Dish Network 1998 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–10

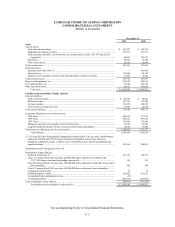

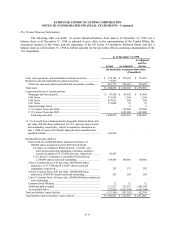

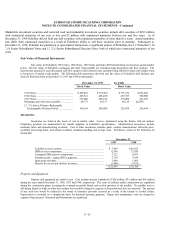

Restrictions on cash held in escrow under the terms of indentures were removed as a result of the Tender

Offers. The restricted cash balances as of December 31, 1998 have been reclassified and included in the “as

adjusted” amount of cash, cash equivalents and marketable investment securities. The restriction on the insurance

receivable of $106 million (not shown) was also removed.

The increase in as adjusted and pro forma total assets includes $1.17 billion of assets to be acquired by

EchoStar pursuant to the 110 Acquisition offset by an approximately $48.1 million decrease in total cash, cash

equivalents and marketable investment securities as a result of the Tender Offers and EchoStar’s redemption on

February 8, 1999, of all of its outstanding Series A Preferred Stock and related accumulated dividends

(approximately $91 million).

The increase in additional paid-in capital consists of the additional assets valued at $1.17 billion, to be

acquired by EchoStar in the 110 Acquisition. Based on the 20 trading day average closing price of EchoStar’s Class

A Shares of $51.05 as of March 11, 1999, EchoStar would have issued 22,918,707 shares to consummate the 110

Acquisition.

The increase in accumulated deficit results from (a) interest expense of approximately $13.3 million from

December 31, 1998 through January 25, 1999, the date of consummation of the Tender Offers (other than with

respect to the Senior Exchange Notes) on debt repurchased and paid, (b) dividends on the Series B Preferred Stock

for the period between January 1, 1999 and January 4, 1999 (the date on which the Series B Preferred Stock was

exchanged into Senior Exchange Notes) and interest expense on the Senior Exchange Notes for the period between

January 4, 1999 and February 2, 1999 (the closing date of that Tender Offer) totaling approximately $2.5 million,

(c) approximately $70 million representing the excess of the $91 million redemption price for the Series A Preferred

Stock over its carrying value at December 31, 1998 and (d) the estimated extraordinary loss upon the early

retirement of the notes pursuant to the Tender Offers of approximately $269 million (approximately $236 million of

tender premiums and consent fees and approximately $33 million associated with the write-off of unamortized

deferred financing costs and other transaction-related costs) that EchoStar will report in 1999.

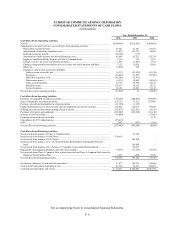

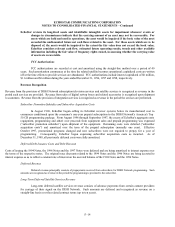

Organization and Legal Structure

Certain companies principally owned and controlled by Mr. Charles W. Ergen were reorganized in 1993

into Dish, Ltd. (together with its subsidiaries, “Dish, Ltd.”). In April 1995, ECC was formed to complete an initial

public offering of its Class A common stock. Concurrently, Mr. Ergen exchanged all of his then outstanding shares

of Class B common stock and 8% Series A Cumulative Preferred Stock of Dish, Ltd. for like shares of ECC. In

December 1995, ECC merged Dish, Ltd. with a wholly-owned subsidiary of ECC (the “Merger”). Substantially all

of EchoStar’s operations are conducted by subsidiaries of Dish, Ltd. The following table summarizes the

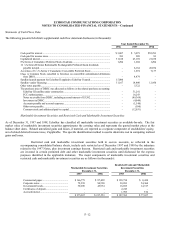

organizational structure of EchoStar and its principal subsidiaries as of December 31, 1998:

Legal Entity

Referred to

Herein As

EchoStar Communications Corporation ECC Publicly owned

EchoStar DBS Corporation DBS Corp ECC

EchoStar Space Corporation Space ECC

Direct Broadcasting Satellite Corporation DBSC ECC

EchoStar Satellite Broadcasting Corporation ESBC DBS Corp

Dish, Ltd. Dish, Ltd. ESBC

EchoStar Satellite Corporation ESC Dish, Ltd.

Echosphere Corporation Echosphere Dish, Ltd.

EchoStar Technologies Corporation (formerly HTS, a Texas

Corporation) ETC Dish, Ltd.

Houston Tracker Systems, Inc., a Colorado Corporation formed in 1998 HTS Dish, Ltd.

DirectSat Corporation DirectSat Dish, Ltd.

EchoStar International Corporation EIC Dish, Ltd.