Dish Network 1998 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–14

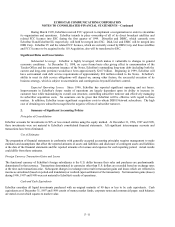

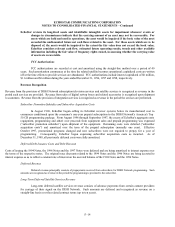

EchoStar reviews its long-lived assets and identifiable intangible assets for impairment whenever events or

changes in circumstances indicate that the carrying amount of an asset may not be recoverable. For

assets which are held and used in operations, the asset would be impaired if the book value of the asset

exceeded the undiscounted future net cash flows related to the asset. For those assets which are to be

disposed of, the assets would be impaired to the extent the fair value does not exceed the book value.

EchoStar considers relevant cash flow, estimated future operating results, trends and other available

information including the fair value of frequency rights owned, in assessing whether the carrying value

of assets are recoverable.

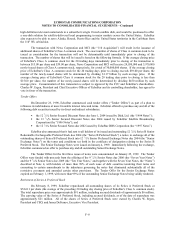

FCC Authorizations

FCC authorizations are recorded at cost and amortized using the straight-line method over a period of 40

years. Such amortization commences at the time the related satellite becomes operational; capitalized costs are written

off at the time efforts to provide services are abandoned. FCC authorizations include interest capitalized of $6 million,

$11 million and $6 million during the years ended December 31, 1996, 1997 and 1998, respectively.

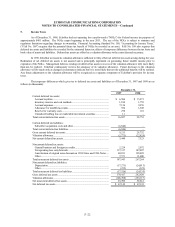

Revenue Recognition

Revenue from the provision of DISH Network subscription television services and satellite services is recognized as revenue in the

period such services are provided. Revenue from sales of digital set-top boxes and related accessories is recognized upon shipment

to customers. Revenue from the provision of integration services is recognized as revenue in the period the services are performed.

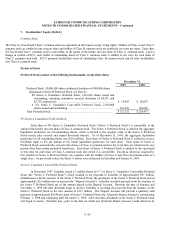

Subscriber Promotion Subsidies and Subscriber Acquisition Costs

In August 1996, EchoStar began selling its EchoStar receiver systems below its manufactured cost to

consumers conditioned upon the consumer’s one-year prepaid subscription to the DISH Network’s America’s Top

50 CD programming package. From August 1996 through September 1997, the excess of EchoStar’s aggregate costs

(equipment, programming and other) over proceeds from equipment sales and prepaid programming was expensed

(“subscriber promotion subsidies”) upon shipment of the equipment. Remaining costs were deferred (“subscriber

acquisition costs”) and amortized over the term of the prepaid subscription (normally one year). Effective

October 1997, promotional programs changed and new subscribers were not required to prepay for a year of

programming. Consequently, EchoStar began expensing subscriber acquisition costs as incurred. As of

December 31, 1998, all previously deferred costs were fully amortized.

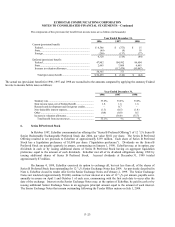

Deferred Debt Issuance Costs and Debt Discount

Costs of issuing the 1994 Notes, the 1996 Notes and the 1997 Notes were deferred and are being amortized to interest expense over

the terms of the respective notes. The original issue discounts related to the 1994 Notes and the 1996 Notes are being accreted to

interest expense so as to reflect a constant rate of interest on the accreted balance of the 1994 Notes and the 1996 Notes.

Deferred Revenue

Deferred revenue principally consists of prepayments received from subscribers for DISH Network programming. Such

amounts are recognized as revenue in the period the programming is provided to the subscriber.

Long-Term Deferred Satellite Services Revenue

Long-term deferred satellite services revenue consists of advance payments from certain content providers

for carriage of their signal on the DISH Network. Such amounts are deferred and recognized as revenue on a

straight-line basis over the related contract terms (up to ten years).