Dish Network 1998 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–17

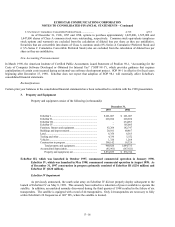

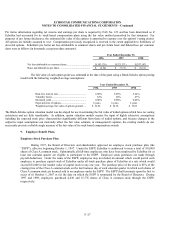

EchoStar is currently able to use a maximum of only 20 transponders as a result of the solar array anomaly

described above. The number of available transponders will decrease over time, but based on existing data,

EchoStar expects that approximately 16 transponders will probably be available over the entire expected 12 year life

of the satellite, absent significant additional transponder or other failures. In September 1998, EchoStar filed a

$219.3 million insurance claim for a total constructive loss (as defined in the launch insurance policy) related to

EchoStar IV. However, if EchoStar were to receive $219.3 million for a total constructive loss on the satellite, the

insurers would obtain the sole right to the benefits of salvage from EchoStar IV under the terms of the launch

insurance policy. While EchoStar believes it has suffered a total constructive loss of EchoStar IV in accordance

with that definition in the launch insurance policy, EchoStar presently intends to negotiate a settlement with the

insurers that will compensate EchoStar for the reduced satellite transmission capacity and allow EchoStar to retain

title to the asset.

During the third quarter of 1998, EchoStar recorded a $106 million provision for loss in connection with

the estimated reduced operational capacity of EchoStar IV. This loss provision represents EchoStar’s present

estimate of the asset impairment attributable to lost transmission capacity on EchoStar IV resulting from the solar

array anomaly described above. EchoStar also recorded a $106 million gain attributable to an anticipated insurance

claim receivable that it believes is probable of receipt. While there can be no assurance as to the amount of the final

insurance settlement, EchoStar believes that it will receive insurance proceeds related to EchoStar IV that will be

sufficient to at least fully offset its asset impairment attributable to the reduction in capacity sustained by

EchoStar IV. While EchoStar believes it has sustained a total constructive loss, insurers have requested additional

information and may contest the claim. To the extent that it appears probable that EchoStar will receive insurance

proceeds in excess of the $106 million currently recorded and that no further provision for loss is necessary, a gain

will be recognized for the incremental amount in the period that the amount of the final settlement can be reasonably

estimated. Likewise, if the satellite insurers obtain the right to salvage from EchoStar IV by payment to EchoStar of

the $219.3 million insured amount, EchoStar will record an additional loss for the remaining carrying value of

EchoStar IV.

EchoStar III Anomaly

During 1998, three transponders on EchoStar III malfunctioned, resulting in the failure of a total of six

transponders on the satellite. While a maximum of 32 transponders can be operated at any time, the satellite was

equipped with a total of 44 transponders to provide redundancy. As a result of this redundancy and because EchoStar

is only licensed by the FCC to operate 11 transponders at 61.5° WL, where the satellite is located, the transponder

anomaly has not resulted in a loss of service to date. The satellite manufacturer, Lockheed Martin, has advised

EchoStar that it believes it has identified the root cause of the failures, and that while further transponder failures are

possible, Lockheed Martin does not believe it is likely that the operational capacity of EchoStar III will be reduced

below 32 transponders. Lockheed Martin also believes it is unlikely that EchoStar’s ability to operate at least the 11

licensed transponders on the satellite will be affected. EchoStar will continue to evaluate the performance of

EchoStar III and may be required to modify its loss assessment as new events or circumstances develop.

The time for filing a claim for a loss under the satellite insurance policy that covered EchoStar III at the time

of the transponder failures has passed. While the insurance carriers were notified of the anomaly, as a result of the

built-in redundancy on the satellite and Lockheed Martin’s conclusions with respect to further failures, no claim for

loss was filed. During the anomaly investigation, EchoStar obtained a $200 million in-orbit insurance policy on

EchoStar III at standard industry rates, which was renewed through June 25, 1999. However, the policy contains a

three-transponder deductible if the satellite is operating at 120 watts per transponder, or a six-transponder deductible if

the satellite is operating at 230 watts per transponder. As such, the policy would not cover transponder failures unless

transponder capacity is reduced to less than 26 transponders in the 120 watt mode or 13 transponders in the 230 watt

mode, during the coverage period. As a result of the deductible, EchoStar could potentially experience uninsured

losses of capacity on EchoStar III. Although there can be no assurance, EchoStar expects that in-orbit insurance can be

procured on more traditional terms in the future if no further failures occur in the interim. If further failures do occur,

EchoStar may not be able to obtain additional insurance on EchoStar III on commercially reasonable terms. EchoStar

does not maintain insurance for lost profit opportunity.