Dish Network 1998 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–12

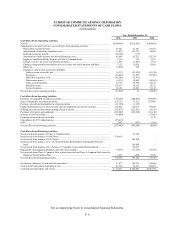

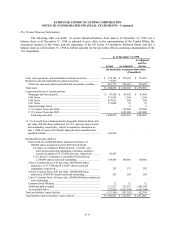

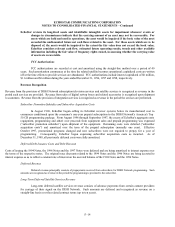

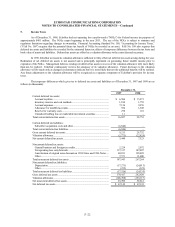

Statements of Cash Flows Data

The following presents EchoStar’s supplemental cash flow statement disclosure (in thousands):

Year Ended December 31,

1996 1997 1998

Cash paid for interest................................................................................................... $ 3,007 $ 5,073 $52,293

Cash paid for income taxes .......................................................................................... 383 209 83

Capitalized interest...................................................................................................... 31,818 43,169 21,678

8% Series A Cumulative Preferred Stock dividends....................................................... 1,204 1,204 1,204

12 1/8% Series B Senior Redeemable Exchangeable Preferred Stock dividends

payable in-kind ....................................................................................................... –6,164 26,874

Accretion of 6 3/4% Series C Cumulative Convertible Preferred Stock ............................ –1,074 7,137

Class A Common Stock cancelled to foreclose on convertible subordinated debentures

from DBSI.............................................................................................................. –4,479 –

Satellite launch payment for EchoStar II applied to EchoStar I launch............................. 15,000 – –

Satellite vendor financing ............................................................................................ 31,167 14,400 12,950

Other notes payable..................................................................................................... –5,322 –

The purchase price of DBSC was allocated as follows in the related purchase accounting:

EchoStar III satellite under construction.................................................................... –51,241 –

FCC authorizations.................................................................................................. –16,243 –

Notes receivable from DBSC, including accrued interest of $3,382............................. –(49,369) –

Investment in DBSC................................................................................................ –(4,044) –

Accounts payable and accrued expenses.................................................................... –(1,540) –

Other notes payable................................................................................................. –(500) –

Common stock and additional paid–in capital............................................................ –(12,031) –

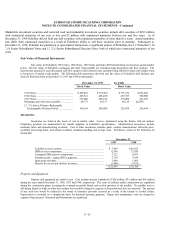

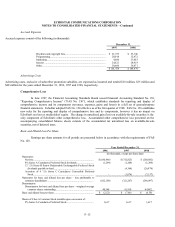

Marketable Investment Securities and Restricted Cash and Marketable Investment Securities

As of December 31, 1997 and 1998, EchoStar has classified all marketable investment securities as available-for-sale. The fair

market value of marketable investment securities approximates the carrying value and represents the quoted market prices at the

balance sheet dates. Related unrealized gains and losses, if material, are reported as a separate component of stockholders’ equity,

net of related deferred income taxes, if applicable. The specific identification method is used to determine cost in computing realized

gains and losses.

Restricted cash and marketable investment securities held in escrow accounts, as reflected in the

accompanying consolidated balance sheets, include cash restricted as of December 1997 and 1998 by the indenture

related to the 1997 Notes, plus investment earnings thereon. Restricted cash and marketable investment securities

are invested in certain permitted debt and other marketable investment securities until disbursed for the express

purposes identified in the applicable indenture. The major components of marketable investment securities and

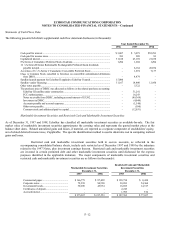

restricted cash and marketable investment securities are as follows (in thousands):

Marketable Investment Securities

Restricted Cash and Marketable

Investment Securities

December 31, December 31,

1997 1998 1997 1998

Commercial paper...................................... $ 166,779 $ 87,099 $ 128,734 $ 8,424

Corporate notes.......................................... 78,238 84,520 38,093 54,360

Government bonds..................................... 30,290 45,934 16,695 14,517

Certificates of deposit................................. - - 2,245 –

Accrued interest......................................... - - 1,995 356

$ 275,307 $ 217,553 $ 187,762 $ 77,657