Dish Network 1998 Annual Report Download - page 58

Download and view the complete annual report

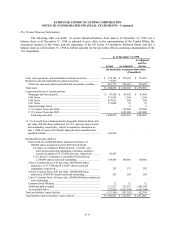

Please find page 58 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

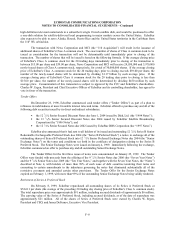

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–11

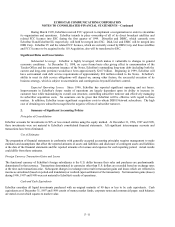

During March 1999, EchoStar received FCC approval to implement a reorganization in order to streamline

its organization and operations. EchoStar intends to place ownership of all of its direct broadcast satellites and

related FCC licenses into ESC during the first quarter of 1999. DirectSat and DBSC, which currently own

EchoStar II and EchoStar III, respectively, will both be merged into ESC. Dish, Ltd. and ESBC will be merged into

DBS Corp. EchoStar IV and the related FCC licenses, which are currently owned by DBS Corp, and those satellites

and FCC licenses to be acquired in the 110 Acquisition, also will be transferred to ESC.

Significant Risks and Uncertainties

Substantial Leverage. EchoStar is highly leveraged, which makes it vulnerable to changes in general

economic conditions. At December 31, 1998, on a pro forma basis after giving effect to consummation of the

Tender Offers and the concurrent issuance of the Notes, EchoStar’s outstanding long-term debt (including both the

current and long-term portions) would have been approximately $2.07 billion. Beginning in 1999, EchoStar will

have semi-annual cash debt service requirements of approximately $94 million related to the Notes. EchoStar’s

ability to meet its debt service obligations will depend on, among other factors, the successful execution of its

business strategy, which is subject to uncertainties and contingencies beyond EchoStar’s control.

Expected Operating Losses. Since 1996, EchoStar has reported significant operating and net losses.

Improvements in EchoStar’s future results of operations are largely dependent upon its ability to increase its

customer base while maintaining its overall cost structure, controlling subscriber turnover and effectively managing

its subscriber acquisition costs. No assurance can be given that EchoStar will be effective with regard to these

matters. In addition, EchoStar incurs significant acquisition costs to obtain DISH Network subscribers. The high

cost of obtaining new subscribers magnifies the negative effects of subscriber turnover.

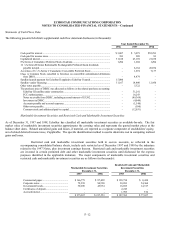

2. Summary of Significant Accounting Policies

Principles of Consolidation

EchoStar accounts for investments in 50% or less owned entities using the equity method. At December 31, 1996, 1997 and 1998,

these investments were not material to EchoStar’s consolidated financial statements. All significant intercompany accounts and

transactions have been eliminated.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements and the reported amounts of revenues and expenses for each reporting period. Actual results

could differ from those estimates.

Foreign Currency Transaction Gains and Losses

The functional currency of EchoStar’s foreign subsidiaries is the U.S. dollar because their sales and purchases are predominantly

denominated in that currency. Transactions denominated in currencies other than U.S. dollars are recorded based on exchange rates

at the time such transactions arise. Subsequent changes in exchange rates result in transaction gains and losses which are reflected in

income as unrealized (based on period-end translation) or realized (upon settlement of the transaction). Net transaction gains (losses)

during 1996, 1997 and 1998 were not material to EchoStar’s results of operations.

Cash and Cash Equivalents

EchoStar considers all liquid investments purchased with an original maturity of 90 days or less to be cash equivalents. Cash

equivalents as of December 31, 1997 and 1998 consist of money market funds, corporate notes and commercial paper; such balances

are stated at cost which equates to market value.