GE 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 GE 2009 ANNUAL REPORT

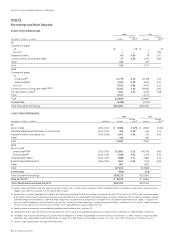

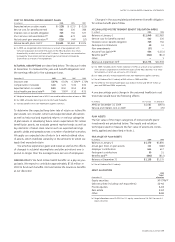

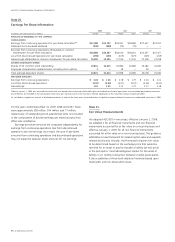

Plan fiduciaries set investment policies and strategies for the

trust and oversee its investment allocation, which includes

selecting investment managers and setting long-term strategic

targets. Long-term strategic investment objectives include pre-

serving the funded status of the plan and balancing risk and

return. Target allocation percentages are established at an asset

class level by plan fiduciaries. Target allocation ranges are guide-

lines, not limitations, and occasionally plan fiduciaries will

approve allocations above or below a target range.

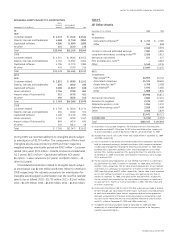

Trust assets invested in short-term securities must generally

be invested in securities rated A1/P1 or better, except for 15%

of such securities that may be rated A2/P2. According to statute,

the aggregate holdings of all qualifying employer securities

(e.g., GE common stock) and qualifying employer real property

may not exceed 10% of the fair value of trust assets at the time

of purchase. GE securities represented 3.7% and 3.6% of trust

assets at year-end 2009 and 2008, respectively.

As of December 31, 2009, retiree benefit plans’ assets were

$1,138 million. U.S. and non-U.S. equity securities amounting to

$315 million and $237 million, respectively, fixed income and cash

investment funds amounting to $214 million and other debt securi-

ties amounting to $193 million represented approximately 80% of

total investments as of December 31, 2009. The plans’ investments

were classified as 42% Level 1, 37% Level 2 and 21% Level 3. The

Level 3 investments primarily represented investments in private

equities and real estate. The changes in Level 3 investments were

insignificant for the year ended December 31, 2009.

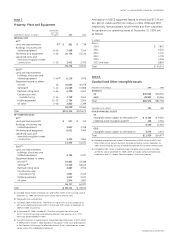

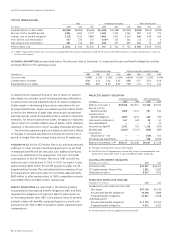

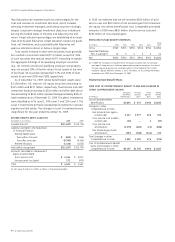

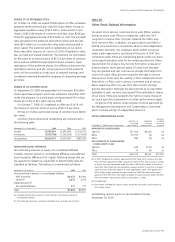

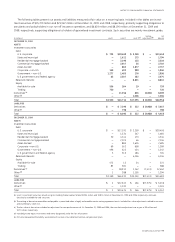

RETIREE BENEFIT ASSET (LIABILITY)

December 31 (In millions) 2009 2008

Funded status (a) $(11,637) $ (10,774)

Liability recorded in the Statement

of Financial Position

Retiree health plans

Due within one year $ (691) $ (644)

Due after one year (9,790) (9,105)

Retiree life plans (1,156) (1,025)

Net liability recognized $(11,637) $ (10,774)

Amounts recorded in shareowners’

equity (unamortized)

Prior service cost $ 4,154 $ 5,027

Net actuarial loss (gain) 272 (475)

Total $ 4,426 $ 4,552

(a) Fair value of assets less APBO, as shown in the preceding tables.

In 2010, we estimate that we will amortize $630 million of prior

service cost and $20 million of net actuarial gain from shareown-

ers’ equity into retiree benefit plans cost. Comparable amortized

amounts in 2009 were $836 million of prior service cost and

$225 million of net actuarial gains.

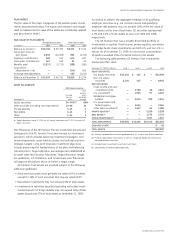

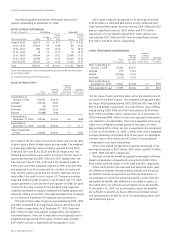

ESTIMATED FUTURE BENEFIT PAYMENTS

(In millions) 2010 2011 2012 2013 2014

2015

2019

–

Gross $960 $925 $930 $945 $950 $4,850

Expected Medicare

Part D subsidy (a) 70 5 5 5 5 20

Net $890 $920 $925 $940 $945 $4,830

(a) In 2009, the Company contracted with a third party to administer our principal

post-age 65 drug plan as a Medicare-approved prescription drug plan. As a result,

this post-age 65 drug plan will no longer qualify for the Medicare Part D direct

employer subsidy effective January 1, 2011. The effects of this change have been

included in our APBO as of December 31, 2009.

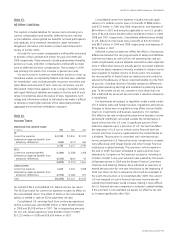

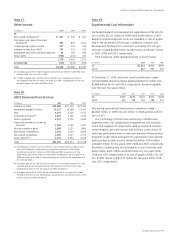

Postretirement Benefit Plans

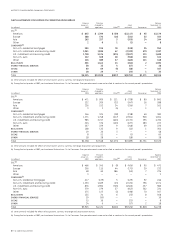

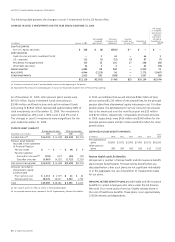

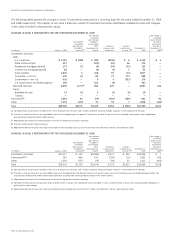

2009 COST OF POSTRETIREMENT BENEFIT PLANS AND CHANGES IN

OTHER COMPREHENSIVE INCOME

(In millions)

Total post

retirement

benefit plans

-

Principal

pension

plans

Other

pension

plans

Retiree

benefit

plans

Cost of postretirement

benefit plans $2,644 $ 547 $ 464 $1,633

Changes in other

comprehensive income

Net actuarial loss (gain) —

current year 3,117 1,977 618 522

Prior service cost (credit) —

current year (34) — 3 (37)

Prior service cost

amortization (1,273) (426) (11) (836)

Net actuarial gain (loss)

amortization (257) (348) (134) 225

Total changes in other

comprehensive income 1,553 1,203 476 (126)

Cost of postretirement benefit

plans and changes in other

comprehensive income $4,197 $1,750 $ 940 $1,507