GE 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 GE 2009 ANNUAL REPORT

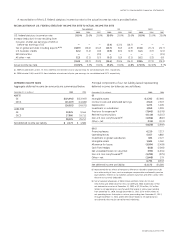

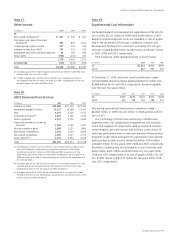

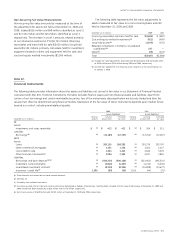

Note 20.

Earnings Per Share Information

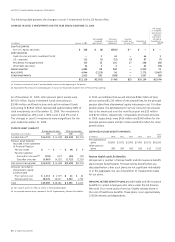

2009 2008 2007

(In millions; per-share amounts in dollars) Diluted Basic Diluted Basic Diluted Basic

AMOUNTS ATTRIBUTABLE TO THE COMPANY:

CONSOLIDATED

Earnings from continuing operations for per-share calculation (a) $11,188 $11,187 $18,091 $18,089 $22,457 $22,457

Preferred stock dividends declared (300) (300) (75) (75) — —

Earnings from continuing operations attributable to common

shareowners for per-share calculation $10,888 $10,887 $18,016 $18,014 $22,457 $22,457

Loss from discontinued operations for per-share calculation (193) (193) (679) (679) (249) (249)

Net earnings attributable to common shareowners for per-share calculation 10,695 10,694 17,336 17,335 22,208 22,208

AVERAGE EQUIVALENT SHARES

Shares of GE common stock outstanding 10,614 10,614 10,080 10,080 10,182 10,182

Employee compensation-related shares, including stock options 1 — 18 — 36 —

Total average equivalent shares 10,615 10,614 10,098 10,080 10,218 10,182

PER-SHARE AMOUNTS

Earnings from continuing operations $ 1.03 $ 1.03 $ 1.78 $ 1.79 $ 2.20 $ 2.21

Loss from discontinued operations (0.02) (0.02) (0.07) (0.07) (0.02) (0.02)

Net earnings 1.01 1.01 1.72 1.72 2.17 2.18

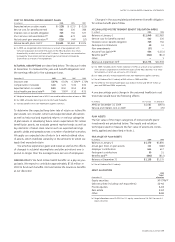

Effective January 1, 2009, our unvested restricted stock unit awards that contain non-forfeitable rights to dividends or dividend equivalents are considered participating securities

and, therefore, are included in the computation of earnings per share pursuant to the two-class method. Application of this treatment had an insignificant effect.

(a) Included an insignificant amount of dividend equivalents in each of the three years presented and an insignificant amount related to accretion of redeemable securities in 2009.

For the years ended December 31, 2009, 2008 and 2007, there

were approximately 328 million, 204 million and 77 million,

respectively, of outstanding stock awards that were not included

in the computation of diluted earnings per share because their

effect was antidilutive.

Earnings-per-share amounts are computed independently for

earnings from continuing operations, loss from discontinued

operations and net earnings. As a result, the sum of per-share

amounts from continuing operations and discontinued operations

may not equal the total per-share amounts for net earnings.

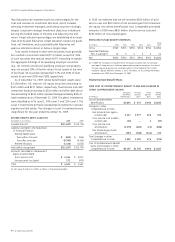

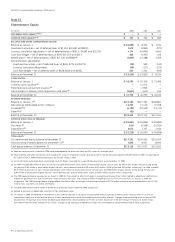

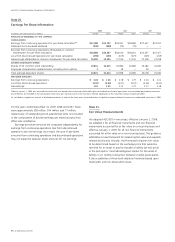

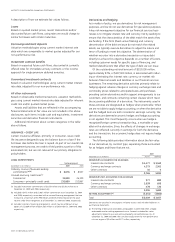

Note 21.

Fair Value Measurements

We adopted ASC 820 in two steps; effective January 1, 2008,

we adopted it for all financial instruments and non-financial

instruments accounted for at fair value on a recurring basis and

effective January 1, 2009, for all non-financial instruments

accounted for at fair value on a non-recurring basis. This guidance

establishes a new framework for measuring fair value and expands

related disclosures. Broadly, the framework requires fair value

to be determined based on the exchange price that would be

received for an asset or paid to transfer a liability (an exit price)

in the principal or most advantageous market for the asset or

liability in an orderly transaction between market participants.

It also establishes a three-level valuation hierarchy based upon

observable and non-observable inputs.