Dish Network 1998 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–23

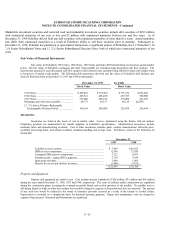

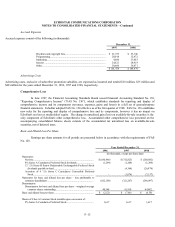

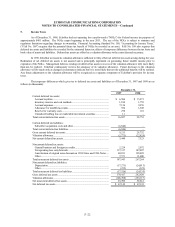

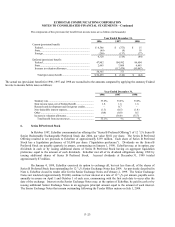

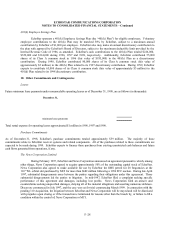

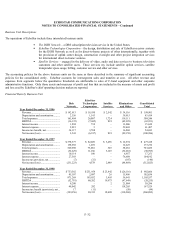

The components of the (provision for) benefit from income taxes are as follows (in thousands):

Year Ended December 31,

1996 1997 1998

Current (provision) benefit:

Federal .................................................................... $ 4,586 $ (373) $ 15

State... ..................................................................... (49) (9) 18

Foreign.................................................................... (209) (137) (77)

4,328 (519) (44)

Deferred (provision) benefit:

Federal .................................................................... 47,902 104,992 86,604

State........................................................................ 2,463 7,860 6,463

Increase in valuation allowance ................................. –(112,479) (93,067)

50,365 373 –

Total (provision) benefit........................................ $ 54,693 $ (146) $ (44)

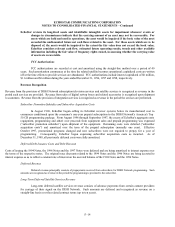

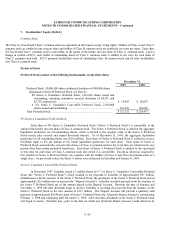

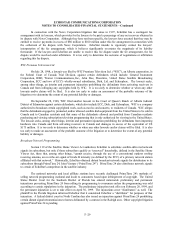

The actual tax (provision) benefit for 1996, 1997 and 1998 are reconciled to the amounts computed by applying the statutory Federal

tax rate to income before taxes as follows:

Year Ended December 31,

1996 1997 1998

Statutory rate .................................................................. 35.0% 35.0% 35.0%

State income taxes, net of Federal benefit ......................... 1.8 1.6 1.6

Research and development and foreign tax credits............. –0.7 –

Non-deductible interest expense....................................... (1.3) (0.5) (1.4)

Other ............................................................................. (0.4) (0.8) 0.5

Increase in valuation allowance........................................ –(36.0) (35.7)

Total benefit from income taxes................................... 35.1% –% –%

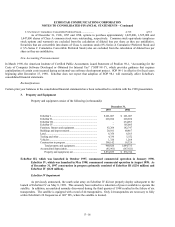

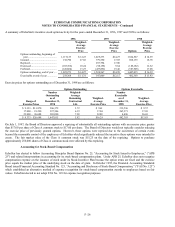

6. Series B Preferred Stock

In October 1997, EchoStar consummated an offering (the “Series B Preferred Offering”) of 12 1/8% Series B

Senior Redeemable Exchangeable Preferred Stock due 2004, par value $0.01 per share. The Series B Preferred

Offering resulted in net proceeds to EchoStar of approximately $193 million. Each share of Series B Preferred

Stock has a liquidation preference of $1,000 per share (“liquidation preference”). Dividends on the Series B

Preferred Stock are payable quarterly in arrears, commencing on January 1, 1998. EchoStar may, at its option, pay

dividends in cash or by issuing additional shares of Series B Preferred Stock having an aggregate liquidation

preference equal to the amount of such dividends. EchoStar met all of its dividend obligations during 1998 by

issuing additional shares of Series B Preferred Stock. Accrued dividends at December 31, 1998 totaled

approximately $7 million.

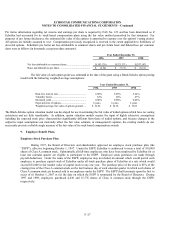

On January 4, 1999, EchoStar exercised its option to exchange all, but not less than all, of the shares of

Series B Preferred Stock then outstanding for 12 1/8% Senior Exchange Notes due 2004. As previously described in

Note 4, EchoStar closed its tender offer for the Senior Exchange Notes on February 2, 1999. The Senior Exchange

Notes not tendered (approximately $5,000) continue to bear interest at a rate of 12 1/8% per annum, payable semi-

annually in arrears on April 1 and October 1 of each year, commencing with the first such date to occur after the

date of the exchange. Interest on the Senior Exchange Notes may, at the option of EchoStar, be paid in cash or by

issuing additional Senior Exchange Notes in an aggregate principal amount equal to the amount of such interest.

The Senior Exchange Notes that remain outstanding following the Tender Offers mature on July 1, 2004.