GE 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2009 ANNUAL REPORT 111

Note 26.

Intercompany Transactions

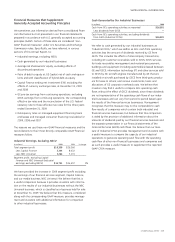

Effects of transactions between related companies are eliminated

and consist primarily of GECS dividends to GE or capital contri-

butions from GE to GECS; GE customer receivables sold to GECS;

GECS services for trade receivables management and material

procurement; buildings and equipment (including automobiles)

leased between GE and GECS; information technology (IT) and

other services sold to GECS by GE; aircraft engines manufactured

by GE that are installed on aircraft purchased by GECS from third-

party producers for lease to others; and various investments, loans

and allocations of GE corporate overhead costs.

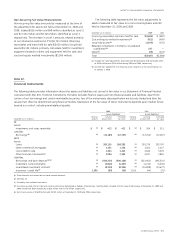

These intercompany transactions are reported in the GE and

GECS columns of our financial statements, but are eliminated

in deriving our consolidated financial statements. Effects of

these eliminations on our consolidated cash flows from operat-

ing, investing and financing activities include the following. Net

decrease (increase) in GE customer receivables sold to GECS of

$(39) million, $90 million and $(255) million have been eliminated

from consolidated cash from operating and investing activities

at December 31, 2009, 2008 and 2007, respectively. Capital

contributions from GE to GECS of $9,500 million and $5,500 mil-

lion have been eliminated from consolidated cash from investing

and financing activities at December 31, 2009 and 2008, respec-

tively. There were no such capital contributions at December 31,

2007. GECS dividends to GE of $2,351 million and $7,291 million

have been eliminated from consolidated cash from operating

and financing activities at December 31, 2008 and 2007, respec-

tively. There were no such dividends at December 31, 2009.

Eliminations of intercompany borrowings (includes GE investment

in GECS short-term borrowings, such as commercial paper) of

$715 million, $(471) million and $2,049 million have been elimi-

nated from financing activities at December 31, 2009, 2008

and 2007, respectively. Other reclassifications and eliminations

of $623 million, $(188) million and $(828) million have been

eliminated from consolidated cash from operating activities

and $(699) million, $(320) million and $1,202 million have been

eliminated from consolidated cash from investing activities at

December 31, 2009, 2008 and 2007, respectively.

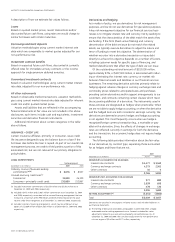

As identified in our Quarterly Report on Form 10-Q for the

fiscal quarter ended March 31, 2009, in the GE and GECS columns

of our Statement of Cash Flows for the year ended December 31,

2008, we properly reported a $5,500 million capital contribution

from GE to GECS as an investing use of cash by GE (included in

the caption “All other investing activities”) and a financing source

of cash to GECS (included in the caption “All other financing

activities”). In our 2008 Form 10-K, this intercompany transaction

was not eliminated in deriving our consolidated cash flows. As a

result, our consolidated cash used for investing activities and

our consolidated cash from financing activities were both over-

stated by the amount of the capital contribution. This item had

no effect on our consolidated cash from operating activities or

total consolidated cash flows, nor did it affect our financial posi-

tion or results of operations. We have corrected this immaterial

item in our current report on Form 10-K.

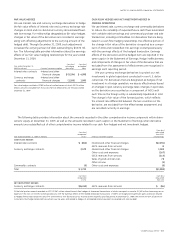

Note 27.

Operating Segments

Basis for presentation

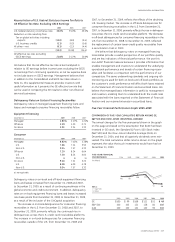

Our operating businesses are organized based on the nature of

markets and customers. Segment accounting policies are the

same as described in Note 1. Segment results for our financial

services businesses reflect the discrete tax effect of transactions,

but the intraperiod tax allocation is reflected outside of the

segment unless otherwise noted in segment results.

Effects of transactions between related companies are elimi-

nated and consist primarily of GECS dividends to GE or capital

contributions from GE to GECS; GE customer receivables sold to

GECS; GECS services for trade receivables management and

material procurement; buildings and equipment (including auto-

mobiles) leased between GE and GECS; information technology

(IT) and other services sold to GECS by GE; aircraft engines manu-

factured by GE that are installed on aircraft purchased by GECS

from third-party producers for lease to others; and various invest-

ments, loans and allocations of GE corporate overhead costs.

Effective January 1, 2010, we reorganized our segments to

better align our Consumer & Industrial and Energy businesses

for growth. As a result of this reorganization, we created a new

segment called Home & Business Solutions that includes the

Appliances and Lighting businesses from our previous Consumer

& Industrial segment and the retained portion of the GE Fanuc

Intelligent Platforms business of our previous Enterprise Solutions

business (formerly within our Technology Infrastructure segment).

In addition, the Industrial business of our previous Consumer

& Industrial segment and the Sensing & Inspection Technologies

and Digital Energy businesses of Enterprise Solutions are now

part of the Energy business within the Energy Infrastructure

segment. The Security business of Enterprise Solutions will be

reported in Corporate Items and Eliminations pending its expected

sale. Also, effective January 1, 2010, the Capital Finance segment

was renamed GE Capital and includes all of the continuing oper-

ations of General Electric Capital Corporation. In addition, the

Transportation Financial Services business, previously reported

in GECAS, will be included in CLL and our Consumer business in

Italy, previously reported in Consumer, will be included in CLL.

Results for 2009 and prior periods are reported on the basis

under which we managed our business in 2009 and do not reflect

the January 2010 reorganization described above.

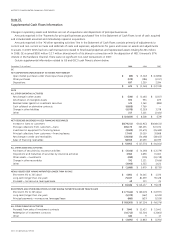

A description of our operating segments as of December 31,

2009, can be found below, and details of segment profit by

operating segment can be found in the Summary of Operating

Segments table in Management’s Discussion and Analysis.

Energy Infrastructure

Power plant products and services, including design, installation,

operation and maintenance services, are sold into global markets.

Gas, steam and aeroderivative turbines, generators, combined

cycle systems, controls and related services, including total asset

optimization solutions, equipment upgrades and long-term

maintenance service agreements are sold to power generation

and other industrial customers. Renewable energy solutions

include wind turbines and solar technology. Water treatment