Dish Network 1998 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–9

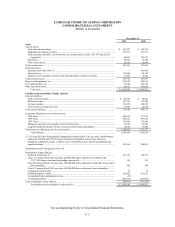

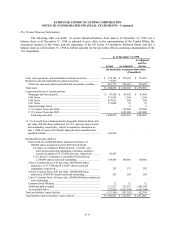

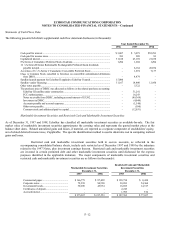

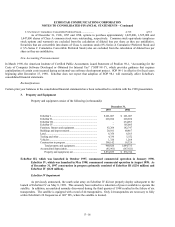

Pro Forma Financial Information

The following table sets forth: (i) certain historical balance sheet data as of December 31, 1998, (ii) a

balance sheet as of December 31, 1998 as adjusted to give effect to the consummation of the Tender Offers, the

concurrent issuance of the Notes, and the repurchase of the 8% Series A Cumulative Preferred Stock, and (iii) a

balance sheet as of December 31, 1998 as further adjusted for the pro forma effects assuming consummation of the

110 Acquisition.

As of December 31, 1998

Actual As Adjusted

As Adjusted

and Pro

Forma

(In thousands, except per share data)

(Unaudited)

Cash, cash equivalents, and marketable investment securities................... $ 324,100 $ 353,699 $ 353,699

Restricted cash and marketable investment securities............................... 77,657 – –

Total cash, cash equivalents and marketable investment securities........ 401,757 353,699 353,699

Total assets $ 1,806,852 $ 1,762,883 $ 2,932,883

Long-term debt (net of current portion):

Mortgages and notes payable ............................................................. $ 43,450 $ 43,450 $ 43,450

1994 Notes....................................................................................... 571,674 1,390 1,390

1996 Notes....................................................................................... 497,955 950 950

1997 Notes....................................................................................... 375,000 15 15

Senior Exchange Notes ..................................................................... – 5 5

9

1

/

4

% Senior Notes due 2006 ........................................................... –375,000 375,000

9

3

/

8

% Senior Notes due 2009 ........................................................... –1,625,000 1,625,000

Total long-term debt...................................................................... 1,488,079 2,045,810 2,045,810

12 1/8% Series B Senior Redeemable Exchangeable Preferred Stock, $.01

par value, 900,000 shares authorized, 225,301, and none shares issued

and outstanding, respectively; subject to mandatory redemption on

July 1, 2004 at a price of $1,000 per share plus all accumulated and

unpaid dividends ............................................................................... 226,038 – –

Stockholders’ Equity (Deficit):

Preferred Stock, 20,000,000 shares authorized (inclusive of

900,000 shares designated as Series B Preferred Stock):

8% Series A Cumulative Preferred Stock, 1,616,681, and

none shares issued and outstanding, including cumulative

accrued dividends of $5,755,000 and none, respectively ........... 20,807 – –

6 ¾% Series C Cumulative Convertible Preferred Stock,

2,300,000 shares issued and outstanding.................................. 108,666 108,666 108,666

Class A Common Stock, $.01 par value, 200,000,000 shares

authorized, 15,317,380 and 38,236,087 shares issued and

outstanding, respectively................................................................ 153 153 382

Class B Common Stock, $.01 par value, 100,000,000 shares

authorized, 29,804,401 shares issued and outstanding ...................... 298 298 298

Class C Common Stock, $.01 par value, 100,000,000 shares authorized,

none outstanding........................................................................... – – –

Common Stock Warrants................................................................... 12 12 12

Additional paid-in capital .................................................................. 231,617 231,617 1,401,388

Accumulated deficit .......................................................................... (733,093) (1,087,948) (1,087,948)

Total stockholders’ equity (deficit) ......................................................... (371,540) (747,202) 422,798

Total liabilities and stockholders’ equity (deficit) .................................... $ 1,806,852 $ 1,762,883 $ 2,932,883