Dish Network 1998 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–28

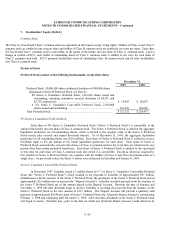

401(k) Employee Savings Plan

EchoStar sponsors a 401(k) Employee Savings Plan (the “401(k) Plan”) for eligible employees. Voluntary

employee contributions to the 401(k) Plan may be matched 50% by EchoStar, subject to a maximum annual

contribution by EchoStar of $1,000 per employee. EchoStar also may make an annual discretionary contribution to

the plan with approval by EchoStar’s Board of Directors, subject to the maximum deductible limit provided by the

Internal Revenue Code of 1986, as amended. EchoStar’s cash contributions to the 401(k) Plan totaled $226,000,

$329,000 and $314,000 during 1996, 1997 and 1998, respectively. Additionally, EchoStar contributed 55,000

shares of its Class A common stock in 1996 (fair value of $935,000) to the 401(k) Plan as a discretionary

contribution. During 1998, EchoStar contributed 80,000 shares of its Class A common stock (fair value of

approximately $2 million) to the 401(k) Plan related to its 1997 discretionary contribution. During 1999, EchoStar

expects to contribute 65,000 shares of its Class A common stock (fair value of approximately $3 million) to the

401(k) Plan related to its 1998 discretionary contribution.

10. Other Commitments and Contingencies

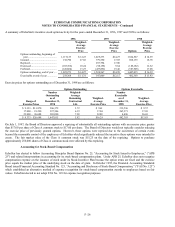

Leases

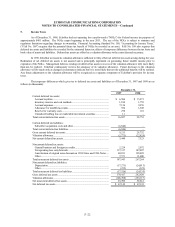

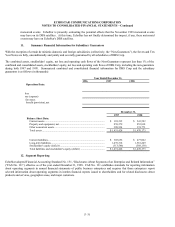

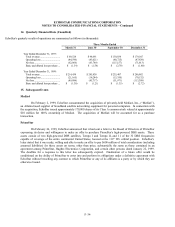

Future minimum lease payments under noncancelable operating leases as of December 31, 1998, are as follows (in thousands):

December 31,

minimum lease payments

Total rental expense for operating leases approximated $1 million in 1996, 1997 and 1998.

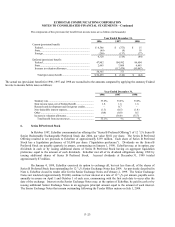

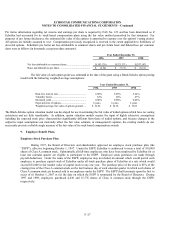

Purchase Commitments

As of December 31, 1998, EchoStar’s purchase commitments totaled approximately $59 million. The majority of these

commitments relate to EchoStar receiver systems and related components. All of the purchases related to these commitments are

expected to be made during 1999. EchoStar expects to finance these purchases from existing unrestricted cash balances and future

cash flows generated from operations, if any.

The News Corporation Limited

During February 1997, EchoStar and News Corporation announced an agreement pursuant to which, among

other things, News Corporation agreed to acquire approximately 50% of the outstanding capital stock of EchoStar.

News Corporation also agreed to make available for use by EchoStar the DBS permit for 28 frequencies at the

110° WL orbital slot purchased by MCI for more than $682 million following a 1996 FCC auction. During late April

1997, substantial disagreements arose between the parties regarding their obligations under this agreement. Those

substantial disagreements led the parties to litigation. In mid-1997, EchoStar filed a complaint seeking specific

performance of this agreement and damages, including lost profits. News Corporation filed an answer and

counterclaims seeking unspecified damages, denying all of the material allegations and asserting numerous defenses.

Discovery commenced in July 1997, and the case was set for trial commencing March 1999. In connection with the

pending 110 Acquisition, the litigation between EchoStar and News Corporation will be stayed and will be dismissed

with prejudice upon closing or if the transaction is terminated for reasons other than the breach by, or failure to fill a

condition within the control of, News Corporation or MCI.