Dish Network 1998 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–15

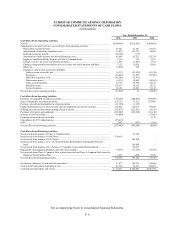

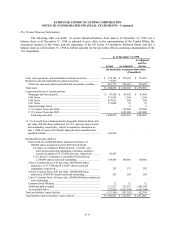

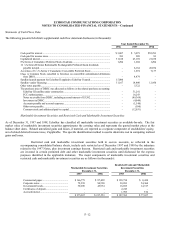

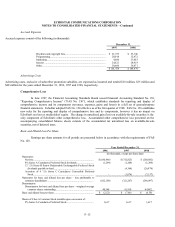

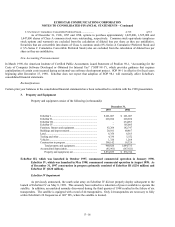

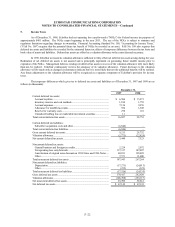

Accrued Expenses

Accrued expenses consist of the following (in thousands):

December 31,

1997 1998

Royalties and copyright fees........................................................... $ 21,573 $ 53,746

Programming ................................................................................ 20,018 35,472

Marketing..................................................................................... 4,660 33,463

Interest ......................................................................................... 24,621 24,918

Other............................................................................................ 30,606 36,871

$ 101,478 $ 184,470

Advertising Costs

Advertising costs, exclusive of subscriber promotion subsidies, are expensed as incurred and totaled $18 million, $35 million and

$48 million for the years ended December 31, 1996, 1997 and 1998, respectively.

Comprehensive Loss

In June 1997, the Financial Accounting Standards Board issued Financial Accounting Standard No. 130,

“Reporting Comprehensive Income” (“FAS No. 130”), which establishes standards for reporting and display of

comprehensive income and its components (revenues, expenses, gains and losses) in a full set of general-purpose

financial statements. EchoStar adopted FAS No. 130 effective as of the first quarter of 1998. FAS No. 130 establishes

new rules for the reporting and display of comprehensive loss and its components, however it has no impact on

EchoStar’s net loss or stockholders’ equity. The change in unrealized gain (loss) on available-for-sale securities is the

only component of EchoStar’s other comprehensive loss. Accumulated other comprehensive loss presented on the

accompanying consolidated balance sheets consists of the accumulated net unrealized loss on available-for-sale

securities, net of deferred taxes.

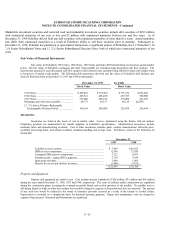

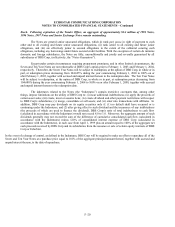

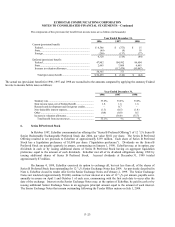

Basic and Diluted Loss Per Share

Earnings per share amounts for all periods are presented below in accordance with the requirements of FAS

No. 128.

Year Ended December 31,

1996 1997 1998

(In thousands, except per share data)

Numerator:

Net loss........................................................................................ $ (100,986) $ (312,825) $ (260,882)

8% Series A Cumulative Preferred Stock dividends ........................ (1,204) (1,204) (1,204)

12 1/8% Series B Senior Redeemable Exchangeable Preferred Stock

dividends payable in-kind.......................................................... –(6,164) (26,874)

Accretion of 6 3/4% Series C Cumulative Convertible Preferred

Stock........................................................................................ –(1,074) (7,137)

Numerator for basic and diluted loss per share – loss attributable to

common shareholders ................................................................... (102,190) (321,267) (296,097)

Denominator:

Denominator for basic and diluted loss per share – weighted-average

common shares outstanding ....................................................... 40,548 41,918 44,982

Basic and diluted loss per share.......................................................... $ (2.52) $ (7.66) $ (6.58)

Shares of Class A Common Stock issuable upon conversion of:

8% Series A Cumulative Preferred Stock........................................ 1,617 1,617 1,617