Dish Network 1998 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

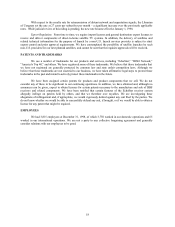

Year Ended December 31,

1994 1995 1996 1997 1998

Other Data

DISH Network subscribers........................................ – – 350,000 1,040,000 1,940,000

Average monthly revenue per subscriber.................. $ – $ – $ 35.50 $ 38.50 $ 39.25

EBITDA(6)................................................................ 15,459 (4,193) (65,931) (50,995) (20,255)

Less amortization of subscriber acquisition costs..... – – (16,073) (121,735) (18,869)

EBITDA, as adjusted to exclude amortization of

subscriber acquisition costs .................................. 15,459 (4,193) (82,004) (172,730) (39,124)

Net cash flows from:

Operating activities............................................... 24,205 (20,328) (27,425) 43 (16,890)

Investing activities ................................................ (338,565) (38,119) (287,642) (597,249) (8,048)

Financing activities............................................... 325,011 62,695 332,544 703,182 (13,722)

(1) The earnings (loss) per share amounts prior to 1997 have been restated as required to comply with Statement of Financial Accounting Standards

(“FAS”) No. 128, “Earnings Per Share.” For further discussion of earnings (loss) per share and the impact of FAS No. 128, see Note 2 to our

Consolidated Financial Statements.

(2) Balance sheet data as of December 31, 1998 as adjusted to give effect to the consummation of the tender offers, the concurrent issuance of the

Seven and Ten Year notes, and the repurchase of the 8% Series A Cumulative Preferred Stock. See “–Management’s Discussion and Analysis of

Financial Condition and Results of Operations-Liquidity and Capital Resources.”

(3) Balance sheet data as of December 31, 1998 further adjusted for the pro forma effects assuming consummation of the 110 acquisition. See “–

Management’s Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources” and “–Business–

Agreement With News Corporation and MCI.”

(4) Restrictions on cash held in escrow under the terms of indentures were removed as a result of the tender offers. The restricted cash balances as of

December 31, 1998 have been reclassified and included in the “as adjusted” amount of cash, cash equivalents and marketable investment

securities. The restriction on the insurance receivable of $106 million (not shown) was also removed. See “–Management’s Discussion and

Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources.”

(5) The increase in total assets includes $1.17 billion of assets to be acquired by us pursuant to the 110 acquisition offset by an approximately $48.1

million decrease in total cash, cash equivalents and marketable investment securities as a result of the tender offers and the redemption on

February 8, 1999, of all of our outstanding Series A Preferred Stock and related accumulated dividends (approximately $91 million). See “–

Business–Agreement With News Corporation and MCI.”

(6) We believe it is common practice in the telecommunications industry for investment bankers and others to use various multiples of current or

projected EBITDA (earnings before interest, taxes, depreciation and amortization) for purposes of estimating current or prospective enterprise

value and as one of many measures of operating performance. Conceptually, EBITDA measures the amount of income generated each period

that could be used to service debt, because EBITDA is independent of the actual leverage employed by the business; but EBITDA ignores funds

needed for capital expenditures and expansion. Some investment analysts track the relationship of EBITDA to total debt as one measure of

financial strength. However, EBITDA does not purport to represent cash provided or used by operating activities and should not be considered in

isolation or as a substitute for measures of performance prepared in accordance with generally accepted accounting principles.

EBITDA differs significantly from cash flows from operating activities reflected in the consolidated statement of cash flows. Cash from

operating activities is net of interest and taxes paid and is a more comprehensive determination of periodic income on a cash (vs. accrual) basis,

exclusive of non-cash items of income and expenses such as depreciation and amortization. In contrast, EBITDA is derived from accrual basis

income and is not reduced for cash invested in working capital. Consequently, EBITDA is not affected by the timing of receivable collections or

when accrued expenses are paid. We are not aware of any uniform standards for determining EBITDA and believe presentations of EBITDA

may not be calculated consistently by different entities in the same or similar businesses. EBITDA is shown before and after amortization of

subscriber acquisition costs, which were deferred through September 1997 and amortized over one year.