Dish Network 1998 Annual Report Download - page 55

Download and view the complete annual report

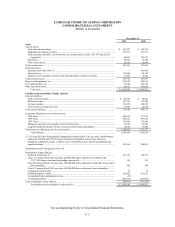

Please find page 55 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–8

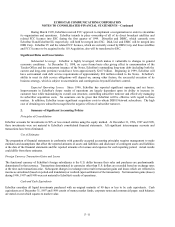

high definition television nationwide to a subscriber’s single 18-inch satellite dish, and would be positioned to offer

a one-dish solution for satellite-delivered local programming to major markets across the United States. EchoStar

also expects to be able to serve Alaska, Hawaii, Puerto Rico and the United States territories in the Caribbean from

the 110° WL orbital slot.

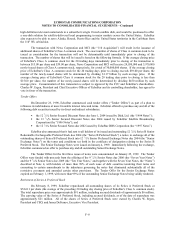

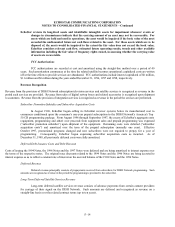

The transaction with News Corporation and MCI (the “110 Acquisition”) will result in the issuance of

additional shares of EchoStar’s Class A common stock. The exact number of shares of Class A common stock to be

issued as consideration for the transaction will not be determinable until immediately prior to closing of the

transaction. The number of shares that will be issued is based on the following formula. If the average closing price

of EchoStar’s Class A common stock for the 20 trading days immediately prior to closing of the transaction is

between $15.00 per share and $39.00 per share, News Corporation and MCI will receive 24,030,000 and 5,970,000

newly-issued shares of Class A common stock, respectively, for a total of 30,000,000 shares. If the average closing

price of EchoStar’s Class A common stock for the 20 trading days prior to closing exceeds $39.00 per share, the

number of the newly-issued shares will be determined by dividing $1.17 billion by such average price. If the

average closing price of EchoStar’s Class A common stock for the 20 trading days prior to closing is less than

$15.00 per share, the number of the newly-issued shares will be determined by dividing $450 million by such

average price. Consummation of this transaction is subject to approval by the FCC and EchoStar’s shareholders.

Charles W. Ergen, President and Chief Executive Officer of EchoStar and its controlling shareholder, has agreed to

vote in favor of the transaction.

Tender Offers

On December 23, 1998, EchoStar commenced cash tender offers (“Tender Offers”) as part of a plan to

refinance its indebtedness at more favorable interest rates and terms. EchoStar offered to purchase any and all of the

following debt securities issued by its direct and indirect subsidiaries:

• the 12 7/8% Senior Secured Discount Notes due June 1, 2004 issued by Dish, Ltd. (the “1994 Notes”);

• the 13 1/8% Senior Secured Discount Notes due 2004 issued by EchoStar Satellite Broadcasting

Corporation (the “1996 Notes”); and

• the 12 1/2% Senior Secured Notes due 2002 issued by EchoStar DBS Corporation (the “1997 Notes”).

EchoStar also announced that it had sent to all holders of its issued and outstanding 12 1/8% Series B Senior

Redeemable Exchangeable Preferred Stock due 2004 (the “Series B Preferred Stock”) a notice to exchange all of the

outstanding shares of Series B Preferred Stock into 12 1/8% Senior Preferred Exchange Notes due 2004 (the “Senior

Exchange Notes”) on the terms and conditions set forth in the certificate of designation relating to the Series B

Preferred Stock. The Senior Exchange Notes were issued on January 4, 1999. Immediately following the exchange,

EchoStar commenced an offer to purchase any and all outstanding Senior Exchange Notes.

The Tender Offers for the first three issues of notes were consummated on January 25, 1999. The Tender

Offers were funded with proceeds from the offering of the 9 1/4% Senior Notes due 2006 (the “Seven Year Notes”)

and the 9 3/8% Senior Notes due 2009 (the “Ten Year Notes,” and together with the Seven Year Notes, the “Notes”)

described at Note 4, with holders of more than 99% of each issue of debt securities tendering their notes and

consenting to certain amendments to the indentures governing the notes that eliminated substantially all of the

restrictive covenants and amended certain other provisions. The Tender Offer for the Senior Exchange Notes

expired on February 1, 1999, with more than 99% of the outstanding Senior Exchange Notes being validly tendered.

Retirement of Series A Preferred Stock

On February 8, 1999, EchoStar repurchased all outstanding shares of its Series A Preferred Stock at

$52.611 per share (the average of the preceding 20 trading day closing price of EchoStar’s Class A common stock).

The total repurchase price was approximately $91 million, including accrued dividends of approximately $6 million.

The carrying value of the Series A Preferred Stock, including accrued dividends, as of the date of repurchase was

approximately $21 million. All of the shares of Series A Preferred Stock were owned by Charles W. Ergen,

President and CEO, and James DeFranco, Executive Vice President.