Dish Network 1998 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–34

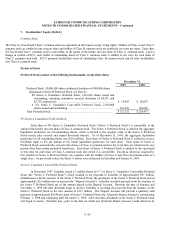

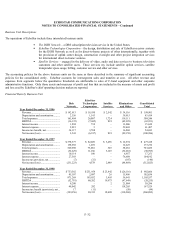

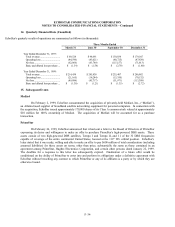

14. Quarterly Financial Data (Unaudited)

EchoStar’s quarterly results of operations are summarized as follows (in thousands):

Three Months Ended

March 31 June 30 September 30 December 31

Year Ended December 31, 1997:

Total revenue ............................. $ 69,524 $ 98,691 $ 130,038 $ 179,165

Operating loss ............................ (44,596) (43,021) (88,725) (47,929)

Net loss...................................... (62,866) (63,789) (115,157) (71,013)

Basic and diluted loss per share ... $ (1.54) $ (1.54) $ (2.78) $ (1.80)

Year Ended December 31, 1998:

Total revenue ............................. $ 214,439 $ 245,838 $ 235,407 $ 286,982

Operating loss ............................ (21,165) (16,244) (15,350) (70,132)

Net loss...................................... (49,886) (45,717) (51,971) (113,308)

Basic and diluted loss per share ... $ (1.30) $ (1.21) $ (1.35) $ (2.72)

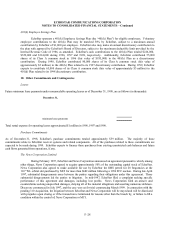

15. Subsequent Events

Media4

On February 2, 1999, EchoStar consummated the acquisition of privately-held Media4, Inc., (“Media4”),

an Atlanta-based supplier of broadband satellite networking equipment for personal computers. In connection with

the acquisition, EchoStar issued approximately 170,000 shares of its Class A common stock valued at approximately

$10 million for 100% ownership of Media4. The acquisition of Media4 will be accounted for as a purchase

transaction.

PrimeStar

On February 26, 1999, EchoStar announced that it had sent a letter to the Board of Directors of PrimeStar

expressing its desire and willingness to make an offer to purchase PrimeStar’s high-powered DBS assets. These

assets consist of two high-powered DBS satellites, Tempo I and Tempo II, and 11 of the 32 DBS frequencies

capable of coverage of the entire continental United States, located at the 119° WL orbital position. EchoStar’s

letter stated that it was ready, willing and able to make an offer to pay $600 million of total consideration (including

assumed liabilities) for these assets on terms, other than price, substantially the same as those contained in an

agreement among PrimeStar, Hughes Electronics Corporation, and certain other persons dated January 22, 1999.

The deadline for a response to this letter has subsequently expired. Finalization of a future offer would be

conditioned on the ability of PrimeStar to enter into and perform its obligations under a definitive agreement with

EchoStar without breaching any contract to which PrimeStar or any of its affiliates is a party or by which they are

otherwise bound.