Dish Network 1998 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

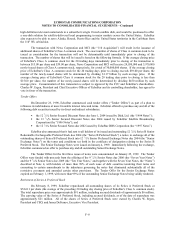

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–13

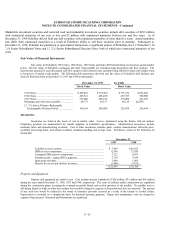

Marketable investment securities and restricted cash and marketable investment securities include debt securities of $293 million

with contractual maturities of one year or less and $2 million with contractual maturities between one and five years. As of

December 31, 1998 EchoStar did not hold any debt securities with contractual maturities of more than five years. Actual maturities

may differ from contractual maturities as a result of EchoStar’s ability to sell these securities prior to maturity. Subsequent to

December 31, 1998, EchoStar has purchased, in open market transactions, a significant portion of PrimeStar, Inc.’s (“ PrimeStar”) 10

7/8% Senior Subordinated Notes and 12 1/4% Senior Subordinated Discount Notes, both of which have contractual maturities of ten

years.

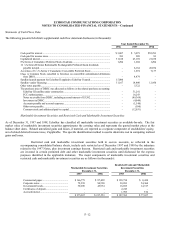

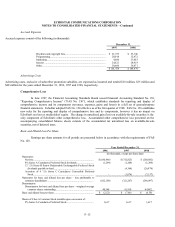

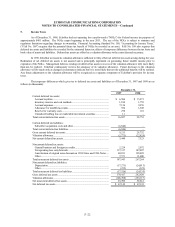

Fair Value of Financial Instruments

Fair values for EchoStar’s 1994 Notes, 1996 Notes, 1997 Notes and Series B Preferred Stock are based on quoted market

prices. The fair values of EchoStar’s mortgages and other notes payable are estimated using discounted cash flow analyses. The

interest rates assumed in such discounted cash flow analyses reflect interest rates currently being offered for loans with similar terms

to borrowers of similar credit quality. The following table summarizes the book and fair values of EchoStar’s debt facilities and

Series B Preferred Stock at December 31, 1997 and 1998 (in thousands):

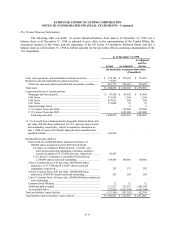

December 31, 1997

31, 1998

Book Value Book Value

1994 Notes ..................................................... $ 499,863 $ 570,960 $ 571,674 $ 636,480

1996 Notes ..................................................... 438,512 488,650 497,955 580,000

1997 Notes ..................................................... 375,000 406,875 375,000 431,250

Mortgages and other notes payable .................. 69,731 69,127 66,129 61,975

12 1/8% Series B Senior Redeemable

Exchangeable Preferred Stock ..................... 199,164 209,000 226,038 259,944

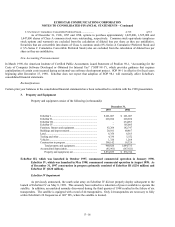

Inventories

Inventories are stated at the lower of cost or market value. Cost is determined using the first-in, first-out method.

Proprietary products are manufactured by outside suppliers to EchoStar’s specifications. Manufactured inventories include

materials, labor and manufacturing overhead. Cost of other inventories includes parts, contract manufacturers’ delivered price,

assembly and testing labor, and related overhead, including handling and storage costs. Inventories consist of the following (in

thousands):

December 31,

1997 1998

EchoStar receiver systems ............................................................. $ 7,649 $ 45,025

DBS receiver components.............................................................. 12,506 27,050

Consigned DBS receiver components............................................. 3,122 6,073

Finished goods − analog DTH equipment ....................................... 2,116 2,656

Spare parts and other ..................................................................... 1,440 1,085

Reserve for excess and obsolete inventory....................................... (3,840) (5,181)

$ 22,993 $ 76,708

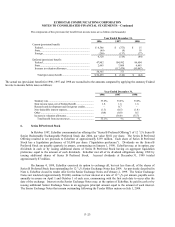

Property and Equipment

Property and equipment are stated at cost. Cost includes interest capitalized of $26 million, $32 million and $16 million

during the years ended December 31, 1996, 1997 and 1998, respectively. The costs of satellites under construction are capitalized

during the construction phase, assuming the eventual successful launch and in-orbit operation of the satellite. If a satellite were to

fail during launch or while in-orbit, the resultant loss would be charged to expense in the period such loss was incurred. The amount

of any such loss would be reduced to the extent of insurance proceeds received as a result of the launch or in-orbit failure.

Depreciation is recorded on a straight-line basis for financial reporting purposes. Repair and maintenance costs are charged to

expense when incurred. Renewals and betterments are capitalized.