GE 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86 GE 2009 ANNUAL REPORT

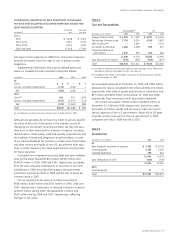

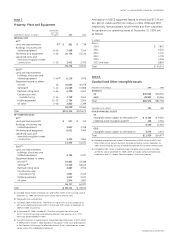

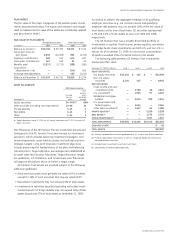

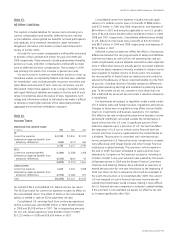

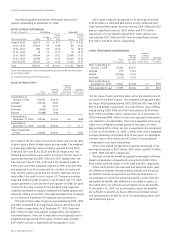

COST OF PENSION PLANS

Total Principal pension plans Other pension plans

(In millions) 2009 2008 2007 2009 2008 2007 2009 2008 2007

Expected return on plan assets $(4,943) $(4,850) $(4,459) $(4,505) $ (4,298) $ (3,950) $(438) $ (552) $(509)

Service cost for benefits earned 1,906 1,663 1,727 1,609 1,331 1,355 297 332 372

Interest cost on benefit obligation 3,129 3,152 2,885 2,669 2,653 2,416 460 499 469

Prior service cost amortization 437 332 247 426

(a) 321 241 11 11 6

Net actuarial loss amortization 482 316 856 348 237 693 134 79 163

Pension plans cost $ 1,011 $ 613 $ 1,256 $ 547 $ 244 $ 755 $ 464 $ 369 $ 501

(a) In 2009, included a $103 million loss as a result of our agreement with Comcast Corporation to transfer the assets of the NBCU business to a newly formed entity in which we

will own a 49% interest.

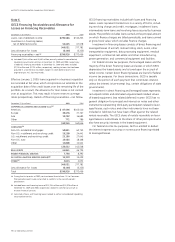

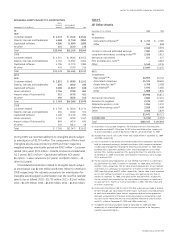

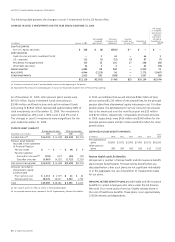

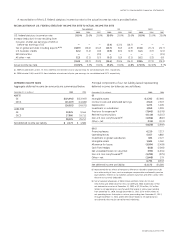

ACTUARIAL ASSUMPTIONS are described below. The discount rates at December 31 measured the year-end benefit obligations and the

earnings effects for the subsequent year.

Principal pension plans Other pension plans (weighted average)

December 31 2009 2008 2007 2006 2009 2008 2007 2006

Discount rate 5.78 % 6.11 % 6.34 % 5.75 % 5.31 % 6.03 % 5.65 % 4.97 %

Compensation increases 4.20 4.20 5.00 5.00 4.56 4.47 4.50 4.26

Expected return on assets 8.50 8.50 8.50 8.50 7.29 7.41 7.51 7.44

To determine the expected long-term rate of return on pension

plan assets, we consider current and expected asset allocations,

as well as historical and expected returns on various categories

of plan assets. In developing future return expectations for our

principal benefit plans’ assets, we evaluate general market trends

as well as key elements of asset class returns such as expected

earnings growth, yields and spreads across a number of potential

scenarios. For the principal pension plans, we apply our expected

rate of return to a market-related value of assets, which stabilizes

variability in the amounts to which we apply that expected return.

We amortize experience gains and losses as well as the effects

of changes in actuarial assumptions and plan provisions over a

period no longer than the average future service of employees.

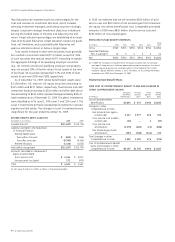

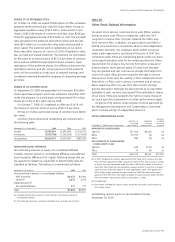

FUNDING POLICY for the GE Pension Plan is to contribute amounts

sufficient to meet minimum funding requirements as set forth

in employee benefit and tax laws plus such additional amounts

as we may determine to be appropriate. We have not made

contributions to the GE Pension Plan since 1987 and will not

make any such contributions in 2010. In 2010, we expect to pay

approximately $190 million for benefit payments under our GE

Supplementary Pension Plan and administrative expenses of our

principal pension plans and expect to contribute approximately

$600 million to other pension plans. In 2009, comparative amounts

were $168 million and $676 million, respectively.

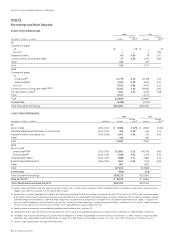

BENEFIT OBLIGATIONS are described in the following tables.

Accumulated and projected benefit obligations (ABO and PBO)

represent the obligations of a pension plan for past service as

of the measurement date. ABO is the present value of benefits

earned to date with benefits computed based on current com-

pensation levels. PBO is ABO increased to reflect expected future

compensation.

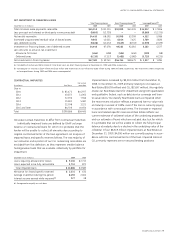

PROJECTED BENEFIT OBLIGATION

Principal pension plans Other pension plans

(In millions) 2009 2008 2009 2008

Balance at January 1 $45,168 $42,947 $7,748 $ 9,014

Service cost for

benefits earned 1,609 1,331 297 332

Interest cost on

benefit obligations 2,669 2,653 460 499

Participant contributions 167 169 35 40

Plan amendments — — 3 16

Actuarial loss (gain) (a) 1,331 791 1,113 (923)

Benefits paid (2,827) (2,723) (398) (383)

Acquisitions

(dispositions) — net — — (219) 545

Exchange rate adjustments — — 558 (1,392)

Balance at December 31 (b) $48,117 $45,168 $9,597 $ 7,748

(a) Principally associated with discount rate changes.

(b) The PBO for the GE Supplementary Pension Plan, which is an unfunded plan, was

$3,828 million and $3,505 million at year-end 2009 and 2008, respectively.

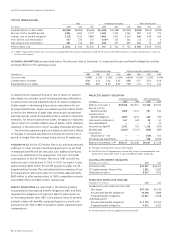

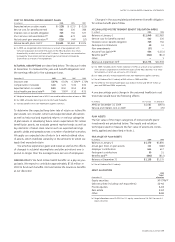

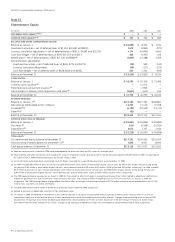

ACCUMULATED BENEFIT OBLIGATION

December 31 (In millions) 2009 2008

GE Pension Plan $42,917 $40,313

GE Supplementary Pension Plan 2,901 2,582

Other pension plans 8,947 7,075

PLANS WITH ASSETS LESS THAN ABO

December 31 (In millions) 2009 2008

Funded plans with assets less than ABO

Plan assets $47,740 $ 4,914

Accumulated benefit obligations 49,948 5,888

Projected benefit obligations 51,837 6,468

Unfunded plans (a)

Accumulated benefit obligations $ 3,725 $3,352

Projected benefit obligations 4,675 4,303

(a) Primarily related to the GE Supplementary Pension Plan.