GE 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108 GE 2009 ANNUAL REPORT

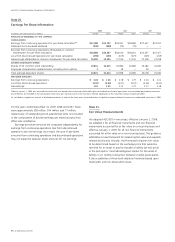

Retained Interests in Securitization Transactions

When we transfer financing receivables, we determine the fair

value of retained interests received as part of the securitization

transaction. Further information about how fair value is determined

is presented in Note 1. Retained interests in securitized receivables

that are classified as investment securities are reported at fair

value in each reporting period. These assets decrease as cash is

received on the underlying financing receivables. Retained interests

classified as financing receivables are accounted for in a similar

manner to our on-book financing receivables.

Key assumptions used in measuring the fair value of retained

interests classified as investment securities and the sensitivity of

the current fair value to changes in those assumptions related to

all outstanding retained interests at December 31, 2009 and

2008 follow.

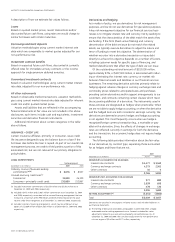

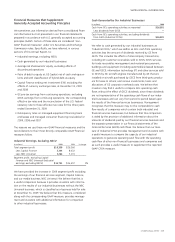

(Dollars in millions) Equipment

Commercial

real estate

Credit card

receivables

Other

assets

2009

Discount rate (a) 8.9% 17.0% 9.1% 5.4%

Effect of

10% adverse change $ (13) $ (12) $ (58) $ (1)

20% adverse change (25) (23) (115) (2)

Prepayment rate (a) (b) 23.8% 11.6% 9.9% 54.0%

Effect of

10% adverse change $ (5) $ (3) $ (54) $ —

20% adverse change (9) (6) (101) (1)

Estimate of credit losses (a) 0.9% 3.3% 15.0% 0.1%

Effect of

10% adverse change $ (7) $ (6) $ (207) $ —

20% adverse change (14) (11) (413) —

Remaining weighted

average asset lives

(in months) 9 51 9 39

Net credit losses for the year $153 $113 $1,914 $13

Delinquencies 132 212 1,663 61

2008

Discount rate (a) 17.6% 25.8% 15.1% 13.4%

Effect of

10% adverse change $ (15) $ (14) $ (53) $ (1)

20% adverse change (30) (26) (105) (3)

Prepayment rate (a) (b) 19.5% 11.3% 9.6% 52.0%

Effect of

10% adverse change $ (2) $ (3) $ (60) $ —

20% adverse change (5) (7) (118) (1)

Estimate of credit losses (a) 0.7% 1.3% 16.2% —%

Effect of

10% adverse change $ (5) $ (2) $ (223) $ —

20% adverse change (10) (4) (440) —

Remaining weighted

average asset lives

(in months) 14 55 10 4

Net credit losses for the year $ 89 $ 28 $1,512 $ 5

Delinquencies 123 260 1,833 80

(a) Based on weighted averages.

(b) Represented a payment rate on credit card receivables, inventory financing

receivables (included within equipment) and trade receivables (included within

other assets).

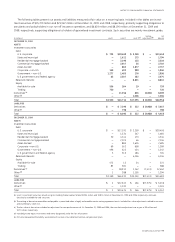

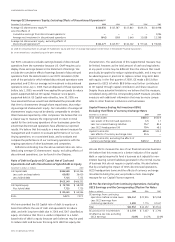

Activity related to retained interests classified as investment

securities in our consolidated financial statements follows.

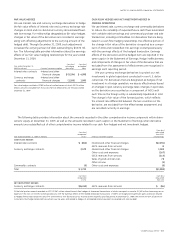

(In millions) 2009 2008 2007

CASH FLOWS ON TRANSFERS

Proceeds from new transfers $10,013 $ 6,655 $22,767

Proceeds from collections reinvested

in revolving period transfers 61,364 70,144 61,625

Cash flows on retained interests

recorded as investment securities 7,027 5,935 4,265

EFFECT ON GECS REVENUES

FROM SERVICES

Net gain on sale $ 1,589 $ 1,133 $ 1,805

Change in fair value of retained

interests recorded in earnings 291 (113) (102)

Other-than-temporary impairments (133) (330) (114)

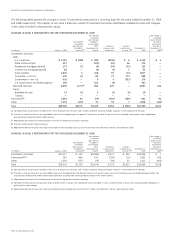

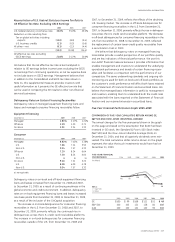

Derivative Activities

In connection with some securitization transactions, the QSPEs

use derivatives to manage interest rate risk between the assets

they own and liabilities they issue. In such instances, at the

inception of the transaction, the QSPE will enter into a derivative

that generally requires the payment of a fixed rate of interest to

a counterparty in exchange for a floating rate of interest in order

to eliminate interest rate, and in certain instances, payment speed

volatility. In some cases, a GE entity is the counterparty to a QSPE’s

derivative; the fair value of such derivatives was a net asset of

$454 million and $752 million at December 31, 2009 and 2008,

respectively. In such cases, a second derivative is executed with a

third party to minimize or eliminate the exposure created by the

first derivative.

Servicing Activities

As part of a securitization transaction, we may provide servicing

in exchange for a market-based fee that is determined on princi-

pal balances. Where the fee does not represent market-based

compensation for these services, a servicing asset or liability is

recorded, as appropriate. The fair value of the servicing asset or

liability is subject to credit, prepayment and interest rate risk.

Servicing assets and liabilities are amortized to earnings in propor-

tion to and over the period of servicing activity. The amount of

our servicing assets and liabilities was insignificant at December 31,

2009 and 2008. We received servicing fees from QSPEs of

$608 million, $641 million and $566 million in 2009, 2008 and

2007, respectively.

When we provide servicing we are contractually permitted

to commingle cash collected from customers on financing

receivables sold to investors with our own cash prior to payment

to a QSPE provided our credit rating does not fall below levels

specified in each of our securitization agreements. Based on our

current credit rating we do not anticipate any restriction to

commingling cash under these arrangements. At December 31,

2009 and 2008, accounts payable included $5,007 million and

$4,446 million, respectively, representing obligations to QSPEs for

collections received in our capacity as servicer from obligors of

the QSPEs.

Included in other GECS receivables at December 31, 2009

and 2008, were $3,526 million and $2,346 million, respectively,

relating to amounts owed by QSPEs to GE, principally for the

purchase of financial assets.