Dish Network 1998 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 1998 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

F–21

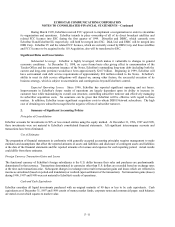

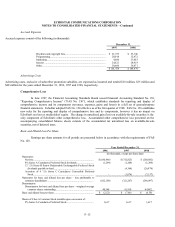

Mortgages and Other Notes Payable

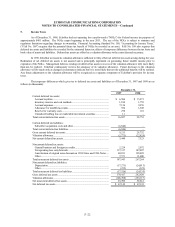

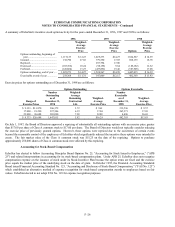

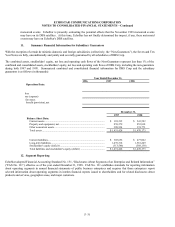

Mortgages and other notes payable consists of the following (in thousands):

December 31,

1997 1998

8.25% note payable for satellite vendor financing for EchoStar I due in equal monthly

installments of $722, including interest, through February 2001............................. $ 24,073 $ 17,137

8.25% note payable for satellite vendor financing for EchoStar II due in equal

monthly installments of $562, including interest, through November 2001 .............. 22,489 17,416

8.25% note payable for satellite vendor financing for EchoStar III due in equal

monthly installments of $294, including interest, through October 2002.................. 13,812 12,183

8.25% note payable for satellite vendor financing for EchoStar IV due in equal

monthly installments of $264, including interest, through May 2003 ....................... –12,950

Mortgages and other unsecured notes payable due in installments through April 2009

with interest rates ranging from 8% to 10% ............................................................ 9,357 6,443

Total ........................................................................................................................ 69,731 66,129

Less current portion .................................................................................................. (17,885) (22,679)

Mortgages and other notes payable, net of current portion .......................................... $ 51,846 $ 43,450

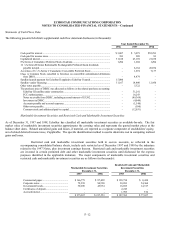

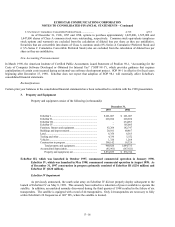

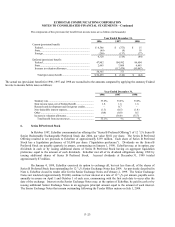

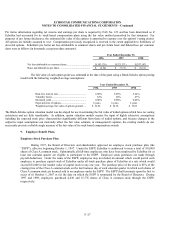

Future maturities of EchoStar’s outstanding long-term debt, after consummation of the Tender Offers and

issuance of the Notes on January 25, 1999, are summarized as follows (in thousands):

Seven Year

Notes

Ten Year

Notes

Mortgages

and Other

Notes

Payable Total

Year Ending December 31,

1999 .................................... $ – $ – $ 22,679 $ 22,679

2000 .................................... – – 20,314 20,314

2001 .................................... – – 13,560 13,560

2002 .................................... – – 5,855 5,855

2003 .................................... ––1,675 1,675

Thereafter............................. 375,000 1,625,000 4,405 2,004,405

Total........................................ $ 375,000 $ 1,625,000 $ 68,488 $ 2,068,488

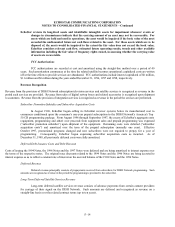

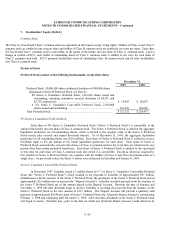

Satellite Vendor Financing

The purchase price for satellites is required to be paid in progress payments, some of which are non-contingent payments

that are deferred until after the respective satellites are in orbit (satellite vendor financing). EchoStar utilized $36 million, $28

million, $14 million and $13 million of satellite vendor financing for EchoStar I, EchoStar II, EchoStar III and EchoStar IV,

respectively. The satellite vendor financing with respect to EchoStar I and EchoStar II is secured by substantially all assets of Dish,

Ltd. and its subsidiaries (subject to certain restrictions) and a corporate guarantee of ECC. The satellite vendor financings for both

EchoStar III and EchoStar IV are secured by an ECC corporate guarantee.