained.

Investment securities priced using non-binding broker quotes

are included in Level 3. As is the case with our primary pricing

vendor, third-party brokers do not provide access to their propri-

etary valuation models, inputs and assumptions. Accordingly, our

risk management personnel conduct internal reviews of pricing

for all such investment securities quarterly to ensure reasonable-

ness of valuations used in our financial statements. These reviews

are designed to identify prices that appear stale, those that have

changed significantly from prior valuations, and other anomalies

that may indicate that a price may not be accurate. Based on the

information available, we believe that the fair values provided

by the brokers are representative of prices that would be received

to sell the assets at the measurement date (exit prices).

Retained interests in securitizations are valued using a dis-

counted cash flow model that considers the underlying structure

of the securitization and estimated net credit exposure, prepay-

ment assumptions, discount rates and expected life.

DERIVATIVES. We use closing prices for derivatives included in

Level 1, which are traded either on exchanges or liquid over-the-

counter markets.

The majority of our derivatives are valued using internal models.

The models maximize the use of market observable inputs

including interest rate curves and both forward and spot prices

for currencies and commodities. Derivative assets and liabilities

included in Level 2 primarily represent interest rate swaps, cross-

currency swaps and foreign currency and commodity forward

and option contracts.

Derivative assets and liabilities included in Level 3 primarily

represent interest rate products that contain embedded option-

ality or prepayment features.

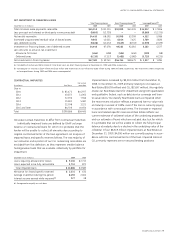

Non-Recurring Fair Value Measurements

Certain assets are measured at fair value on a non-recurring

basis. These assets are not measured at fair value on an ongoing

basis, but are subject to fair value adjustments only in certain

circumstances. These assets can include loans and long-lived

assets that have been reduced to fair value when they are held

for sale, impaired loans that have been reduced based on the

fair value of the underlying collateral, cost and equity method

investments and long-lived assets that are written down to fair

value when they are impaired and the remeasurement of retained

investments in formerly consolidated subsidiaries upon a change

in control that results in deconsolidation of a subsidiary, if we

sell a controlling interest and retain a noncontrolling stake in the

entity. Assets that are written down to fair value when impaired

and retained investments are not subsequently adjusted to fair

value unless further impairment occurs.

The following describes the valuation methodologies we use

to measure financial and non-financial instruments accounted for

at fair value on a non-recurring basis and for assets within our

pension plans and retiree benefit plans at each reporting period,

as applicable.

LOANS. When available, we use observable market data, including

pricing on recent closed market transactions, to value loans that

are included in Level 2. When this data is unobservable, we use

valuation methodologies using current market interest rate data

adjusted for inherent credit risk, and such loans are included in

Level 3. When appropriate, loans are valued using collateral values

as a practical expedient.

COST AND EQUITY METHOD INVESTMENTS are valued using market

observable data such as quoted prices when available. When

market observable data is unavailable, investments are valued

using a discounted cash flow model, comparative market multiples

or a combination of both approaches as appropriate. These invest-

ments are generally included in Level 3.

Investments in private equity, real estate and collective funds

are valued using net asset values. The net asset values are deter-

mined based on the fair values of the underlying investments in

the funds. Investments in private equity and real estate funds

are generally included in Level 3 because they are not redeem-

able at the measurement date. Investments in collective funds

are included in Level 2.

LONG-LIVED ASSETS, including aircraft and real estate, are valued

using the best information available, including quoted market

prices or market prices for similar assets when available or internal

cash flow estimates discounted at an appropriate interest rate

or independent appraisals, as appropriate. For real estate, cash

flow estimates are based on current market estimates that

reflect current and projected lease profiles and available industry

information about expected trends in rental, occupancy and

capitalization rates. These investments are generally included in

Level 3.