Dish Network 1998 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–24

7. Stockholders’ Equity (Deficit)

Common Stock

The Class A, Class B and Class C common stock are equivalent in all respects except voting rights. Holders of Class A and Class C

common stock are entitled to one vote per share and holders of Class B common stock are entitled to ten votes per share. Each share

of Class B and Class C common stock is convertible, at the option of the holder, into one share of Class A common stock. Upon a

change in control of ECC, each holder of outstanding shares of Class C common stock is entitled to ten votes for each share of

Class C common stock held. ECC’s principal stockholder owns all outstanding Class B common stock and all other stockholders

own Class A common stock.

Preferred Stock

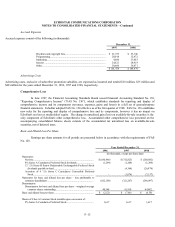

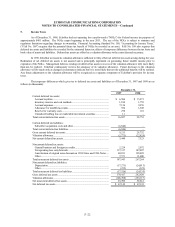

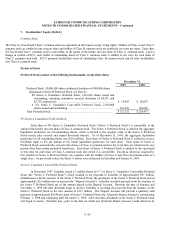

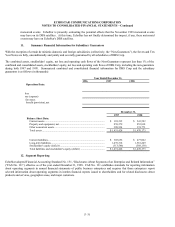

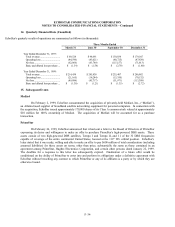

Preferred Stock consists of the following (in thousands, except share data):

December 31,

1997 1998

Preferred Stock, 20,000,000 shares authorized (inclusive of 900,000 shares

designated as Series B Preferred Stock, see Note 6):

8% Series A Cumulative Preferred Stock, 1,616,681 shares issued and

outstanding, including cumulative accrued dividends of $4,551 and

$5,755, respectively .......................................................................... $ 19,603 $ 20,807

6 ¾% Series C Cumulative Convertible Preferred Stock, 2,300,000

shares issued and outstanding ............................................................ 101,529 108,666

Total Preferred Stock .................................................................................. $ 121,132 $ 129,473

8% Series A Cumulative Preferred Stock

Each share of 8% Series A Cumulative Preferred Stock (“Series A Preferred Stock”) is convertible, at the

option of the holder, into one share of Class A common stock. The Series A Preferred Stock is stated at the aggregate

liquidation preference for all outstanding shares, which is limited to the original value of the Series A Preferred

Stock issued, plus accrued and unpaid dividends thereon. As of December 31, 1998, the aggregate liquidation

preference for all outstanding shares was $20.8 million. Each share of Series A Preferred Stock is entitled to receive

dividends equal to 8% per annum of the initial liquidation preference for such share. Each share of Series A

Preferred Stock automatically converts into shares of Class A common stock in the event they are transferred to any

person other than certain permitted transferees. Each share of Series A Preferred Stock is entitled to the equivalent

of ten votes for each share of Class A common stock into which it is convertible. Except as otherwise required by

law, holders of Series A Preferred Stock vote together with the holders of Class A and Class B common stock as a

single class. As previously noted, the Series A shares were redeemed by EchoStar on February 8, 1999.

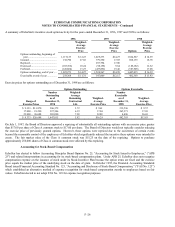

Series C Cumulative Convertible Preferred Stock

In November 1997, EchoStar issued 2.3 million shares of 6 3/4% Series C Cumulative Convertible Preferred

Stock (the “Series C Preferred Stock”) which resulted in net proceeds to EchoStar of approximately $97 million.

Simultaneous with the issuance of the Series C Preferred Stock, the purchasers of the Series C Preferred Stock placed

approximately $15 million into an account (the “Deposit Account”). EchoStar recorded proceeds from the issuance of

the Series C Preferred Stock net of the amount placed in the Deposit Account. Between the date of issuance and

November 2, 1999 (the date dividends begin to accrue), EchoStar is accreting the proceeds from the issuance of the

Series C Preferred Stock to the face amount of $115 million. The Deposit Account will provide a quarterly cash

payment of approximately $0.844 per share of Series C Preferred Stock (the “Quarterly Return Amount”), commencing

February 1, 1998 and continuing until November 1, 1999. After that date, dividends on the Series C Preferred Stock

will begin to accrue. EchoStar may, prior to the date on which any Quarterly Return Amount would otherwise be