Dish Network 1998 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

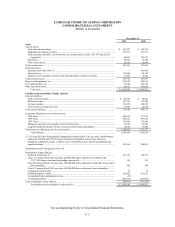

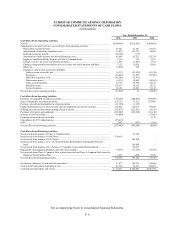

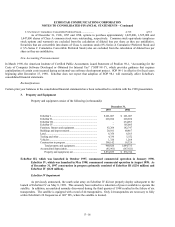

ECHOSTAR COMMUNICATIONS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

See accompanying Notes to Consolidated Financial Statements.

F–6

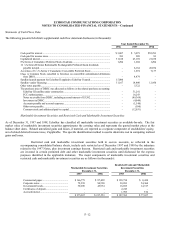

Year Ended December 31,

1996 1997 1998

Cash Flows From Operating Activities:

Net loss ..................................................................................................................................................... $(100,986) $(312,825) $(260,882)

Adjustments to reconcile net loss to net cash flows from operating activities:

Depreciation and amortization ............................................................................................................ 27,341 51,541 83,767

Amortization of subscriber acquisition costs....................................................................................... 16,073 121,735 18,869

Deferred income tax benefit ................................................................................................................ (50,365) (373) –

Amortization of debt discount and deferred financing costs............................................................... 61,695 83,221 125,724

Employee benefits funded by issuance of Class A Common Stock ................................................... 1,116 352 2,291

Change in reserve for excess and obsolete inventory.......................................................................... 2,866 (1,823) 1,341

Change in long-term deferred satellite services revenue and other long-term liabilities.................... 7,152 12,056 13,856

Other, net.............................................................................................................................................. (3,854) 442 –

Changes in current assets and current liabilities:

Trade accounts receivable, net ........................................................................................................ (4,337) (52,558) (41,159)

Inventories ....................................................................................................................................... (36,864) 51,597 (55,056)

Subscriber acquisition costs ............................................................................................................ (84,202) (72,475) –

Other current assets ......................................................................................................................... (6,513) 10,969 (10,264)

Trade accounts payable................................................................................................................... 21,756 26,708 22,136

Deferred revenue............................................................................................................................. 103,511 18,612 10,275

Accrued expenses............................................................................................................................ 18,186 62,864 72,212

Net cash flows from operating activities.................................................................................................. (27,425) 43 (16,890)

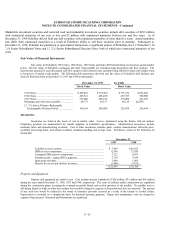

Cash Flows From Investing Activities:

Purchases of marketable investment securities ........................................................................................ (138,295) (308,006) (570,096)

Sales of marketable investment securities................................................................................................ 135,176 51,513 627,860

Purchases of restricted marketable investment securities ........................................................................ (21,100) (1,145) –

Funds released from escrow and restricted cash and marketable investment securities ......................... 235,052 120,215 116,468

Offering proceeds and investment earnings placed in escrow................................................................. (193,972) (227,561) (6,343)

Purchases of property and equipment ...................................................................................................... (221,889) (232,058) (161,140)

Issuance of notes receivable ..................................................................................................................... (30,000) –(17,666)

Payments received on note receivable ..................................................................................................... – – 3,170

Expenditures for FCC authorizations....................................................................................................... (55,419) – –

Other ......................................................................................................................................................... 2,805 (207) (301)

Net cash flows from investing activities .................................................................................................. (287,642) (597,249) (8,048)

Cash Flows From Financing Activities:

Net proceeds from issuance of Class A Common Stock ......................................................................... –63,250 –

Net proceeds from issuance of 1996 Notes.............................................................................................. 336,916 – –

Net proceeds from issuance of 1997 Notes.............................................................................................. –362,500 –

Net proceeds from issuance of 12 1/8% Series B Senior Redeemable Exchangeable Preferred

Stock –193,000 –

Net proceeds from issuance of 6 3/4% Series C Cumulative Convertible Preferred Stock ..................... –96,677 –

Repayments of mortgage indebtedness and other notes payable............................................................. (6,631) (13,253) (16,552)

Net proceeds from Class A Common Stock options exercised and Class A Common Stock issued to

Employee Stock Purchase Plan ........................................................................................................... 2,259 1,008 2,830

Net cash flows from financing activities.................................................................................................. 332,544 703,182 (13,722)

Net increase (decrease) in cash and cash equivalents .............................................................................. 17,477 105,976 (38,660)

Cash and cash equivalents, beginning of year ......................................................................................... 21,754 39,231 145,207

Cash and cash equivalents, end of year.................................................................................................... $ 39,231 $ 145,207 $ 106,547